The Deteriorating Liquidity of U.S. Treasury Markets: Implications and Risks

1 comment

Overview of the Liquidity Decline

As liquidity in the U.S. Treasury market continues to worsen, a multitude of factors are reinforcing this troubling trend. Simon White, a Bloomberg macro strategist, points out that rising inflation risks, alongside an increasing issuance of long-term government bonds due to fiscal deficits, are placing significant pressure on market liquidity. This creates a negative feedback loop where volatility in yields, constrained dealer balance sheets, and broader financial market dynamics amplify each other, increasing liquidity risks.

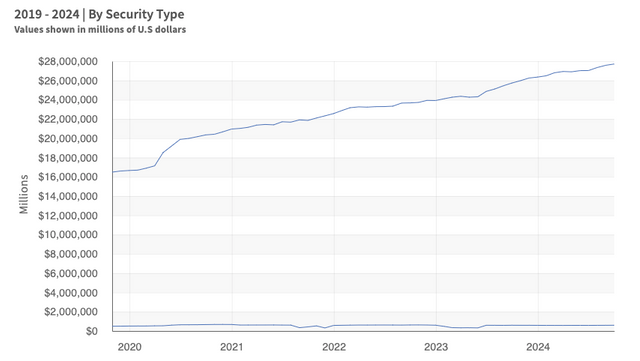

U.S. Debt Held by the Public Outstanding

Key Factors Contributing to the Decline

1. Volatility and Inflation Risks

Despite some moderation in price growth, inflation risks remain unresolved. The U.S. government is faced with addressing fiscal deficits amounting to $1.8 trillion, leading to the issuance of more long-term Treasury bonds. This, in turn, exacerbates liquidity problems, as the market must absorb larger quantities of these bonds. The MOVE Index, a key measure of Treasury volatility, has risen, reflecting uncertainty in how restrictive the Fed's monetary policy must be to control inflation.

2. Tightening Bank Balance Sheets

Post-Global Financial Crisis reforms have required banks to hold more capital against assets, including U.S. Treasuries, to meet Supplementary Leverage Ratio (SLR) requirements. As market volatility increases, banks are stepping back from their role as intermediaries, further eroding liquidity. This situation worsened after the Fed ended temporary exemptions to SLR regulations.

3. The Fed’s Quantitative Tightening

The Federal Reserve has reduced its bond-buying program, cutting down its balance sheet by $60 billion per month. While this move is aimed at curbing inflation, it has also diminished liquidity in the Treasury market. With fewer buyers and banks pulling back, the depth of the market has fallen significantly, resulting in wider bid-ask spreads and making it more expensive to trade in large volume.

4. Financial Reflexivity

There is a reinforcing dynamic between Treasury yield volatility, constrained balance sheets, and government bond issuance. As yield volatility increases, it makes the already fragile liquidity environment worse, especially for "off-the-run" Treasury securities that have less trading volume and are less liquid.

Implications for the Broader Market

1. Treasury Liquidity and Stock Market

Rising Treasury yields could spill over into the equity market. Higher yields typically make borrowing more expensive for companies, reducing profitability and possibly leading to lower stock prices. In extreme scenarios, such market instability could prompt the Federal Reserve to intervene once again, as it did during the financial crisis and the COVID-19 pandemic.

2. Market Volatility

Increased Treasury volatility also poses risks for bond funds. Some Treasury-heavy funds have faced outflows as investors seek safer havens or more liquid assets. This has left less market depth and fewer participants in the bond market, further challenging liquidity.

Navigating the Liquidity Crunch

Investors should closely monitor the evolving liquidity situation in the Treasury market. With inflation risks persisting, fiscal deficits rising, and market participants pulling back from providing liquidity, the risk of higher volatility remains high. The Federal Reserve may need to recalibrate its quantitative tightening policies if liquidity risks worsen, potentially destabilizing not only the bond market but also equities.

As market participants, staying informed about these trends is crucial for managing risk in portfolios that include U.S. Treasuries or assets influenced by Treasury yields.

Harry Potter Library (HPL) Community

Please join the HPL community. You will get upvotes for your posts. Simply join and post there using the tags "hpl" or "harrypotterlibrary" in your post.

- Community Address: https://steemit.com/trending/hive-140602

- About HPL Community:

EN: Harry Potter Library - HPL

KR: [해리포터의 도서관 (Harry Potter Library, HPL)](https://steemit.com/hive-140602/@harryji/ab7uv-harry-potter-library-hpl

Comments