A first look at the SPS cost-benefit numbers

1 comment

A couple weeks ago, I posted How attractive is the SPS as a takeover target?, where I considered the possibility of an outside investor buying STEEM just to gain control of the Steem Proposal System (SPS) funding. As a shot in the dark, I made the (unsubstantiated) assumption that someone who owned 25% of STEEM could control the fund.

Basically, I'm speculating that there is some theoretical point where it would make sense for a highly funded investor to load up with STEEM just to gain control of the SPS Wallet. I have no idea where that point might be, but if we track values over time, we can see whether it's getting closer or further. So, I slapped together a script and started saving the data every day.

Two weeks later, here's a first look at how things have moved based on daily downloads:

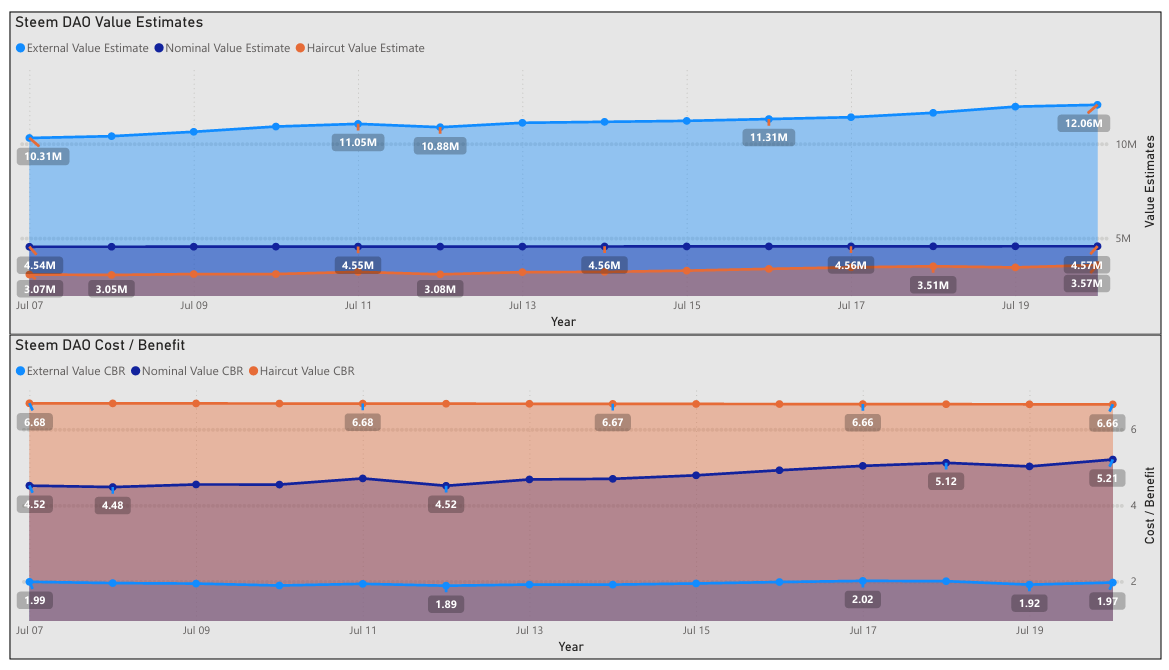

In the top visualization, we see the values of the SPS wallet during the two weeks.

- External value (light blue) is based on @coingecko SBD prices. This rose from $10.3 million to $12.06 million (17%).

- Nominal value (navy) is based SBDs at $1. This rose from $4.54 million to $4.57 million (<1%).

- Haircut value (orange) is based on the blockchain's haircut pricing, if someone were to convert SBDs to STEEM. This gained from $3.07 million to $3.57 million (16%).

In the bottom visualization, we see the total cost to buy a 25% share of all out-standing STEEM divided by the value of the SPS wallet. Again, this is broken into the same three values.

- External Costs / benefits (CBR): Decreased from 1.99 to 1.97 (1%).

- Nominal CBR: Increased from 4.52 to 5.21 (15%)

- Haircut CBR: Declined from 6.68 to 6.66 (~0.3%)

We can think of it like this: If the CBR is 2, that means someone would need to invest $2 to gain control of $1 in the SPS. If they achieved control of the SPS fund, that's an instantaneous gain of 50% on their investment (***on paper, but probably not in practice - see below).

In general, higher CBRs mean that the SPS is a less attractive target, and vice versa.

There are, however, a lot of reasons why this scenario doesn't actually depict any real-world investment returns. Among them are the following:

- The SPS is limited in how many SBDs it can pay out in a day, so the would-be investor would have to wait a long time to realize the gains.

- Buying large amounts of STEEM would be sure to move market prices

- Selling or converting large amounts of SBDs would also be sure to move market prices

- Attempts to gain control of the SPS would almost certainly trigger bidding wars.

- In those bidding wars, existing large stakeholders have a huge head start on outside investors who might want to gain control

- etc... I'm sure there are more.

As these values change over time, though, I still think that the movement tells us something about the relative attractiveness of the SPS as a reason for investing in STEEM.

It also occurs to me that the existence of the SPS probably places some sort of a floor under the price of STEEM. It seems that any time the price of STEEM drifts below this hypothetical floor, it would be likely to trigger a takeover attempt, which would lead to a bidding war that would drive the price back up. So... the more valuable the SPS, the higher the floor... maybe 😉.

Thank you for your time and attention.

As a general rule, I up-vote comments that demonstrate "proof of reading".

Steve Palmer is an IT professional with three decades of professional experience in data communications and information systems. He holds a bachelor's degree in mathematics, a master's degree in computer science, and a master's degree in information systems and technology management. He has been awarded 3 US patents.

Pixabay license, source

Reminder

Visit the /promoted page and #burnsteem25 to support the inflation-fighters who are helping to enable decentralized regulation of Steem token supply growth.

Comments