Sell in May and Go Away?

11 comments

Today being Labor Day - the unofficial end of summer in the United States, I thought I'd look at Steem's historical performance in light of the old trading axiom, "Sell in May and go away". How has Steem performed during the summer months of its history?

Let's take a look. The following table and charts are based on data from Yahoo! Finance.

Overview Table

| Year | June 1 Open | August 31 Close | Summer Change |

|---|---|---|---|

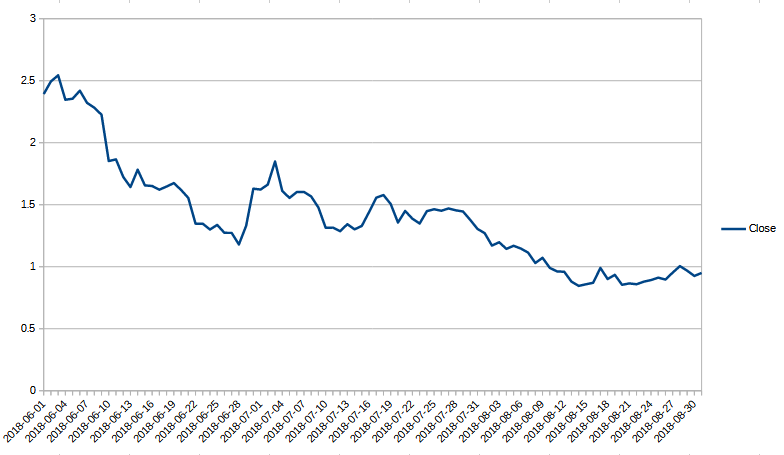

| 2018 | 2.38176 | 0.94985 | Down |

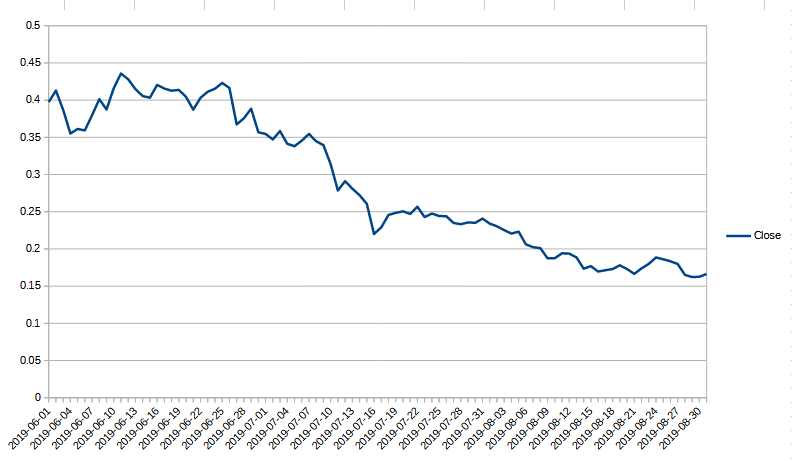

| 2019 | 0.40252 | 0.166318 | Down |

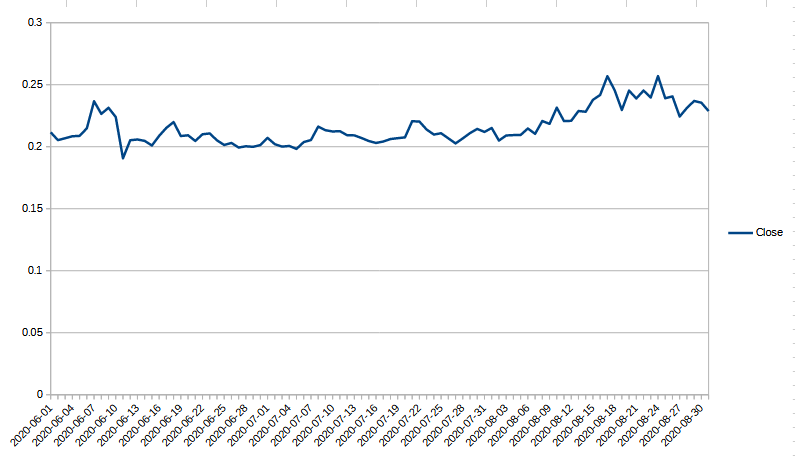

| 2020 | 0.209503 | 0.228726 | Up |

| 2021 | 0.563054 | 0.588153 | Up |

| 2022 | 0.267813 | 0.229373 | Down |

| 2023 | 0.181805 | 0.152875 | Down |

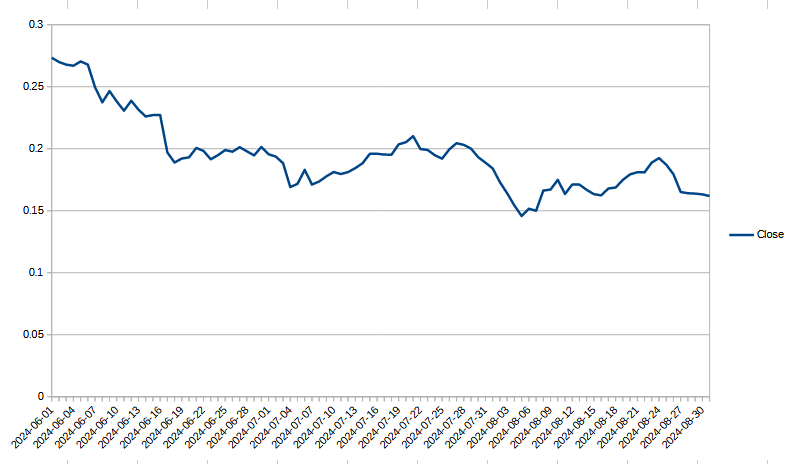

| 2024 | 0.279959 | 0.16183 | Down |

Annual charts

2018

2019

2020

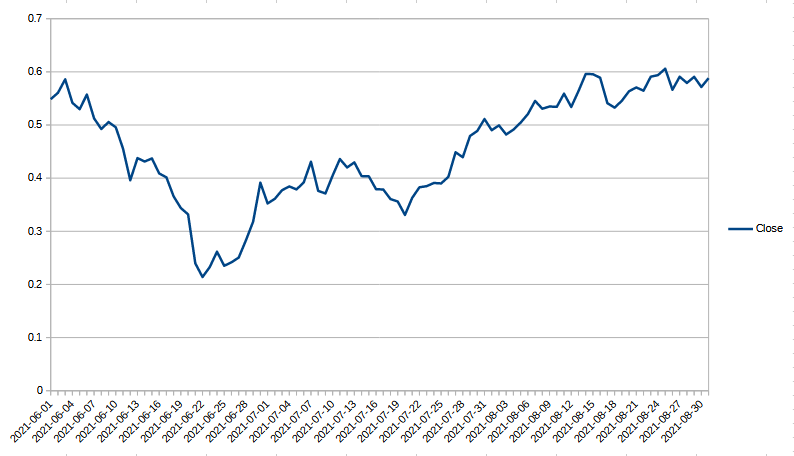

2021

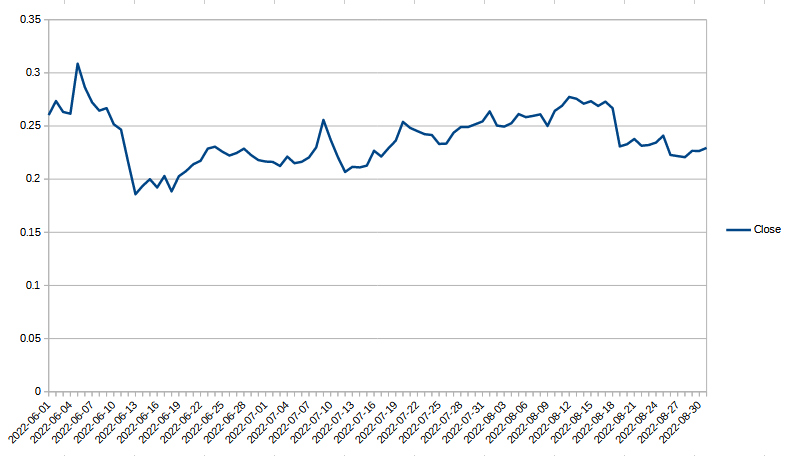

2022

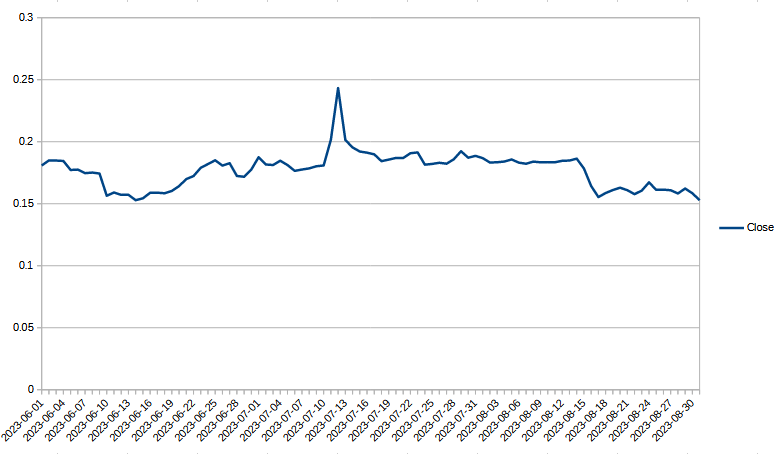

2023

2024

Conclusion

In summary, the summer prices have declined during 5 of 7 years where data is available. Further, in the two summers when prices advanced, they only moved up by small amounts.

In MythBusters lingo, I guess we can say, "Myth confirmed". 😉

Note, however, that these numbers do not include things like interest and curation rewards that result from owning powered-up STEEM.

For the record, I think this sort of data is fun to look at, but I don't think it tells us anything at all about what to expect in the future. This is posted for entertainment purposes, only.

Thank you for your time and attention.

As a general rule, I up-vote comments that demonstrate "proof of reading".

Steve Palmer is an IT professional with three decades of professional experience in data communications and information systems. He holds a bachelor's degree in mathematics, a master's degree in computer science, and a master's degree in information systems and technology management. He has been awarded 3 US patents.

Pixabay license, source

Reminder

Visit the /promoted page and #burnsteem25 to support the inflation-fighters who are helping to enable decentralized regulation of Steem token supply growth.

Comments