How to properly use a crypto signal

3 comments

Hello guys,

I welcome you all to my blog once again. It is another day of the week and I'm delighted to share with you all an insightful aspect of the topic how to properly use a crypto signal. As a Steemian, I believe some of us have started trading the crypto market.

If my assumption is true then I want to believe that we have joined some groups where we meet some great traders and also where signals about trading are given.

No one is a reservoir of knowledge and that is why we join the team of expect all over the world to learn from them as well. My case is not an exception and that is why I'm writing on this today.

Learning crypto trading can be very hectic because of the many things involved. Over the past few months, I have joined various groups on WhatsApp, telegram, discord, and many more social media just to get myself educated on crypto trading most of these groups, I pay heavily to join and learn from them.

When you have joined or if you haven't you may want to DYOR. It is good for you to decide which you want to join but most of the reliable ones are paid groups. This post is aimed at educating those who are in such groups or those who will join these groups to learn and earn.

You may never have the opportunity to be told that immediately after a signal is sent, you are to go into the market if it is using a market order or a limit order. I will explain better below.

Types of order in the market

Basically, in trading the two major types of orders you will encounter are the limit order and the market order. Sometimes this is not stated in the signal so you have to learn some of them yourself.

Market order means you should enter the market at the current price immediately after the signal is sent to the group. On the other hand, a limit order means you can still enter the market but this time the trade will only trigger when it reaches the market price which you have set.

In both, the market order starts the trade immediately whereas the limit order waits for the market price to reach the level where the open order is to kick start the market. So your signals can come in any of them, your ability to know which is which and how to go about it matters a lot.

Buy Signal

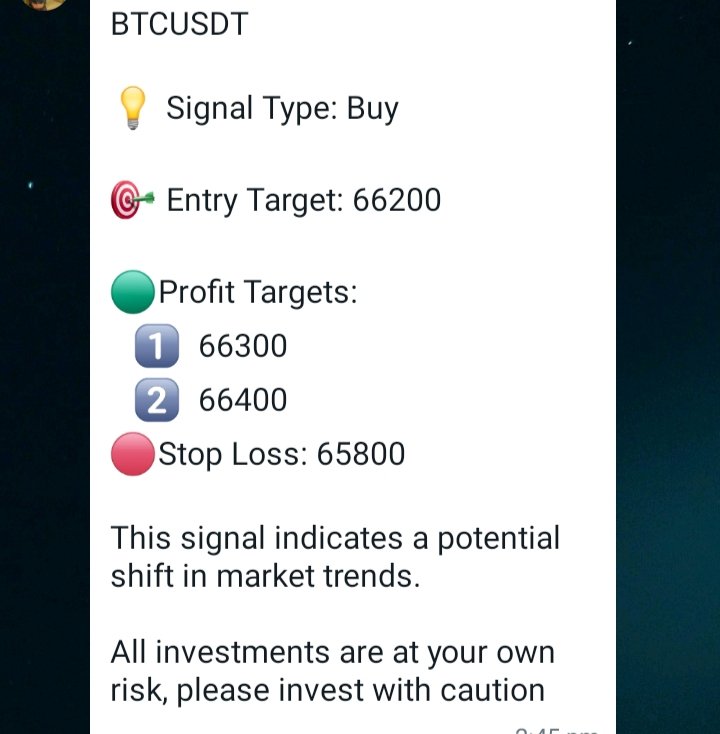

Let's consider an example of a buy signal that was sent to one of the groups I belong to. From the screenshot below, you will notice parameters like signal type, entry target 🎯, profit targets 🎯 and stop loss.

Now when such a signal is sent to any of the groups you belong to, check to be sure that it hasn't been more than a minute since it was sent and if you don't know whether it's a limit or market order, ask those concerned to guide you.

You only enter the market order when the signal is not above 1 minute. If it is above that time, I will suggest you don't enter the trade. Wait for another signal or check a good entry within the same direction.

Sell Signal

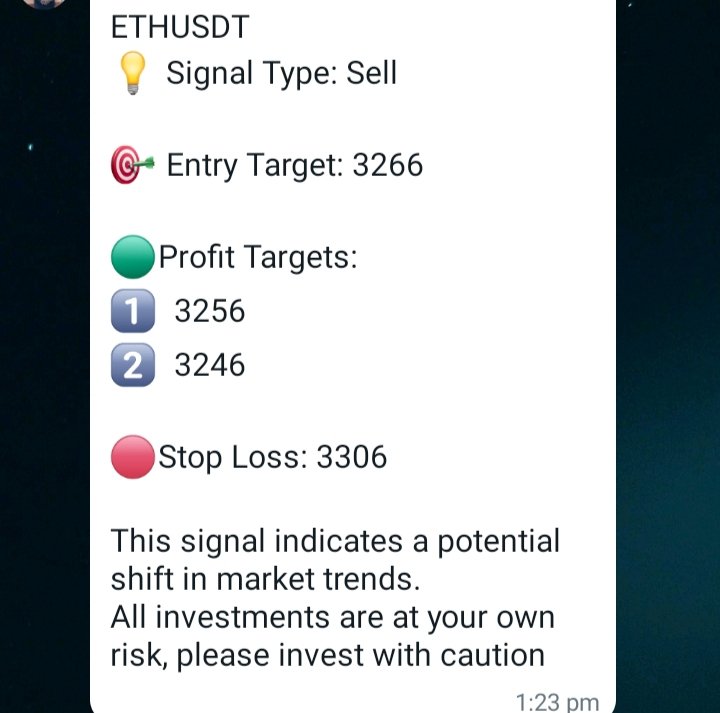

Just like the buy signal, the sell signal is also the same because it has the same properties. From the screenshot below, you will notice parameters like signal type, entry target 🎯, profit targets 🎯 and stop loss.

Now when such a signal is sent to any of the groups you belong to, check to be sure that it hasn't been more than a minute since it was sent and if you don't know whether it's a limit or market order, ask those concerned to guide you.

So that is how to properly use a signal to trade.

In summary, for you to excel in your trading career, you must still have some basic knowledge of technical analysis because that plays an important role in using the signals sent in the group so learn a little about technical analysis such as the levels of support and resistance and what the various moves in the market means.

Remember also that trading is like meditation, patience is the key. Always wait for the market to come to you and not for you to go to the market. Learn to identify your key support and resistance level and also trade with the trend and in that way, you will be a successful trader.

Finally, I want to thank you all for reading through my post today. If you have any questions or contributions, please do well to use the comment section of this post. See you all in my next publication.

Disclaimer: This post is made as an education and not investment advice. Digital asset prices are subject to change. All forms of crypto investment have a high risk. I am not a financial advisor, before jumping to any conclusions in this matter please do your research and consult a financial advisor.

NB: All images except otherwise stated are mine and taken from WhatsApp group

Comments