An Introduction to Drawdown In Crypto Trading

3 comments

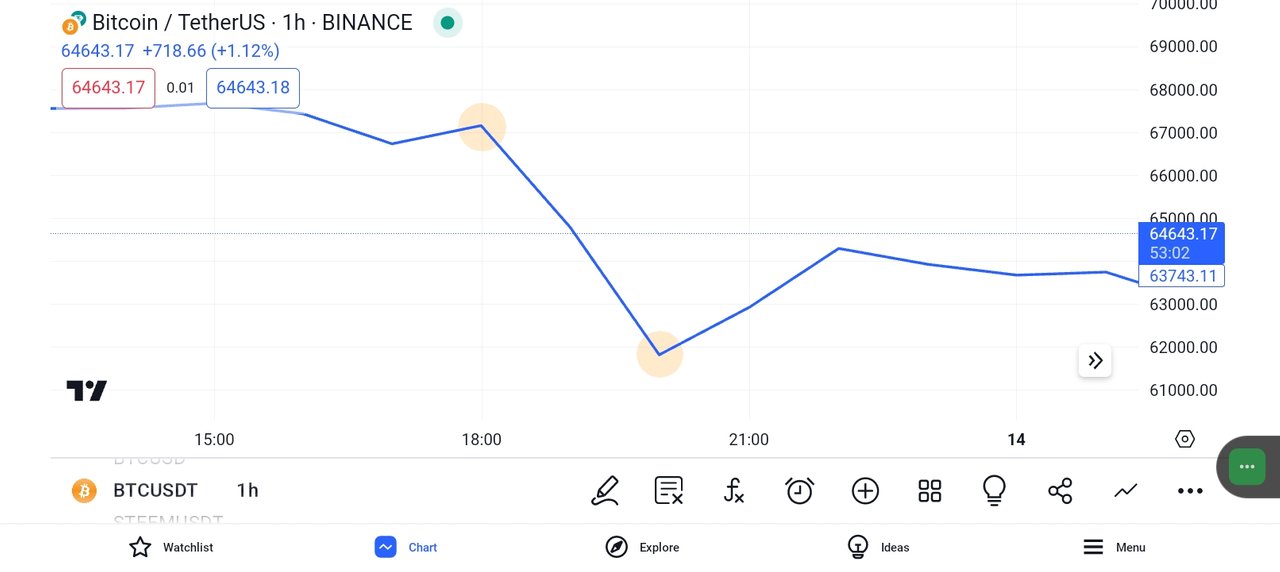

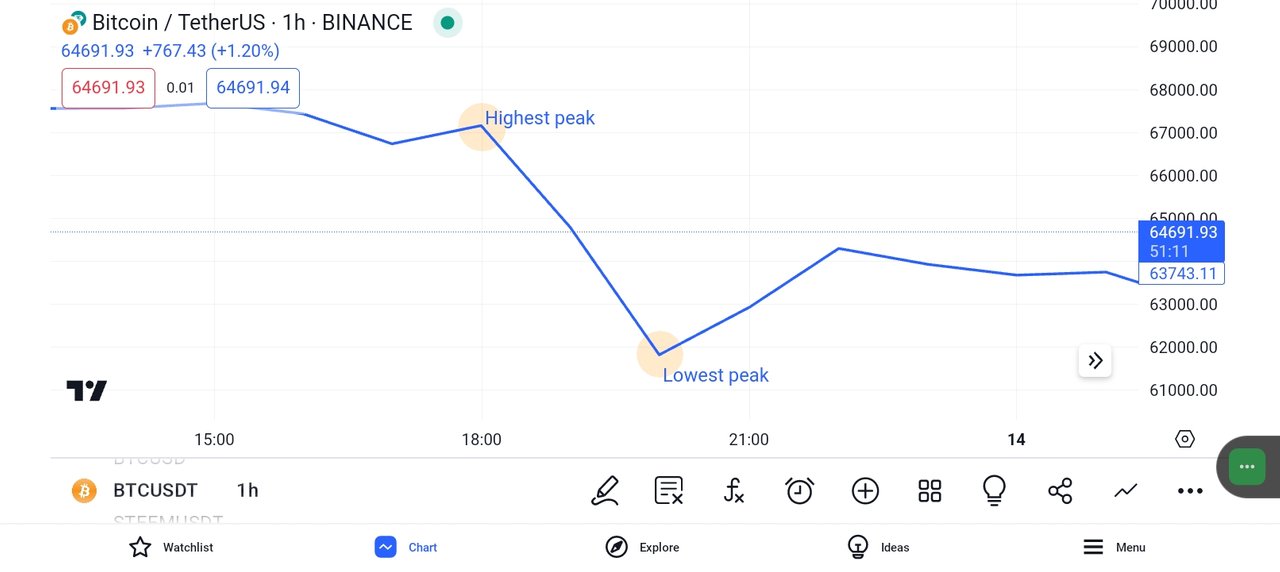

As a trader or an investor, been in the crypto market experiencing a decline of your investment or trade from its highest peak down to a lower peak just know that what has happened to your investment or trade is what is known as drawdown.

Tradingview

If the value of your investment remains below its prior peak (highest price) for a longer duration, the value of the investment will become smaller until the drawdown is over. Drawdown in crypto trading is what we will be learning in this post.

| Drawdown Concept |

|---|

As an investor or trader, you shouldn't think of joking with risk management as it is very important when it comes to trading the financial markets like crypto. Having sound knowledge of risk management will definitely, save you from losses thereby helping you to make profits in the long run.

The truth about crypto trading success is understanding risk management principles (rules). Now before we begin with our discussion let's consider looking at this example:

For example, let's say you have $1,000 in your trading account and you have lost $500. With the example given it means you have lost 50% of your investment.

The example which you have seen above, is purely what traders/investors call "drawdown". In a simple understanding, it is now clear to us that "Drawdown" means the reduction of one's capital (money) after a series of losing trades in the process of trading to make profits. Drawdown is a very important concept you shouldn't overlook when dealing with financial markets such as crypto.

Tradingview

It is a concept that measures the decline in the value of your trading account of investment from its highest peak to its lowest point. The screenshot image above is a perfect illustration of the drawdown concept. Calculating drawdown is very easy, as all you have to do is get the difference between the highest peak of your investment and minus it from the lowest peak.

| How to Calculate Drawdown |

|---|

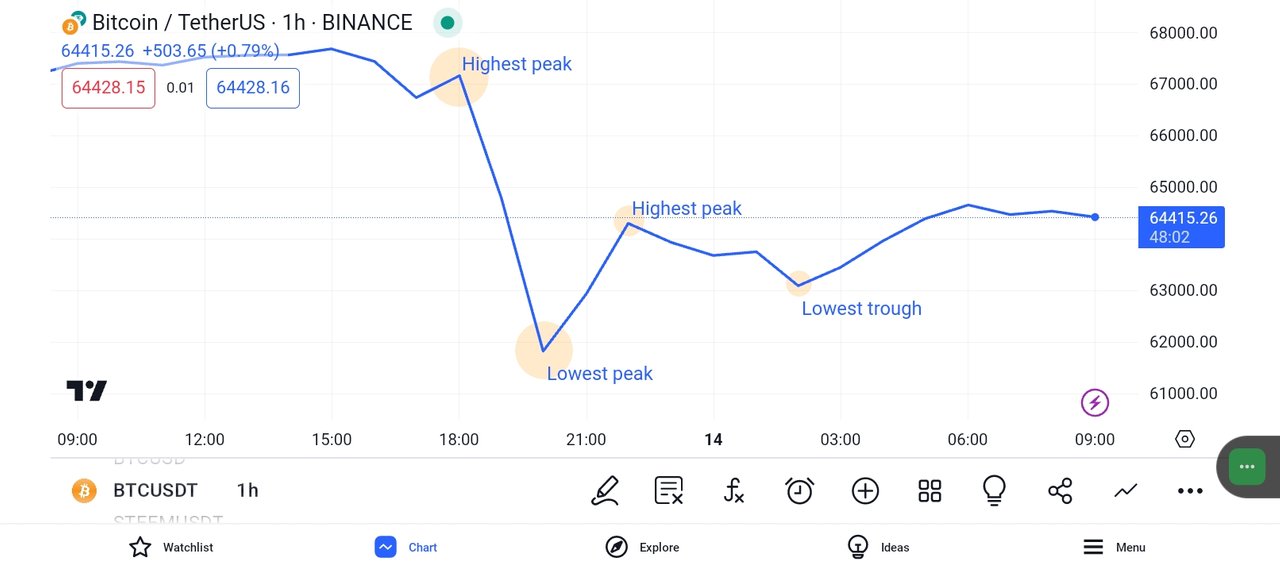

Tradingview

As introduced it is very easy to calculate drawdown, and all you need is to get the difference between the highest peak and the lowest peak of your investment you can make use of the formula shared below.

Percentage Drawdown (%) = ((Highest Peak Value - Lowest Trough Value) / Highest Peak Value)) * 100

Where:

Lowest trough value: stands for the historical lowest price point reached by the asset you have invested in.

Highest peak value: stands for the highest point the price of the asset you have invested in has reached.

| Important of Drawdown in Crypto Trading |

|---|

In the crypto industry, drawdown is an important factor that you should look into. It will help you to create a better strategy for managing your investment and crypto portfolio. If you understand the concept of drawdown it would help you to plan better for the future regarding your crypto investment.

Drawdown is beyond the natural component of risk management and trading digital assets which you have to understand how the concept works. Drawdown is the best and easiest way most traders and investors are using to avoid losses in the crypto market.

| Conclusion |

|---|

We have again learned about the drawdown in the crypto market in this post. Drawdown is far beyond the decline in price if your investment is from the highest peak down to the lowest peak which I believe in this post you have come to understand what drawdown is. Note that this post is treated as educational content and not investment advice.

Comments