Advanced Trading: Multi-Timeframe Analysis and Market Cycles

1 comment

Hello everyone! I hope you will be good. Today I am here to participate in the contest of Steemit Crypto Academy about the Advanced Trading: Multi-Timeframe Analysis and Market Cycles. It is really an interesting and knowledgeable contest. There is a lot to explore. If you want to join then:

Question 1: Understanding Market Cycles

Explain the four key phases of market cycles (accumulation, expansion, distribution, and contraction) and their significance in cryptocurrency trading.

Market cycles are very important in trading. They help to understand the price movements in the crypto trading. In the crypto market there are different cycles and in each cycle the market behaves differently. In each cycle the price movements are specific within a specific range.

Each market cycle has a predictable pattern. This pattern is predicted based on different aspects of the market. Here are some important aspects on the basis of the market patterns are predicted for each cycle:

- Market sentiments

- Demand

- Supply

- External factors

The traders predict the behaviour of the cycle on the basis of these above aspects. These market cycles help the traders to get insights about the market. They can take a good decision about the trading by seeing these cycles because in each cycle the market behaves with a specific price movement. These are the different market cycles which have different price movements:

- Accumulation Cycle

- Expansion Cycle

- Distribution Cycle

- Contraction Cycle

Here is a detailed overview of these market cycles:

1. Accumulation Cycle

This phase happens after a severe market downturn or a after a long bear market. In this phase the prices are low and stable. The prices are not much volatile in this phase. They move with low volatility. In this phase the market does not show any interest of the rise in the market. In this phase the the market absorb the the selling pressure. And in this phase the market attracts the investors and digest the investments and prepare itself for the next big movement.

Accumulation phase of the market is a golden opportunity for the investors to accumulate the assets. The smart investors take advantage of this opportunity. The institutional investors hold the assets in this phase for the big profit in the next phase. Moreover the experienced traders also understand the value and worth of this phase. The informed traders also take benefit from this accumulation phase. The accumulation phase is actually the buying opportunity for the investors. The smart investors know that the price will rise in the future after this accumulation phase.

In the accumulation phase the interest of the people is very low especially the public or the retailers. And in this phase the trading volumes are also not favourable the trading volume is also low because of the low activity in the trading. The people take this phase as slightly neutral and many have negative perspectives about this phase. They have negative emotions and they think that the market is boring in this stage and it will not move upward but it will go more downward.

Technical Indicators:

There are different technical indicators which also suggest the movement of the price in this accumulation phase. According to the technical indicators these important points can be noted:

- Price is consolidating in a tight range, which forms a foundation.

- Indicators such as RSI (Relative Strength Index) may reflect over sold conditions.

Trading Significance:

As I have mentioned earlier that this phase has a great importance in the trading and it offers a great opportunity to the investors. Here are some key points to show its significance in the trading:

- This is a strategic time to build positions in undervalued assets.

- This phase is used by long term traders to buy in at a good price before the market rises.

Here I have taken an example of the accumulation zone from the STEEM/USDT chart. We can observe that the market is moving within the box. The price is just moving sideways in this phase and is not crossing the support and resistance.

2. Expansion (Markup) Cycle

This is another important market cycle. In this market cycle the price moves in a specific behaviour. It happens right after the accumulation phase. It is always followed by the accumulation cycle. As from the name we can predict that it is the phase where the market starts expanding its wings.

In this market cycle the prices start rising. The prices goes in the uptrend and they continuously rise in the upward direction. And by seeing this rise in the price may new investors start accumulating the assets and due to which the price continuously moves. This phase is carried out by the outcome of the positive news about the market. The technical progress of the assets also causes the expansion cycle in the market. When the use cases of the cryptocurrency increases then the buying occurs at great speed this also causes the expansion cycle.

In this phase when the prices start rising then seeing the trend the retail investors also take part in the market. They accumulate the assets and the price continuously rise in the upward direction. It causes the rise of the demand in the assets. During this cycle the volumes also increases because of high activity of the traders.

In this phase the momentum of the market is built and this momentum of the rise in the prices attract more investors towards the cryptocurrency. And when these investors start accumulating the assets the prices further go in the upward direction. In this phase the skepticism is shifted towards the optimism and then eventually towards the euphoria.

Technical Indicators

Here is the behaviour of the technical indicators during the expansion phase:

- Breakout patterns emerge such as higher highs and higher lows on charts.

- Volume spikes coincide with price rallies confirming the uptrend.

- Moving averages often manifest bull crossovers, such as 50-day MA over 200-day MA.

Trading Significance:

The significance of the expansion phase or cycle in the trading is given below:

- Traders use trend-following trading styles and take advantage of positive momentum.

- The money-making period is usually the greatest here, because confidence in the markets tends to rise, and prices start shooting up.

Here you can see the expansion phase example of the STEEM/USDT chart. We can observe that the price expanding and rising in the upward direction. It means that the more and more investors are joining forces to push the price in the upward direction.

3. Distribution Cycle

This is very important cycle in the crypto market. Many people are trapped in this cycle so it has a lot of significance in the market. As from the name it is shown that this cycle is related to the distribution. So in this phase the assets are distributed.

Asset distribution cycle stands that the big whales or the institutional investors who accumulated the assets in the accumulation cycle start distributing their assets. We know that the price is drove higher and higher because of the participation of the retail investors. When the price reaches at its peak because of the retail investors then they institutional investors and the whales starts selling or distributing their holdings to the retailers. The retailers starts buying those assets.

In this stage the volume increases more because of the huge selling of the assets but the price remains stick at specific range. It is because the selling assets are being bought by the retail investors and due to which the market tries to balance the condition. The institutional investors leave the market at this phase by holding the big bags of profit.

So in the distribution the upward movement of the assets is dismissed by the resistance and selling pressure. So the smart investors sell their shares to the late comer investors in the market. The late comers think that the price will go further in the upward direction. These are the traders with less experience and knowledge of crypto.

In this cycle the market sentiments are different. The newcomers think that the market will go further upward and it shows optimism. But the old investors become cautious at this stage and they avoid sitting in the running train. But at this stage the price does not go downward direction suddenly but the market sees small rallies and pullbacks. The buying of the retailer or late investors thrust the price in the upward direction temporarily.

Technical Indicators:

Here is the behaviour of the technical indicators during the distribution phase:

- Volume tends to reach a peak and then turn down, which means interest is dropping.

- Patterns such as double tops or head and shoulders can start to appear, which can suggest a reversal.

- Oscillators like RSI can indicate overbought conditions.

Trading Significance:

The significance of the distribution phase or cycle in the trading is given below:

- It is a risk management time. Traders can decrease their exposure, take profits, or set stop-loss orders to lock in the gains.

- Closely monitoring the market during this phase can be helpful in determining the start of a bearish trend.

Here you can see the example of the distribution phase of STEEM/USDT trading pair. We can see that the price is fluctuating at this stage and it is coming down as well as it is spiking in the upward direction. Actually the institutional investors and the other smart investors are selling their holdings.

4. Contraction (Markdown) Cycle

This is the last cycle of the 4 cycles where the cycle is completed and after this cycle the initial cycle of the market starts again. This contraction cycle starts right after the distribution cycle. And it happens because of the distribution zone as distribution is the factor which causes this cycle.

Actually in this zone the market momentum is broken. The price trend reverses in this cycle. And this cycle leads to move the price in the downward direction. In this phase the bearish movement of the price starts. And the prices start decreasing and falling down due to the increased selling pressure.

And during this phase the negative sentiment of the market starts. And FUD take control of the market. The panic selling starts at this phase by the retail investors when they see hug volumes but the decrease in the price. And this also represents the downtrend of the market. The prices declines quickly at this stage.

In this phase the drop in the prices happen suddenly and these drops are huge but the recovery in the price is very small. And overall trend is downtrend where the prices fell down on the whole. In this cycle the interest of the market also drops and then the trading volumes also start declining because the participants leave the market.

Technical Indicators

Here is the behaviour of the technical indicators during the contraction phase:

- Downward trends are established, with lower highs and lower lows on charts.

- Moving averages have bearish crossovers; for example, the 50-day MA crossing below the 200-day MA.

- Indicators such as RSI can show extreme conditions of being oversold.

Trading Significance:

The significance of the contraction phase or cycle in the trading is given below:

- Traders will focus on capital protection either by exiting the market or through short selling.

- In many cases, this phase provides clues to the next accumulation phase as prices start levelling out after a long-term downward trend.

Here is the example of the contraction phase of the STEEM/USDT trading pair. We can observe that the price is dropping from the top after the distribution phase. It is because of the huge selling pressure.

Market Cycles in Cryptocurrency Trading

Here is the significance of the market cycles in the cryptocurrency trading:

- Opportunity Identification:

- The phases can be seen as an indicator of entry (Accumulation) and exit (Distribution) points for traders.

- Recognizing the signs of a phase change allows traders to adjust strategies accordingly.

- Risk Management:

- The understanding of cycle dynamics eliminates impulsive decisions made when markets are at their extreme, for example, when people are panicking and selling in Markdown or buying euphorically in Markup.

- Enhancing Strategy

- Traders can work on an enhanced strategy through technical analysis, sentiment analysis, and fundamental analysis specific to the stage.

- Volatile Response:

- Cryptocurrency markets have high volatility, and often the cycles run through faster than the traditional markets. Knowing this keeps a trader ahead.

Through mastering these cycles, cryptocurrency traders can enhance their ability to navigate market volatility, draw benefits from trends, and minimize risks.

Question 2: Applying Multi-Timeframe Analysis

Demonstrate how multi-timeframe analysis can be used to identify trends and reversals during different market cycle phases. Use examples from Steem/USDT charts.

Multi timeframe analysis are very important in the identification of the trends and reversals during the different market cycles. Multi timeframe analysis is a wonderful technique where the traders can examine the same asset on the different timeframes. The traders use this technique to understand the broader trend as well as the finer details about the market.

Each timeframe has its own importance and uniqueness in the detection of the market cycle and the trends reversals. By analyzing the higher timeframes such as daily or weekly and lower timeframes such as hourly or 4 hour charts the traders can identify the trends and reversals. They can identify the ideal entry and exit points in the market in the diferent cycles or phases.

Here is a complete guide that how we can apply multi timeframes to the STEEM/USDT charts during each phase.

1. Accumulation Phase

As we have discussed earlier that accumulation phase is the phase where the market prepares itself for the next bull run. The price in this phase moves sideways in a specific range of the support and resistance. It is the opportunity for the investors to take advantage and they can accumulate assets in this phase. Here are the analysis for the different time frames. I will perform the analysis on the two timeframes one is longer timeframe and one is short timeframe.

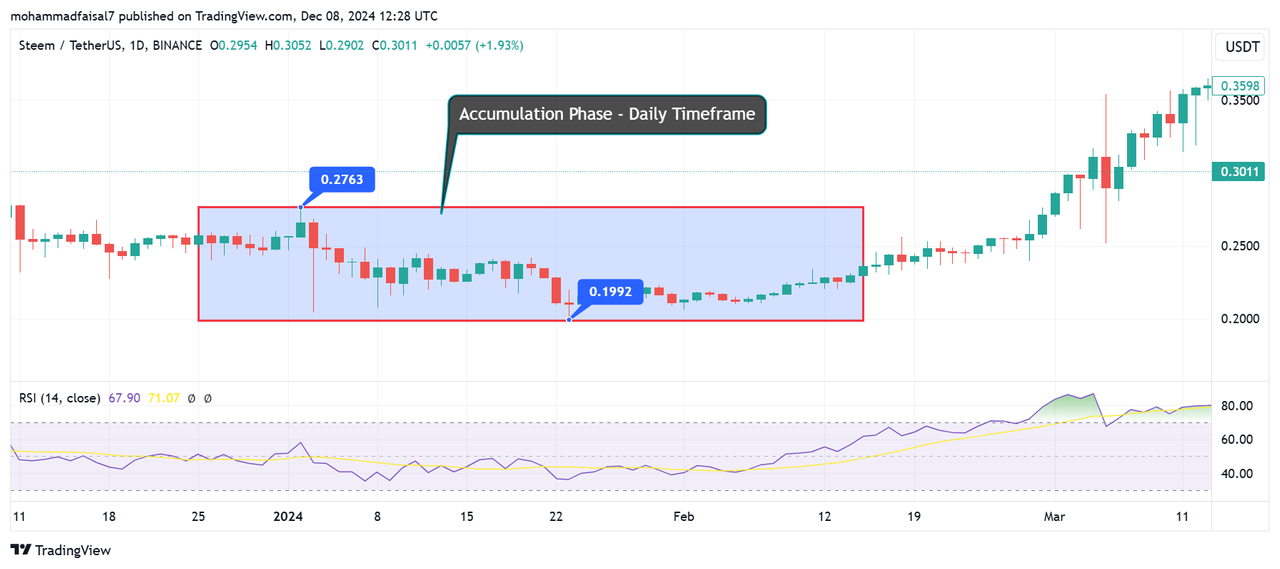

Higher Timeframe (Daily)

This is the daily timeframe chart of the STEEM/USDT trading pair. In this higher timeframe the price is in the accumulation cycle. This often happens after the decline or a downtrend in the price. You can see in the above chart that the price is moving in the box where the lower line of the box is acting as a support level and the upper level of the box is acting as a resistance.

Except this resistance and support there are further fine support and resistance areas within the box. The higher resistance level of STEEM/USDT is $0.2763 and the price is being rejected from this level or below this level towards the downward direction. The lower resistance level of STEEM/USDT is at the price level of $0.1992. We can see that each time the price is being rejected from this support level or the support level above this major support area.

This is a higher timeframe chart which is representing the long term scenario of the price movement. Here I have applied the RSI indicator to get to know more about this accumulation cycle. We can see that the in the accumulation phase in the higher timeframe the RSI indicator is also suggesting an oversold condition which is a buying opportunity. So in this accumulation phase this daily timeframe cart is representing a trend reversal in the price because of the oversold condition. It means the market has started recovering and after this recovery soon the market will move in the upward direction. This daily timeframe has suggested trend reversal in the price action right after this accumulation phase.

Lower Timeframe (4-hour or Hourly)

This is the lower timeframe chart of the STEEM/USDT trading pair. In this chart the trading behaviour of the STEEM/USDT is shown in the 4 hour timeframe. It is better to understand the market in the short term. It is very helpful to determine the trend reversals and the movement of the price.

This low timeframe helps us to monitor the small changes in the price. We can see that the market is in the accumulation phase. And the price is moving within the box. The line of the box is representing the resistance of the price in this short timeframe. And the lower line of the box is representing the support in this timeframe.

If we see the RSI indicator it is suggesting the oversold condition. It means that the price is preparing itself for the next big move and it is the opportunity for the traders to accumulate STEEM/USDT at this phase to generate profit in the future but in near future as it is the short timeframe.

This chart is showing low volatility in the market as the price is limited to move in the specific range. The price is moving between the $0.2553 to $0.2847. This suggests that the current trend is of accumulation and is changing gradually and right after this accumulation phase the trend will be reversed because the market is preparing itself for the next leg up.

2. Expansion (Markup) Phase

We have already discussed this phase that in this phase the price starts expanding or rising. It happens right after the accumulation phase and the price starts increasing in the upward direction. This attracts more investors and retailers to accumulate the assets to further push the price in the upward direction. Here are the analysis for the different time frames. I will perform the analysis on the two timeframes one is longer timeframe and one is short timeframe.

Higher Timeframe (Daily )

Here we can see that after the consolidation of the market the price has started rising in the upward direction. This is the expansion zone. And during thsi expansion zone in this daily timeframe we can see a trend reversal in the market price.

In this long timeframe we can see that the trend reversal has confirmed as in this expansion zone the price has successfully broken the resistance and after breaking it the price is rising in the upward direction. This is how the multi timeframe analysis help us to identify the trend reversals in the market. We can see a clear trend reversal in the expansion zone where the market has crossed the resistance.

Moreover if we see the RSI indicator then we can observe previously it suggested an overbought condition that the price will move in the upward direction soon and similarly in this the RSI indicator is rising suggesting the entrance of the buyers in the market and it will further push the price in the upward direction. Here we can see that the large green candles are being formed and the volume is also increasing at great rate while the upward movement of the price.

Lower Timeframe (4-hour)

This is the low timeframe chart where we can see the identification of the trend reversal in the price. We can see that the price has broken through the resistance zone. It is the trend confirmation that the price will further move in the upward direction. In this expansion zone the prices move rapidly by forming the big green candles. And here if we see carefully the resistance which it has broken has become support.

3. Distribution Phase

We know that distribution is the peak price movement where the institutional investors start selling their assets and the volume increases but the price does not which further confirms the distribution zone.

Higher Timeframe (Daily)

Here if we see STEEM/USDT chart in the higher timeframe we can detect the distribution zone where the price is rejected. In this phase the trend reversal is also detected where the price has been rejected by the resistance. Actually at this phase the institutional investors and the other smart investors sell their holdings and distribute them to the retailers.

The RSI indicator has confirmed the reversal in the trend as it is representing the overbought condition. From this it is confirmed that the trend is going to reverse. And we can observe that after this indication the distribution phase started where the price tries to maintain but eventually started falling down. It is how we can detect the trend reversals in the market in the different cycles of the market by using the different timeframes.

Lower Timeframe (4-hour):

This low timeframe scenario helps us to understand the increased selling pressure on the assets during the intraday rallies. It reflects the higher wicks on the candlesticks. Here in this chart we can see the reversal in the trend. In this timeframe the distribution phase is happening as highlighted in the box. Here we can see carefully that the price is rejected from the top resistance. The RSI indicator is also suggesting the overbought condition. It is the confirmation of the trend reversal. It is how we can identify the trend reversal in the distribution phase by using different timeframes.

In this distribution phase of low timeframe the price drops and it indicates the institutional investors sell their assets to the retail traders. Actually due to this selling pressure the price has failed to break the upper resistance level.

4. Contraction (Markdown) Phase

Contraction phase happen right after the distribution phase actually in this phase the price starts contracting or lowering from the peak level.

Higher Timeframe (Daily)

This is the daily time frame chart to represent the contraction phase and the rejection in the market. We can see that the price has been rejected by the resistance and due to which the selling pressure has increased at this level which lead to the reversal in the trend. And this reversal in the trend caused to happen the contraction zone. We can see that the price is decreasing gradually in the downward direction.

After the trend reversal by the rejection of the price due to the resistance bearish movement of the price has started in the downward direction. The RSI indicator is also indicating the overbought condition due to which the trend was confirmed earlier and it further led the price to move in the downward direction.

Lower Timeframe (4-hour)

In this lower timeframe chart of STEEM/USDT we can observe the trend reversal in the price of the STEEM/USDT. This trend reversal happened due to the distribution phase. The RSI indicator suggested the rejection by giving the overbought situation.

The contraction phase has led the price to move in the downward direction. The price is contracting gradually after the trend reversal. This low time frame helps us to identify the small spikes in the price and helps us to identify the temporary bounces in the market.

This contraction cycle in this short timeframe suggests that the trader can take a short entry at that point to make profit while shorting the price. If the trader do not want to short the market and it is already holding a long trade then the trader can exit the long trader after the detection of the trend reversal in the price.

In this short timeframe we can further use other technical indicators to confirm the trend reversal as we can see RSI indicator in the current chart. It is helping to detect the trend reversal. We can see that the price tried to go in the upward direction but it was rejected the resistance again and it started moving in the downtrend.

Why Multi-Timeframe Analysis Matters

- Trend Confirmation:

- Higher timeframes reveal the dominant trend, ensuring traders align their trades with the larger market direction.

- Precise Timing:

- Lower timeframes highlight short-term opportunities for entries and exits, especially during transitions between phases.

- Risk Management:

- Combining perspectives from multiple timeframes reduces the likelihood of false signals.

Using MTA with tools like support/resistance levels, trendlines, and momentum indicators, traders can effectively navigate the cycles in Steem/USDT or any other cryptocurrency as I have explored Steem/USDT chart for the examples.

Question 3: Combining Market Cycles with Multi-Timeframe Analysis

Show how to align multi-timeframe analysis with market cycles to refine your trading strategies. Highlight how these tools complement each other in volatile markets.

Two powerful concepts used in trading are market cycles and multi-timeframe analysis, which combined help align the strategy of a trader with the rhythm of the market as well as to adapt to price movement across timeframes. Market cycles can provide the context for understanding the phases of price movement, whereas MTA refines the execution by indicating the points for entry and exit at finer levels of granularity. This concept is important in volatile markets, such as Steem/USDT, where prices vary sharply.

Below is a detailed explanation of how to use the MTA in conjunction with the market cycles to fine tune trading strategies.

1. Accumulation Phase: Preparing for Trend Reversals

Market Cycle Insights

- After a long downtrend has stabilized and price has mostly traded sideways.

- Large institutions, or smart money, quietly accumulate positions when retail traders lose interest.

- Volume is normally meager but periodic peaks give a signal that interest may be building up.

- Sentiment Emotional: Bears/neutralists feel that market lacks direction.

MTA Application

Higher Timeframes (Daily/Weekly)

- Be watching for horizontal price action that is within a critical area of support. Often occurs at the time of significant over-sold conditions on such as the RSI (value <30).

- Example: On the Steem/USDT weekly chart, notice that prices stay in a long consolidation from $0.20 to bounce between $0.18 and $0.22.

- We can use tools like the moving averages (50-week MA flattening) to prove stabilization.

Lower Timeframes (4-hour/Hourly)

- On lower timeframes, notice small volume spikes, higher lows, or bullish divergences on RSI/MACD, pointing to slight buying activity.

- Example: On the 4-hour Steem/USDT chart, there is a minor breakout above $0.22, with growing trading volume. This might be the sign of accumulation beginning.

Strategy:

- Accumulate near the lower edge of the consolidation range.

- Set stop-losses just below the support.

- Do not over-leverage accumulation can last for weeks or even months.

2. Expansion (Markup) Phase: Riding the Uptrend

Market Cycle Insights

- The expansion phase commences when prices break out of the accumulation range and higher highs and higher lows appear.

- Increased volume and market optimism confirm the uptrend as retail traders and institutions start buying aggressively.

- Emotional Sentiment: Bullish, as confidence grows and FOMO (fear of missing out) drives participation.

MTA Application

Higher Timeframes (Daily/Weekly)

- Look for breakouts above key resistance levels on a weekly chart, like $0.30.

- Confirm the trend with moving average crossovers, like when the 50-day MA crosses above the 200-day MA, referred to as a golden cross.

- Example: On the Steem/USDT daily chart, prices rally from $0.30 to $0.50, making higher lows.

Lower Timeframes (4-hour/Hourly)

- Use retracements to identify entry points during pullbacks. Tools like Fibonacci retracements (e.g., 38.2% or 50%) are useful.

- Example: On the 4-hour chart, prices retrace to $0.45, a previous resistance-turned-support, before continuing upward.

Strategy

- Add to positions during pullbacks in the uptrend.

- Scale out near pre-determined resistance levels or as price approaches overbought conditions on RSI (>70).

- Avoid counter-trend trades, as momentum is firmly upward.

3. Distribution Phase: Preparing for Reversals

Market Cycle Insights

- Prices stall after an extended rally, forming a plateau where buyers and sellers struggle for control.

- Smart money starts to sell as volumes decline during the upward moves and increase during the sell offs.

- Emotional Sentiment: Cautious, or euphoric: many believe that the move will continue despite weakening signs

MTA Applied

High Timeframes (Daily / Weekly)

- Be on the lookout for sideways movements in price near key zones of resistance, usually falling volume.

- Monitor for bearish divergences. Price is forming higher highs, while RSI or MACD is forming lower highs.

- Example: On the Steem/USDT daily chart, price peaks at $0.30-$0.35 and fails to break higher for multiple weeks.

Lower Timeframes (4-hour/Hourly)

- Note intraday rejection patterns, including long wicks near resistance or increased selling pressure.

- Example: On the 4-hour chart, Steem/USDT repeatedly tests $0.35 but fails, showing waning bullish momentum.

Strategy

- Exit long positions incrementally as signs of distribution emerge.

- Avoid aggressive buying, and prepare for potential short trades once the breakdown is confirmed.

- Tighten stop-losses to protect profits.

4. Contraction (Markdown) Phase: Managing Downtrends

Market Cycle Insights

- The contraction phase bears an environment of persistent selling pressure. Here, the prices make lower highs and lower lows.

- Panic selling and emotional capitulation prevail in this phase.

- Bearish Sentiment: This is characterized by emotional fear and uncertainty.

MTA Applied

Higher Timeframes (Daily/Weekly)

- Confirm the downtrend with bearish moving average crossovers (e.g., 50-day MA below 200-day MA) and significant breakdowns below support levels.

- Example: On the Steem/USDT weekly chart, prices fall below $0.40, triggering further selling pressure.

Lower Timeframes (4-hour/Hourly)

- Use lower timeframes to identify relief rallies for shorting opportunities.

- Watch the technical indicators such as RSI or bBollinger Bands closely, where the price hugging the lower band will confirm strong bearish momentum.

- Example: On the 4-hour chart, Steem/USDT rallies briefly to $0.35 before continuing downward.

Strategy

- Short temporary rallies when in clear downtrends.

- Do not try to catch falling knives by waiting for confirmed reversals before going long.

- Preserve capital.

Why Combining Market Cycles and MTA Is Effective

Improved Context:

- Market cycles give the big picture, allowing traders to understand the overall environment (bullish vs. bearish).

- MTA ensures that trades are in phase by analyzing trends across timeframes.

Flexibility in Volatile Markets:

- Cryptocurrency markets, like Steem/USDT, are very volatile. MTA can be used to trade sudden movements because it uses both higher and lower timeframes.

Better Risk Management

- This is to say that by superimposing the broader cycle view upon granular details, traders can define tighter stop-losses and take-profits with certainty.

Strategic Precision

- This helps the trader identify optimal entry/exit points and avoid emotional decisions by systematically applying MTA within each phase.

The use of the big picture (market cycles) and small details (multi-timeframe analysis) will help refine the strategy and navigate with confidence volatile markets like Steem/USDT.

Question 4: Developing an Advanced Trading Strategy

Create a trading strategy for Steem/USDT that integrates market cycle phases and multi-timeframe analysis. Specify your entry, exit, and risk management criteria.

Here is an effective trading strategy for Steem/USDT by taking into consideration both the phase of the market cycle and multi-timeframe analysis. It details all criteria for entry, exit, and risk management, so this would be a well rounded system for navigating volatile market conditions.

1. Preparation: Determining the Phase of the Market Cycle

Market cycles have to be understood in order to adapt the trading plan with more general trends. Every cycle has its unique demands:

Accumulation Phase

It is the stage of stabilizing around the great downtrend. Prices tend to move sideways, which forms a range with lower volatility. This time long-term investors or 'smart money' start accumulating positions. Characteristics involve:

- Price stays around major support levels

- Low trading volume with intermittent high trading volumes that are signs of accumulation.

- Bullish divergences on technical indicators such as RSI or MACD.

Expansion Phase

Expansion is characterized by strong buying interest and a clean breakout above the accumulation range. Prices form higher highs and higher lows which indicates the beginning of a new uptrend. Features of this phase include:

- Volume continues to rise because demand exceeds supply.

- Momentum indicators are quite strong, with RSI remaining greater than 50 and MACD producing bullish crossovers.

- Breaking out from consolidation patterns like an ascending triangle.

Distribution Phase

Distribution forms near the end of a rising trend as "smart money" begins to liquidate their positions. Prices may assume a range or show divergence in momentum. Here are the features and characteristics:

- Volume divergence as the price goes price up but the volume down.

- Reversal patterns such as double tops or head and shoulders.

- Overbought conditions with RSI greater than 70.

Contraction Phase

A contraction phase is a downtrend of lower highs and lower lows. Selling pressure usually occurs when it is initiated by adverse market psychology or fundamental events. These are some characteristics:

- Breakdowns below key support levels.

- Increasing volume on the downside.

- RSI falls below 30, or MACD has a bearish crossover.

2. Multi-Timeframe Analysis

Multi-timeframe analysis ensures that trades are in line with the overall market trend while fine-tuning entry and exit points.

Higher Timeframes (Daily/Weekly)

- Determine the dominant trend and phase of the market cycle.

- Highlight important support and resistance levels based on historical price action.

- Confirm long-term patterns, such as trendlines or channels.

Lower Timeframes (4-hour/Hourly)

- Study short-term price action to identify precision entry and exit points.

- Identify levels of support and resistance for intraday trading.

- Confirm setups using various candlestick patterns such as pin bars, engulfing bars, or inside bars.

Example: Steem/USDT

- This would show if the asset is in a larger trend from the weekly chart.

- The 4-hour chart can identify an ideal entry when there is a pullback or breakout.

3. Entry, Exit, and Risk Management Criteria

Accumulation Phase Strategy

This phase of waiting for confirmation of a reversal:

Entry Criteria

- Larger timeframe: Look for a range at support, say around $0.18-$0.22. If the price has broken lower, volume spikes appear as the price moves higher.

- Lower timeframe: Enter on a breakout above the range such as $0.22 with confirmation from volume and bullish momentum indicators.

Exit Criteria

- Take partial profits at the next resistance level such as $0.30 to lock in gains.

- Exit fully if the price re-enters the consolidation range, signaling a failed breakout.

Risk Management

- Place a stop-loss slightly below the lower boundary of the range such as $0.17.

- Risk only 1-2% of your capital per trade.

Expansion Phase Strategy

Expansion is ideal for trend-following strategies:

Entry Criteria

- Higher timeframe: Confirm a breakout and uptrend, such as Steem/USDT moving above $0.30 with strong volume.

- Time frame: Enter on pullbacks to Fibonacci levels (38.2% or 50%) or a moving average (50 EMA).

Exit Conditions

- Partial exit at the first significant resistance such as $0.25.

- Full exit if bearish divergences appear on RSI or MACD.

Risk Management

- Use a trailing stop-loss to lock in gains, yet let the trade run.

- Avoid entering when RSI is above 70, which means that conditions are overbought.

Distribution Phase Strategy

In this phase the focus is on shorting or reducing the exposure:

Entry Criteria

- Higher timeframe: Spot price stalling at resistance like $0.30 and volume is declining.

- Shorter time frame: Shortly after the price breaks down below support or creates bearish patterns such as a double top. And we can exit the long entries here.

Exit Rules

- Short cover near supports such as $0.30 and if the entry is long then we can exit the trade.

- Take out entire position if price turns above breakdown point.

Risk Management

- Place a stop-loss slightly above the resistance point, say, at $0.32.

- The position size should factor in increased volatility.

Contraction Phase Strategy

Focus on preserving capital and taking advantage of speedy trades:

Entry Criteria

- Higher time frame: Reiterate a dominant downtrend as Steem/USDT puts in lower lows.

- Lower time frame: Short during relief rallies to levels of resistance or out of small consolidations on smaller time frames.

Exit Criteria

- Cover short near support levels, e.g. $0.30.

- If a bullish divergence is noticed on RSI/MACD then close it completely.

Risk Management

- Dynamically adjust stop losses with Average True Range (ATR)

- Do not over leverage the position when the market is volatile.

4. Refining the Strategy

There is always a room to make the trading strategy more better and working to remain safe in the market while making profit. So here are some tips which are helpful to refine the trade:

Indicators and Tools

We can implement different indicators along with the multi timeframes and market cycles. Some important and useful indicators are given below:

- RSI: To confirm overbought (above 70) or oversold (below 30) conditions.

- MACD: To monitor crossovers and through the use of histograms to show shifts in momentum.

- Volume: To establish an increase or decrease in volume to support trends or breakouts.

- Moving Averages: The 50-day and 200-day moving average combination for determining the direction of trend.

Fundamental Analysis

In order to further refine the trading strategy we can use technical setups along with fundamental insights which may include:

- Trending news or market sentiment about Steem.

- Updates on the development or changes in the cryptocurrency's ecosystem.

Dynamic Adjustments

- Adjust position size during volatile times to reduce risks.

- Use trailing stops to lock profits while allowing trades to ride extended trends.

By seamlessly integrating market cycle phases and **multi timeframe analysis, this strategy ensures that traders can adapt to varying conditions, refining entries and exits for maximum profitability while safeguarding capital with the help of the risk management techniques.

Question 5: Mitigating Risks in a Volatile Market

Discuss how to manage risks and avoid false signals when trading across multiple timeframes during different market cycle phases.

Trading in a volatile market comes with its own special set of challenges and opportunities. For traders, a fine line between capitalizing on the potential benefits and protecting the capital against unpredictable price movement is an important balancing act. Since false signals, more prevalent in volatile markets, lead to poor decisions, resulting in tremendous losses if managed inefficiently. It can thus be said that the essence of a structured approach involves multi-timeframe analysis for better navigation through different market cycle phases. The following presents an expanded framework in light of comprehensive risk management.

1. Volatility and Its Consequences

Volatility is the trademark of cryptocurrency markets: rapid changes in price can occur within minutes or hours. It is driven by market sentiment, news events, and low liquidity in some trading pairs. While volatility offers immense possibilities for gains, it also raises the chances of false breakouts and impulsive decisions to trade.

In the Accumulation Phase, prices tend to stay within a tight range, often making false breakouts that immediately reverse. Traders who prematurely take positions without confirmation get small, frequent losses. During the Expansion Phase, the market is strongly trending, with pullbacks often being steep enough to stop out traders who do not account for the higher volatility.

The Distribution Phase tends to mislead traders with short-term rallies that cannot hold for more time, as large investors are selling their positions. Lastly, the Contraction Phase is characterized by volatile price action based on fear, uncertainty, or news events. By recognizing these signs, traders can predict market movements and adjust their strategies appropriately.

2. Managing Risks Across Timeframes

Higher Timeframes for Trend Confirmation

Higher timeframes, such as the daily or weekly charts, give a better view of the underlying market trend. These timeframes will help to weed out the noise and show major support and resistance zones. For instance, a trader might be analyzing Steem/USDT and notice that the cryptocurrency has been in an uptrend on the weekly chart but would avoid long positions if the daily chart looked to be consolidating or reversing.

Higher timeframes also reveal the broader market cycle phase, enabling traders to align their strategies with the overall trend. For instance, during the Distribution Phase, higher timeframes may show declining momentum, signaling a potential shift to the Contraction Phase.

Lower Timeframes for Precision

The clarity provided by higher timeframes, lower timeframes such as the 1-hour or 4-hour charts provide precision for entries and exits. These charts are very useful for timing trades, catching short-term patterns, and position management in a dynamic way. On the other hand, lower timeframes are noisier, leading to false signals.

To avoid such a risk, traders should use only those signals from the lower timeframes, which are in the direction of trends or patterns depicted in higher timeframes. Suppose there is a bullish breakout on the 4-hour chart, to confirm a trade setup, this must be aligned with a strong uptrend on the daily chart.

3. Using Indicators to Filter False Signals

Indicators confirm the trade setup and limit the number of false signals. Multiple indicators are important during volatile markets, increasing the likelihood of success.

Volume Analysis: Volume is a leading indicator for determining the strength of a market. A breakout above resistance is more likely to succeed with high volume instead of with low volume. For example, if Steem/USDT moves above $0.25 resistance with increasing volume, it shows genuine buying interest.

RSI Divergences: The RSI can uncover hidden trends. A bearish divergence, or a situation in which price is making higher highs and RSI is making lower highs, near a key resistance level is a potential reversal.

Moving Averages: SMAs or EMAs can be used to define dynamic areas of support and resistance. The 50-day and 200-day moving averages are widely used to define changes in trend.

Combining these indicators with multi-timeframe analysis creates a robust strategy that minimizes reliance on a single signal and reduces the likelihood of entering false trades.

4. Position Sizing and Stop-Loss Placement

Position sizing is a cornerstone of effective risk management. By risking only a small percentage of capital per trade, usually 1-2%, one can sustain multiple losses in a row without depleting one's account. For example, with $10,000 in capital, a trader should not risk more than $100 to $200 per trade.

Stop loss placement is equally important and shall not be arbitrary but logical. During the Accumulation Phase, stop-losses are usually placed below the support level of the consolidation range. In the Expansion Phase, traders might use the Average True Range (ATR) to set dynamic stop-losses accounting for increased volatility. For instance, if the ATR for Steem/USDT is $0.03, a stop-loss might be set $0.03 below the entry price to allow for normal fluctuations.

5. Emotional Risks Management

Volatility, in any market, could easily provoke an extremely strong emotional response and, subsequently, impulsive decisions apart from the trader's strategy. This includes FOMO in sharp rallies and panic selling on pullbacks, among others.

Emotional risk management for traders includes the following:

- Have a Plan: Pre-trade, clearly define your entry, exit, and stop-loss criteria.

- Use Alerts: Place price alerts on your setups instead of continuously watching the charts, which can result in overtrading.

- Practice Discipline: Stick to the trading plan and do not chase the market.

Maintain a trading journal to go over old trades to analyze and learn from emotional biases to make better decisions in the future.

6. Avoiding Overreliance on a Single Timeframe

A common mistake made by many traders is depending on only one timeframe, which leads them to myopia in their views. By incorporating multi-timeframe analysis, traders are capable of acquiring a proper idea about market dynamics.

If the 1-hour chart shows a bullish breakout and the daily chart shows a bearish trend, for instance, that breakout will likely fail. On the other hand, a bearish candlestick on the hourly chart within a strong uptrend on the daily chart may present an opportunity to buy instead of selling. This alignment across timeframes ensures that trades are executed in the context of the broader market structure.

7. Risk Management Tools

Modern trading platforms offer facilities for better risk management, such as:

- Trailing Stop-Losses: Automatically adjust while the market is moving in your favor and lock in gains toward future upsides.

- Hedging: Opening inverse positions of your assets could work to offset the losses resulting from volatility.

- Diversification: It helps decrease the risk of a particular trade or marketplace movement by spreading investments across a range of pairs or asset classes. For instance, a trader already long Steem/USDT may hedge against system wide downturns with an open short position in Bitcoin.

8. Practical Example: Steem/USDT Strategy

Consider the following scenario.

Accumulation Phase: Steem/USDT consolidates between $0.18 and $0.22. The trader enters a long position at $0.22 after a breakout with high volume, placing a stop-loss at $0.17.

Expansion Phase: The trader adds to their position on pullbacks, using Fibonacci retracement levels (38.2%, 50%) to time entries.

Distribution Phase: The trader gradually exits their position as volume decreases and bearish candlestick patterns emerge.

Contraction Phase: The trader refrains from new trades and observes the market for signals of the next Accumulation Phase.

Mitigating risks in volatile markets requires a structured approach that integrates technical analysis, emotional discipline, and effective use of tools. By understanding the slight differences of market cycle phases and applying multi timeframe analysis traders can avoid false signals and position themselves for long term success.

Comments