SLC | S21W2 | Costs for entrepreneurs - Cost elements

1 comment

Canvas source How do costs relate to financial accounting?

Costs and financial accounting are like best friends in the business world. Costs give financial accounting all the details it needs to keep things in check. Think of costs as the money you spend to keep your business running, whether it's for materials, labor, or rent.

Financial accounting then steps in as the record keeper, tracking all these expenses and ensuring they’re documented properly. This helps in showing where the business funds are going and how well the company is performing.

Without knowing costs, financial accounting would be lost, like a chef with no ingredients! Accurate cost tracking makes financial reports reliable, helping entrepreneurs make smart decisions and set realistic goals.

There are fixed costs, which stay the same every month, and variable costs, which change with production levels. Both play a big role in a company's profitability.

In short, costs and financial accounting work together to help businesses understand their financial health and plan for the future.

Establish the difference between fixed costs and variable costs, providing examples of each.

Fixed cost items are those that do not change with either the amount of outputs produced or the sales made by the business. They are like bills that keep on arriving irrespective of the happening or not happening of any event. They include shop rents, payment for insurance, and staff salaries for full-time employees. For example, if a baker pays $1,000 for renting, this amount will not change regardless of whether they bake 10 or 1,000 cakes.

Variable costs vary with an increase in the level of output. The higher the units or units of goods and services that are produced, the more variable costs increase. Above, relating this to the bakery variable costs would include flour, sugar, and packaging; these are costs, however that will rise with the production of more cakes. That is, if the bakery is to bake twice as many cakes they will need to use flour that will be twice the amount used to make the first batch of cakes and, therefore, the cost of its ingredients will be more.

Summary Fixed costs do not depend on the volume of production; however, variable costs vary directly with the output.

In a real or fictional case, identify the cost elements in manufacturing a product or providing a service.

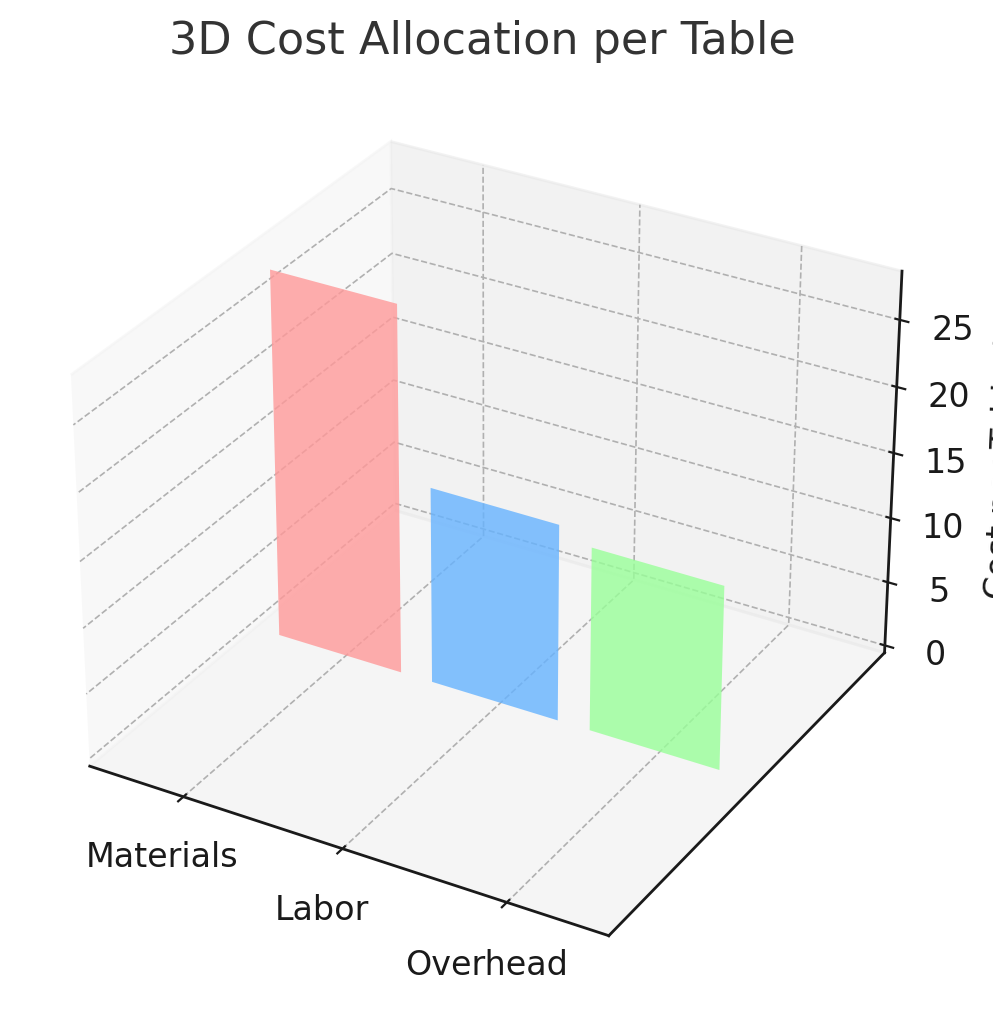

The cost elements of producing a product or providing a service are direct materials, direct labor, and overhead. Take the case of a firm that manufactures wooden tables. The wood, nails, and paint that go into every table would be direct material. If it takes $20 of wood, $5 of nails, and $3 of paint for every table to have, then this would mean it costs $28 in materials per table. Direct labor costs are wages paid to employees who directly participate in the creation of the final product. Assume that it takes a direct laborer one hour to make a table, and the labor rate is $15 per hour; so, the direct labor cost for each table is $15.

Overheads or indirect costs are indirect costs incurred to support the production process but not directly assigned to each table. Examples of overheads include factory rent, utilities, and depreciation on machinery.

Assume a monthly rent of $2,000, utilities of $500, and machinery depreciations of $300. This totals to a sum of the overheads that is accrued for the month at $2,800. In case the factory produced 200 tables in a month, then the overhead cost allocated to each table would work out at $2,800 / 200 = $14.

All these costs sum up to $28 (materials) + $15 (labor) + $14 (overhead) = $57 per table. This can best be represented in a simple chart as shown below, explaining how such costs are applied per table:.

| Costs elements | Amount per table |

|---|---|

| Meterial | $28 |

| Labour | $15 |

| Overhead | $14 |

| Total | $57 |

|

|---|

In this example, we can see how each of the individual elements contributes to the total cost for manufacturing. This way, when a producer is trying to calculate cost elements, he or she can understand better how his company's costs are distributed and make informed pricing and budgeting decisions in relation to production.

The company Steemians manufactures a single product. During a given period, the following costs were incurred:

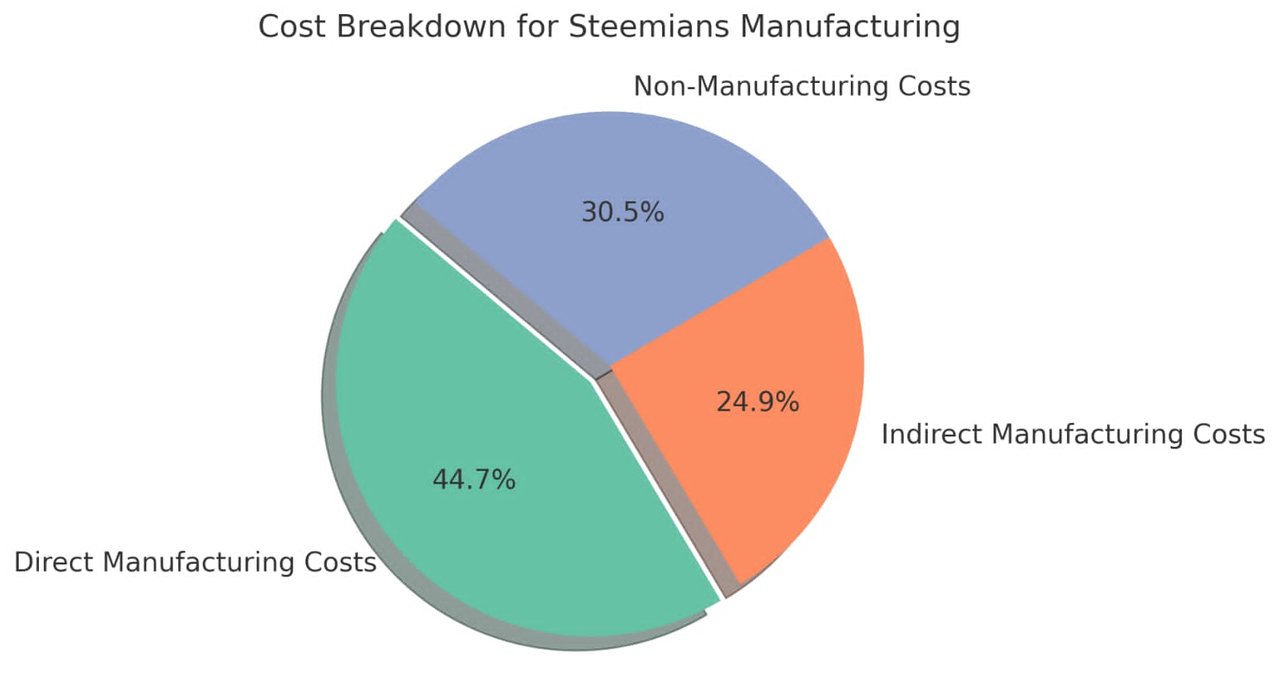

While breaking down the costs, one can break the cost item of a one-product manufacturing company into Direct Costs, Indirect Costs, and Non-Manufacturing Costs. This would know where the money is spent and which cost directly relates to the production versus general business activity.

Here follow the categorization of costs:

| Concept | Cost ($) | Category |

|---|---|---|

| Direct raw material | 130 | Direct Cost |

| Direct labor | 100 | Direct Cost |

| Manufacturing Supplies | 210 | Direct Cost |

| Depreciation of plant and machinery | 25 | Indirect Cost |

| Plant Manager | 65 | Indirect Cost |

| Taxes and plant insurance | 70 | Indirect Cost |

| Building maintenance | 50 | Indirect Cost |

| Public services | 35 | Indirect Cost |

| Delivery costs | 70 | Non-Manufacturing Cost |

| Sales Commissions | 65 | Non-Manufacturing Cost |

| Sales and administrative expenses | 80 | Non-Manufacturing Cost |

| Maintenance of distribution equipment | 65 | Non-Manufacturing Cost |

| Advertising | 20 | Non-Manufacturing Cost |

|

|---|

Total Calculation

- Total Direct Manufacturing Costs: 130 + 100 + 210 = $440

- Total Indirect Manufacturing Costs: 25 + 65 + 70 + 50 + 35 = $245

- Total Non-Manufacturing Costs: 70 + 65 + 80 + 65 + 20 = $300

This classified provides a clear view of the costs associated directly with production, operational overhead, and the other non-manufacturing expenses which aid in financial planning and decision-making.

I am inviting my friends @suboohi, @saintkevin, @dove11 to participate in this contest. Thank you for reading .

Best Regards,

artist1111

Comments