Bitcoin Ownership: The Shift to Institutional Hands

0 comments

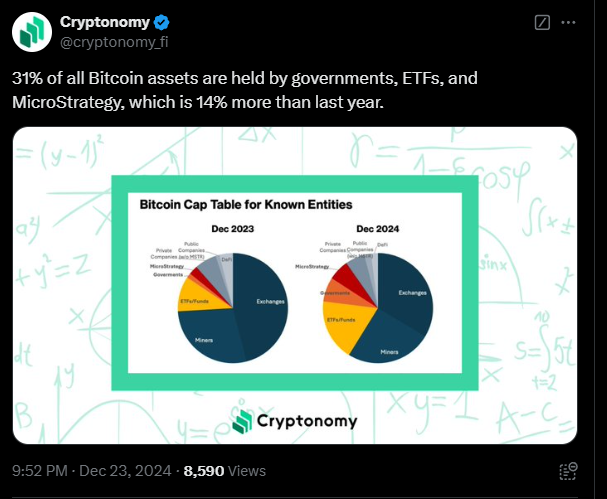

In a remarkable turn of events for the cryptocurrency market, a significant portion of Bitcoin's supply has now shifted into the hands of major institutions, including governments, Exchange Traded Funds (ETFs), and the tech firm MicroStrategy. As of the latest reports, these entities collectively hold 31% of all known Bitcoin, a notable increase from 14% last year.

The Institutional Shift

Governments: With increasing recognition of Bitcoin's value, several governments have started to include Bitcoin in their reserves. This move could be interpreted as a hedge against inflation or a statement of faith in digital currencies.

ETFs: The introduction of Bitcoin ETFs has allowed investors to gain exposure to Bitcoin without the complexities of managing cryptocurrency directly. This has led to a surge in Bitcoin being held through these regulated investment vehicles.

MicroStrategy: Known for its aggressive Bitcoin acquisition strategy, MicroStrategy has been buying Bitcoin for its corporate treasury since August 2020, positioning itself as one of the largest holders of the cryptocurrency.

Implications for the Market

The accumulation of Bitcoin by these large entities can have several implications:

Reduced Supply: With less Bitcoin available on the open market, the supply dynamics could lead to price appreciation if demand continues to grow.

Increased Legitimacy: Institutional adoption can lend credibility to Bitcoin, potentially encouraging more investors to consider it a viable asset class.

Market Stability: Large holders might stabilize the market by reducing the volatility often seen in Bitcoin's price due to speculative trading.

What Does This Mean for Individual Investors?

For individual investors, this trend might suggest:

Higher Entry Barriers: As more Bitcoin is locked into institutional hands, buying Bitcoin might become more competitive, potentially driving up prices.

Long-term Holding: With institutions known for long-term investment strategies, Bitcoin might be held off the market for extended periods, affecting liquidity.

Regulatory Scrutiny: Increased governmental involvement could lead to more regulatory oversight, which could be both beneficial for mainstream adoption and challenging for the ethos of decentralization.

Conclusion

The landscape of Bitcoin ownership is changing, with a clear pivot towards institutional holders. This shift could herald a new phase in Bitcoin's lifecycle, where it transitions from a speculative asset to a staple in both governmental and corporate portfolios.

Comments