Massive Bitcoin Outflow from Exchanges

0 comments

Investors are showing confidence in Bitcoin by withdrawing their coins from exchange platforms and storing them in personal wallets.

The Bitcoin market is experiencing a significant phenomenon in recent weeks: a massive outflow of the cryptocurrency from centralized exchanges to personal wallets. This movement, which translates into a record decrease in the balance of Bitcoin on exchange platforms, suggests growing investor confidence in the cryptocurrency and an expectation of greater profits in the long term.

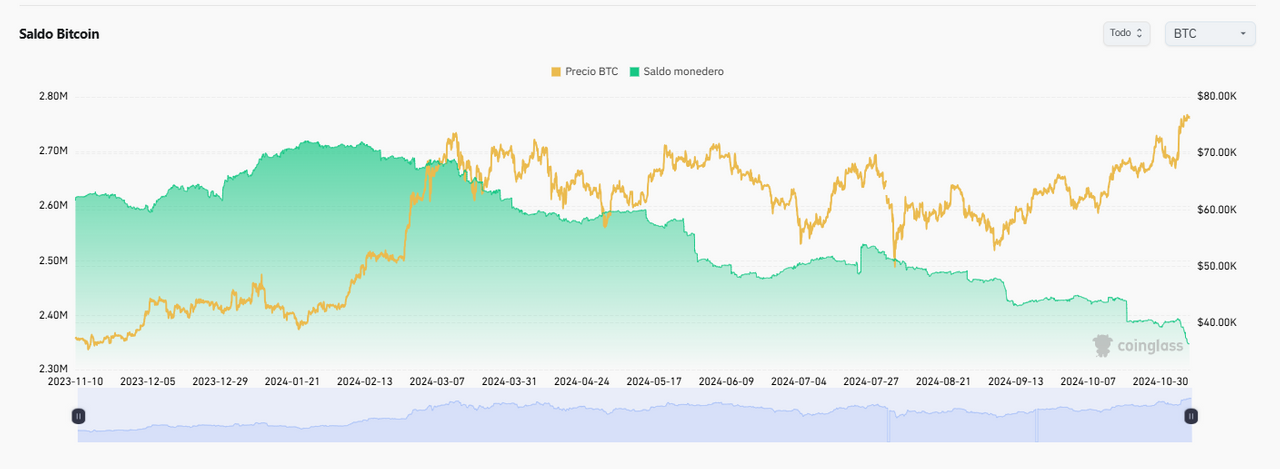

According to Coinglass data, the balance of bitcoin on centralized exchanges has fallen to historic lows over the past year / Coinglass

An unprecedented exodus

According to Coinglass data, the balance of Bitcoin on centralized exchanges fell to historic lows in the last year. In recent weeks, more than 78,000 BTC left these platforms, with Bybit leading this trend with more than 39,000 BTC. Bithumb with 9,499 BTC. Even Binance, the largest exchange in the world, recorded outflows of more than 15,201.66 BTC in the last seven days.

What does self-custody mean?

By storing their bitcoins in personal wallets, users gain exclusive custody of their funds, giving them greater control and security. Unlike exchanges, where users deposit their assets, personal wallets allow users to hold the private keys that allow them to access their funds at any time.

This behavior by investors indicates a clear preference for self-custody. By withdrawing their bitcoins from exchanges, investors are sending a clear message: they believe in the cryptocurrency's long-term potential and have no intention of selling anytime soon.

Furthermore, this move coincides with a strong uptrend for bitcoin, which recently broke through a major resistance at $72,000. Consolidation above key moving averages suggests that the cryptocurrency could be entering a new phase of growth.

Capital flow into bitcoin

Despite strong outflows from exchanges, the bitcoin spot market is also experiencing a positive net capital flow in recent weeks. This indicates that new investors are buying into the cryptocurrency. According to Coinglass data, over the past 15 days the net capital flow for bitcoin stands at +$991.13 million. This suggests that there is sustained demand from investors, who are buying bitcoin to hold for the long term.

The exodus of bitcoin from centralized exchanges is a bullish sign that reflects the growing confidence of investors in the cryptocurrency. By opting for self-custody, users are taking a more long-term stance and are willing to assume greater control over their assets.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves high risk and investors should conduct their own research before making any decisions.

Comments