Steemit Crypto Academy Season 4 Week 8 [Advanced Course] | Zethyr Finance

23 comments

Introduction

The season 4 at the crypto academy has entered week 8, and all has been running smoothly so far. I strongly believe many students have been impacted through different lectures taught this season and that the process has enhanced their knowledge of the crypto ecosystem. For this week, I will be presenting yet another lecture and I welcome you on this.

Made in Canva

Background to the Study

The advent of DeFi (Decentralized Finance) has been accompanied by different products in the crypto ecosystem which enables the users to carry out transactions of choice independently without the involvement of third parties. With such addition to the crypto ecosystem, users can now perform any transaction at their convenience to either carry out money movement or improve the profitability of some of the assets they owned.

Some of the products of DeFi enable users to swap assets at will without involving third parties, lending, and borrowing assets, acting as liquidity providers, and so on. One of the great blockchains that have come up with different innovations is the Tron Blockchain with many dApps built on it, and this enables users to interact with different dApps to perform any transaction of choice. Today, we would be talking about one of the dApps built on the Tron blockchain, and it's no other than Zethyr Finance. Let's go into it proper.

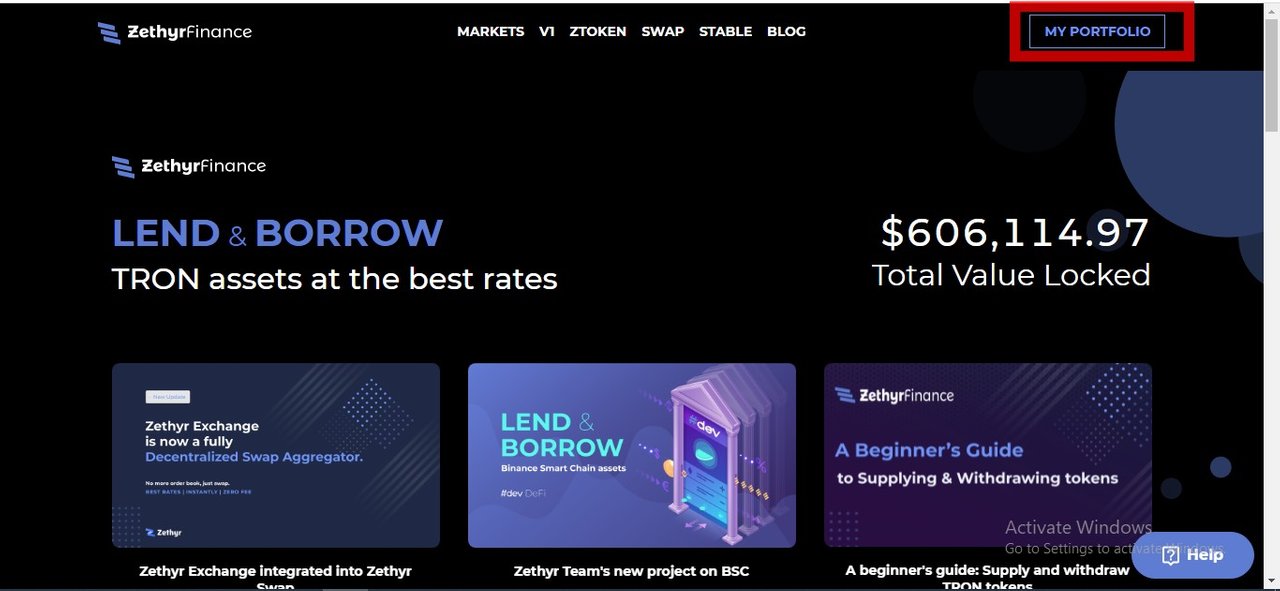

Zethyr Finance

Zethyr Finance is one of the numerous dApps built on the Tron blockchain, maybe new but its features are earning it a solid stand amongst several other dApps on the blockchain. Zethyr Finance is a lending protocol on the Tron blockchain which enable users to lend out their Tron assets (TRX, USDT, WIN, BTT...) on the protocol through the process known as supply to earn certain APY as specified in the market of choice.

In addition, the protocol also enable users to borrow from the assets that were supplied by other users, and this can be accessed through the feature known as borrow, also to be repaid at a certain APY. This is not the first lending protocol on the Tron blockchain but it's important to know that even this protocol has a DEX for the exchange of Tron assets, such a feature is missing in some other lending protocol.

A few Features of Zethyr Finance

There are a few features of the protocol in question and in this section, we would be exploring different features of Zethyr Finance and see what each of them does on the protocol. Let's quickly run through them.

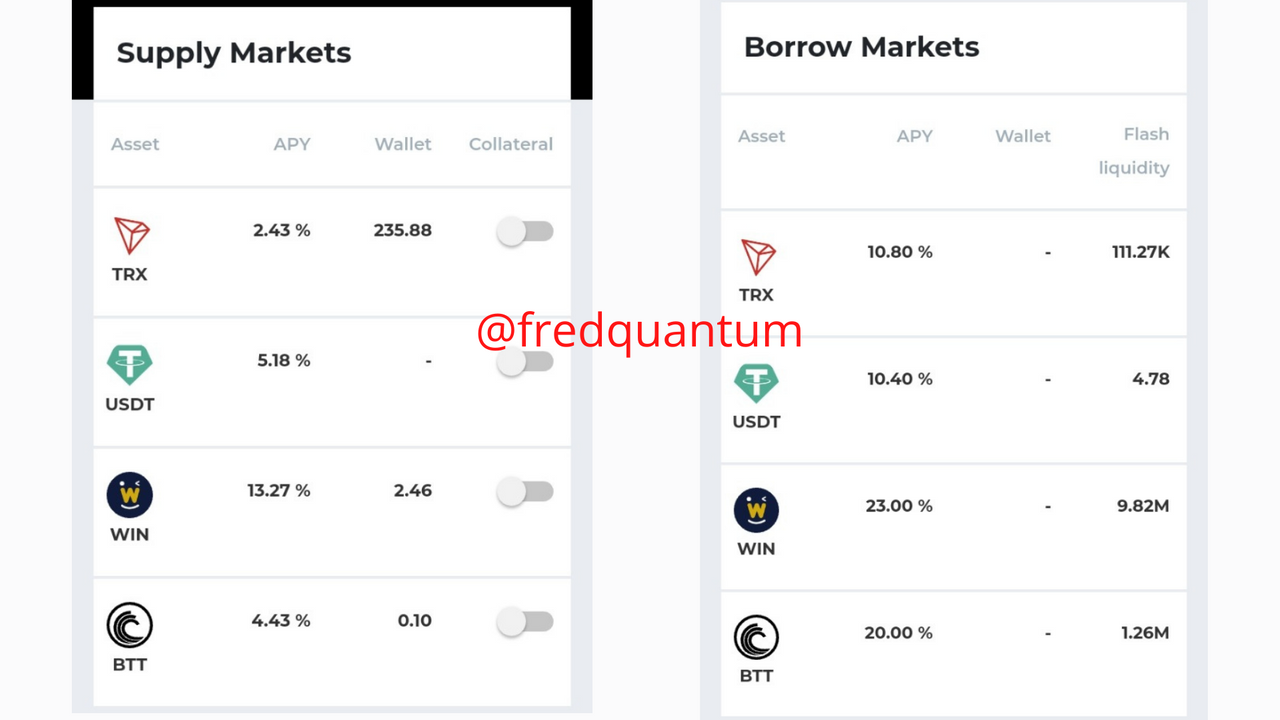

Lending/Borrowing

Lending/Borrowing is one of the features of Zethyr Finance where users can easily lend out their assets through supply function on the protocol to earn profits at a certain APY from the Tron assets held in their wallet, likewise, users can easily borrow assets from other users' supply on the protocol, and the function borrow is used for this purpose. Lending/Borrowing is a great feature of the protocol which enable users to earn extra profits from their held assets and also, position themselves for the opportunity to borrow assets to take care of urgent needs (either for investment purpose or personal needs).

Supply and Borrow markets on Zethyr Finance

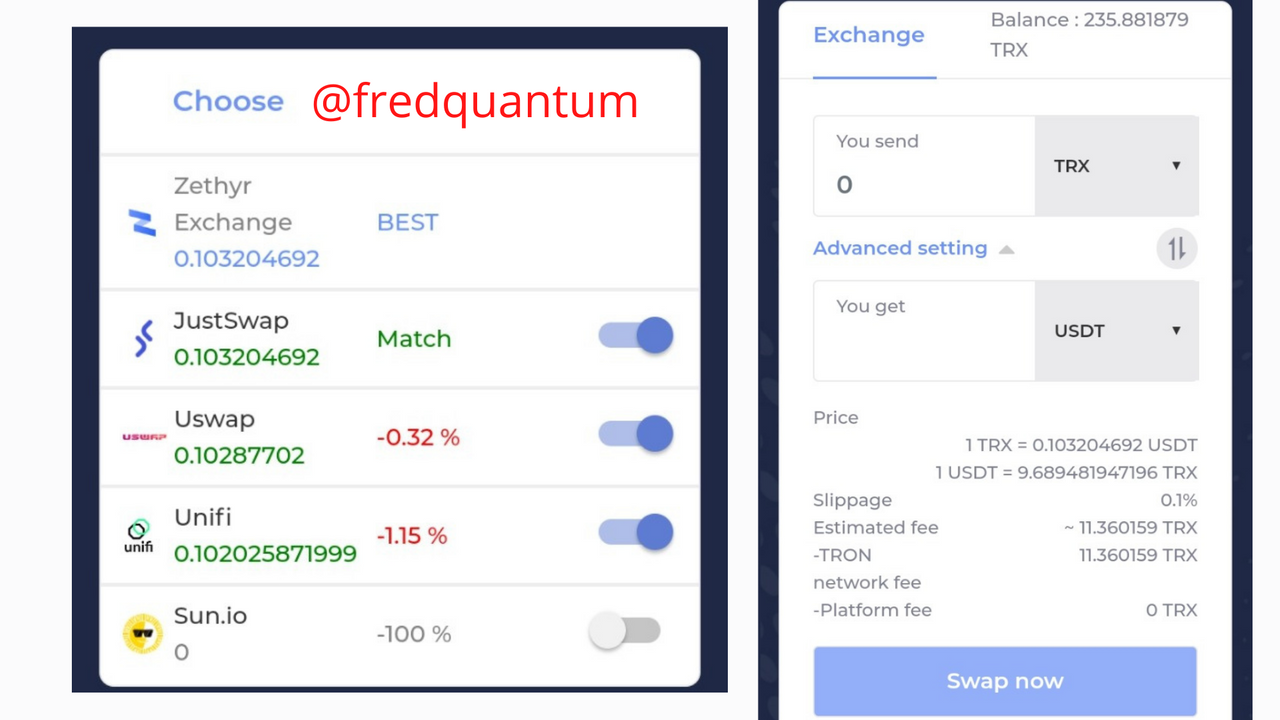

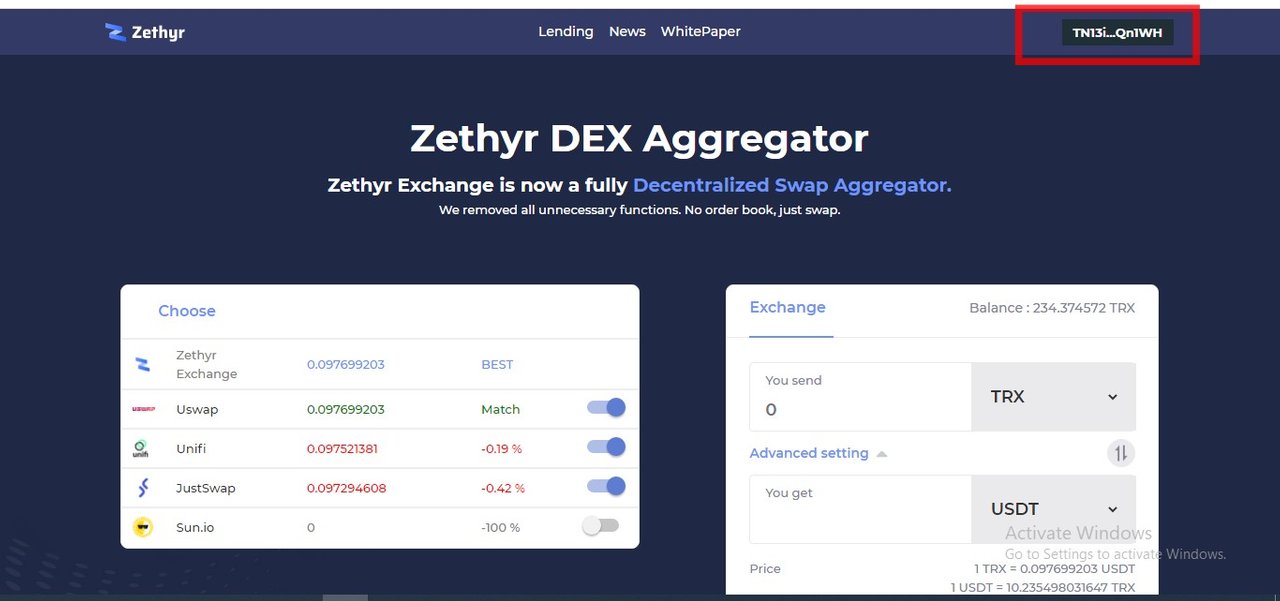

Zethyr Exchange

Another great feature of Zethyr Finance is the DEX which enables users to swap their Tron assets for another asset of choice. Like I mentioned earlier, other lending/borrowing protocols don't have this feature but Zethyr Finance offers this to enable users to use the swap option of the protocol to perform the exchange of Tron assets. Zethyr Finance is a DEX aggregator that compiles and compares information about a price and liquidity of an asset from different DEX to offer the best pricing for the swap action on the protocol.

Zethyr Exchange

Above is the swap interface of the Zethyr Finance and you can see the work of the DEX aggregator as the rate at which TRX is exchanged for USDT matches that of JustSwap.

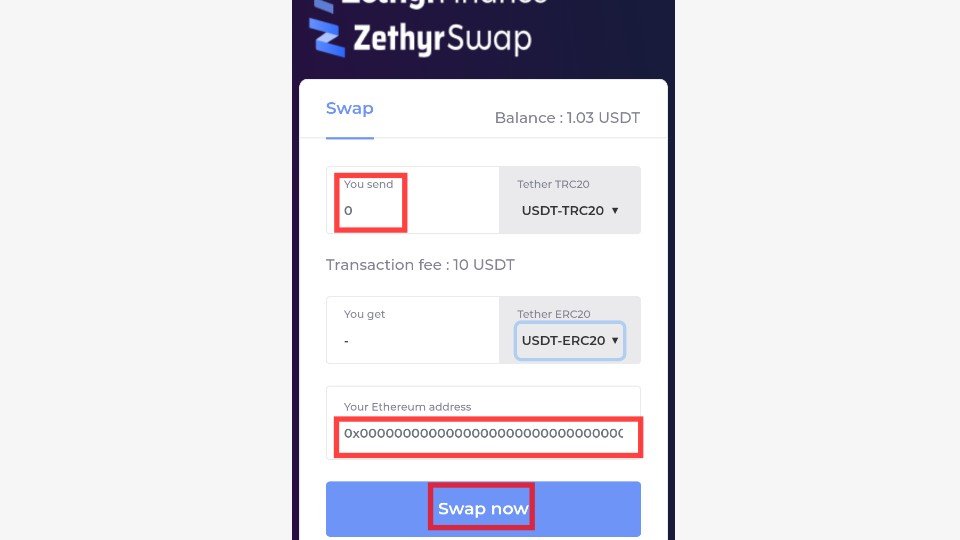

Stable Swap

Stable Swap is a great feature of Zethyr Finance which enables cross-chain swap of stablecoins. This feature is termed as cross-swap that can be used to swap USDT (TRC20) to USDT (ERC20). The only available asset on the feature as at the time of writing this article is USDT and it's quite awesome as it enables one to swap owned Tron USDT in the wallet directly to USDT on the Ethereum network, great stuff, and with no doubt, this is a wonderful feature for cross-chain transactions.

From the screenshot above, all you just need to do is input the amount of USDT (TRC20) you intended to swap, paste your USDT Ethereum address (destination wallet) and click Swap. The transaction fee is 10 USDT which is quite costly but it all depends on what the user wants to use the asset for, which would determine its suitability (investment-wise).

ZToken

ZToken is another feature of Zethyr Finance to talk about, when assets are supplied on the protocol users get ZTokens and this can be used as collateral to be eligible for borrowing on the protocol, also, it represents the overall user's asset on the protocol including the accrued interest .

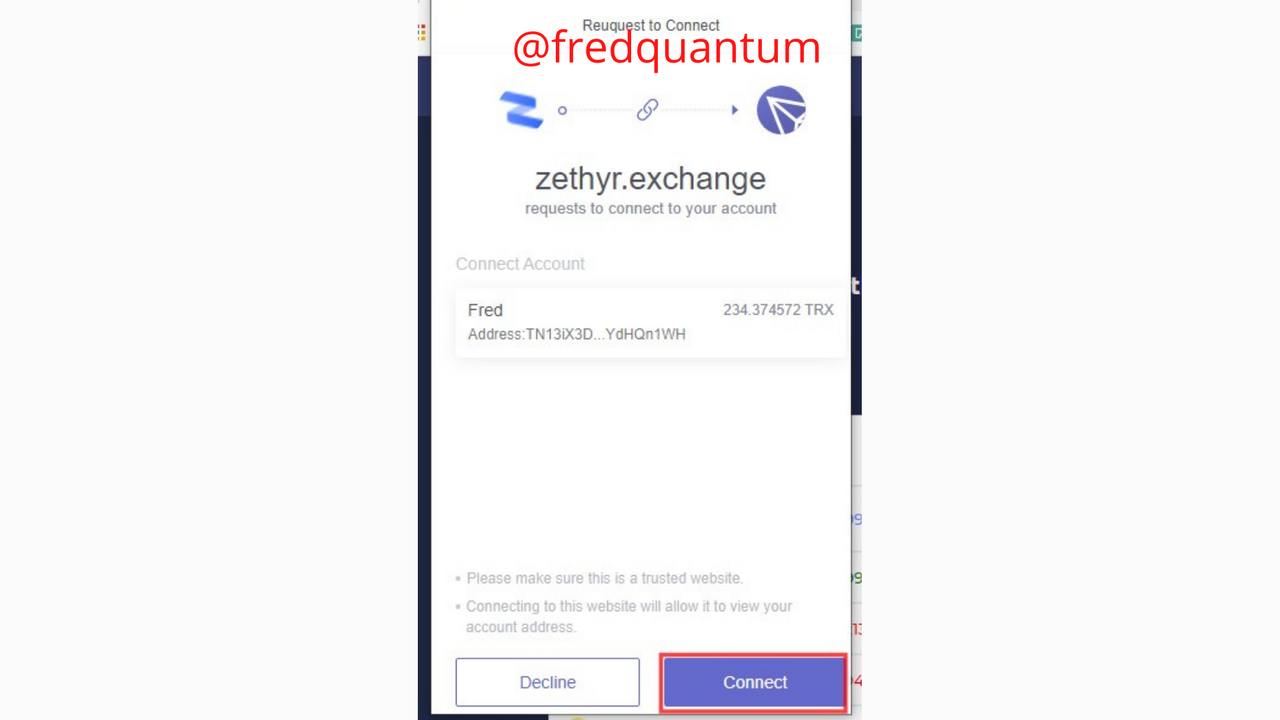

How to Connect TronLink Wallet to Zethyr Finance

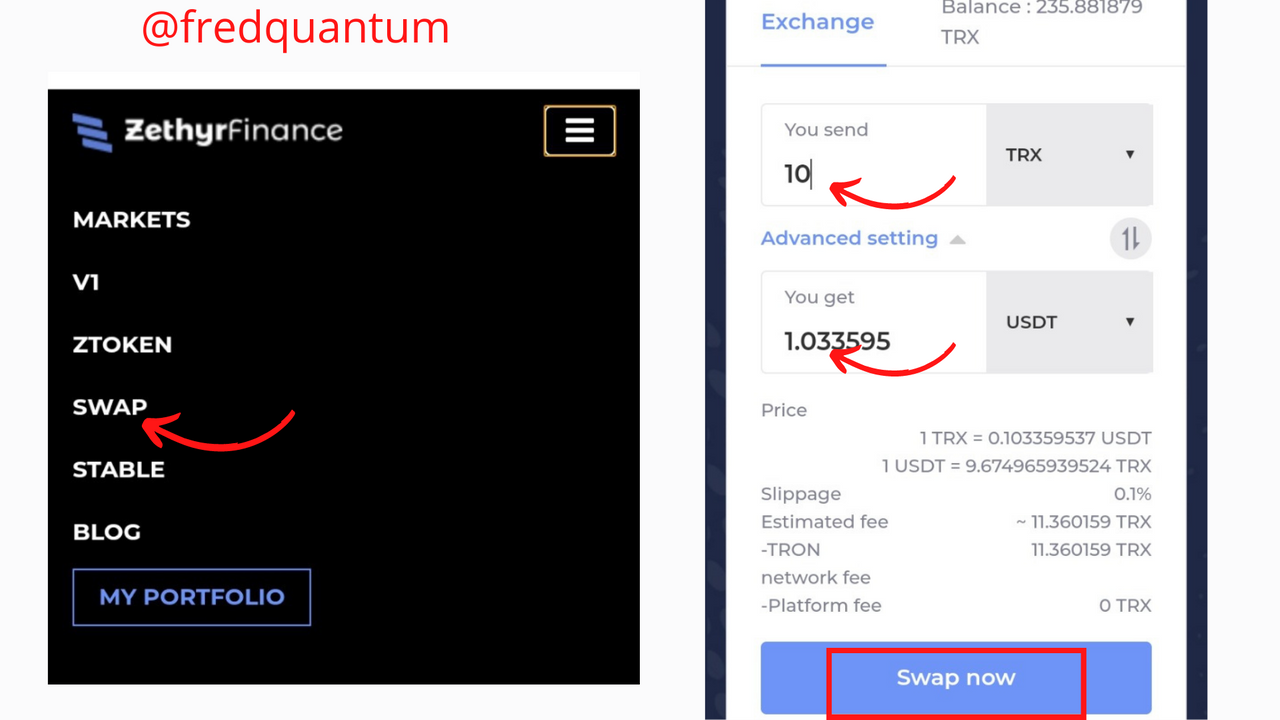

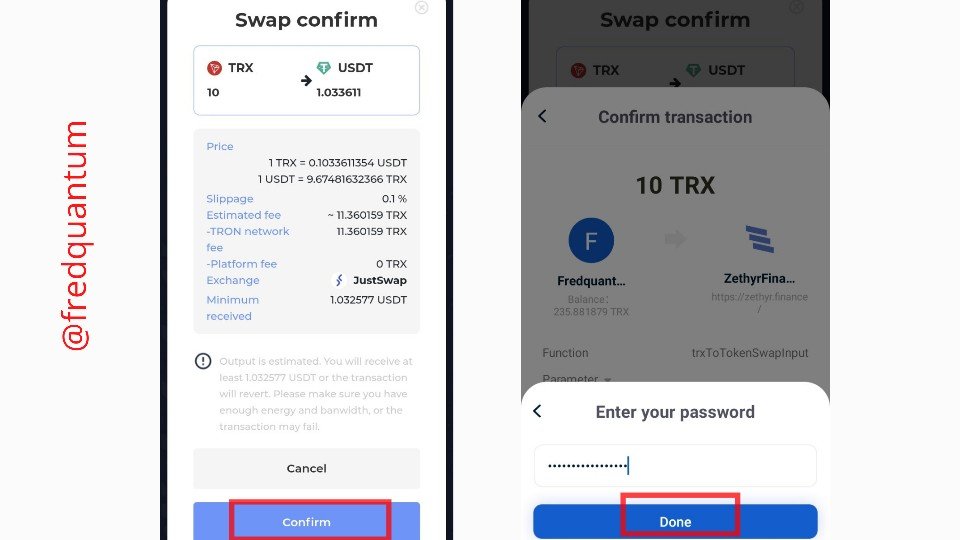

How to Swap Tron Assets on Zethyr Finance

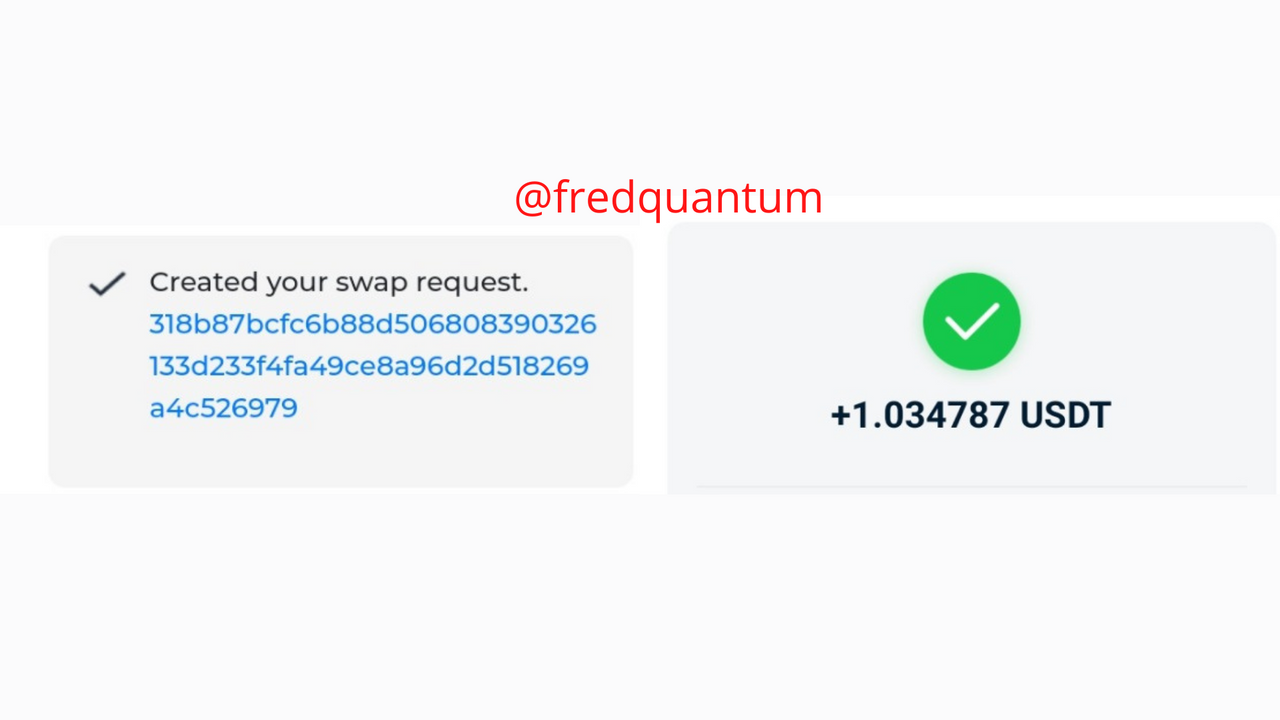

The transaction Hash to the above is 318b87bcfc6b88d506808390326133d233f4fa49ce8a96d2d518269a4c526979.

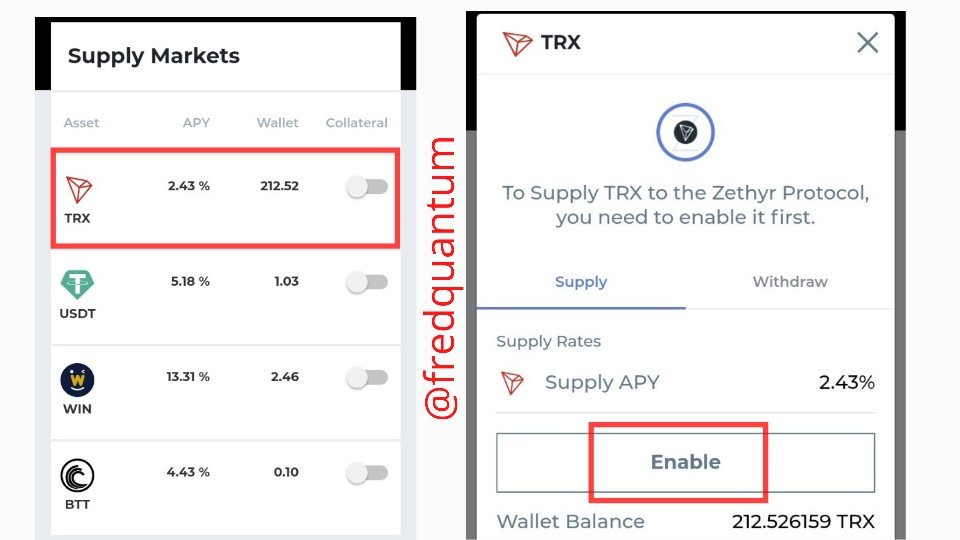

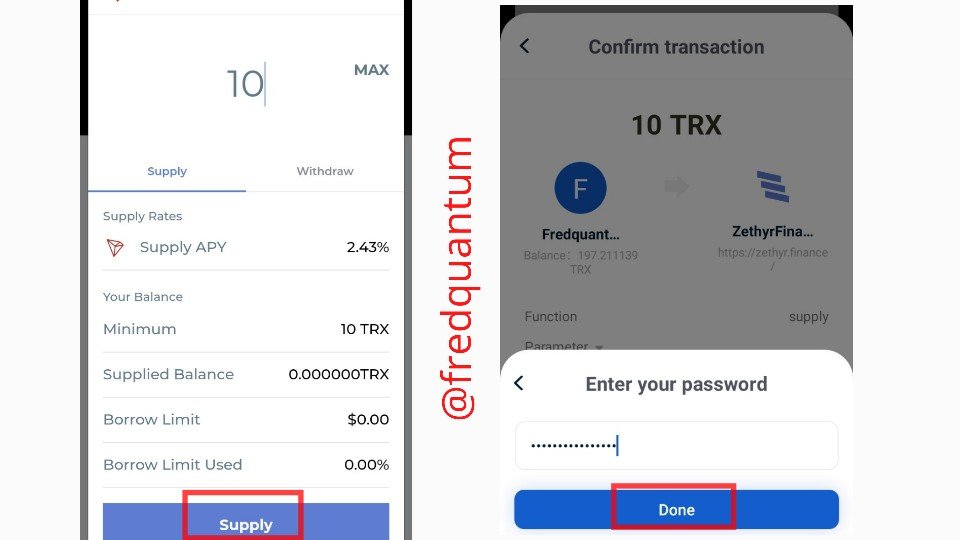

How to Supply Tron assets on Zethyr Finance

The steps above complete the process of supplying assets on Zethyr Finance and you can find the details of the transaction here, 868abeb154276fb03d97634de11f1b6aca3731b9c1ac68238ea0f37bd1313500.

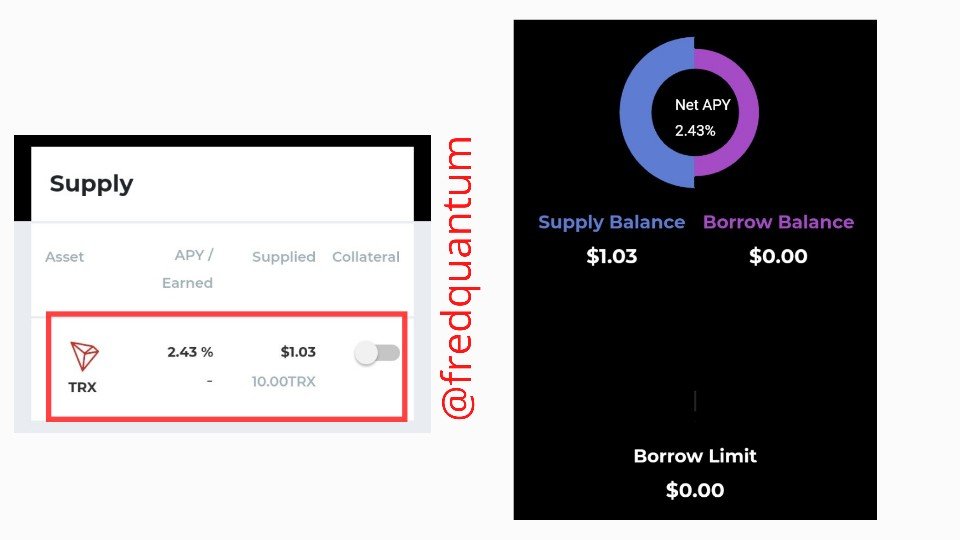

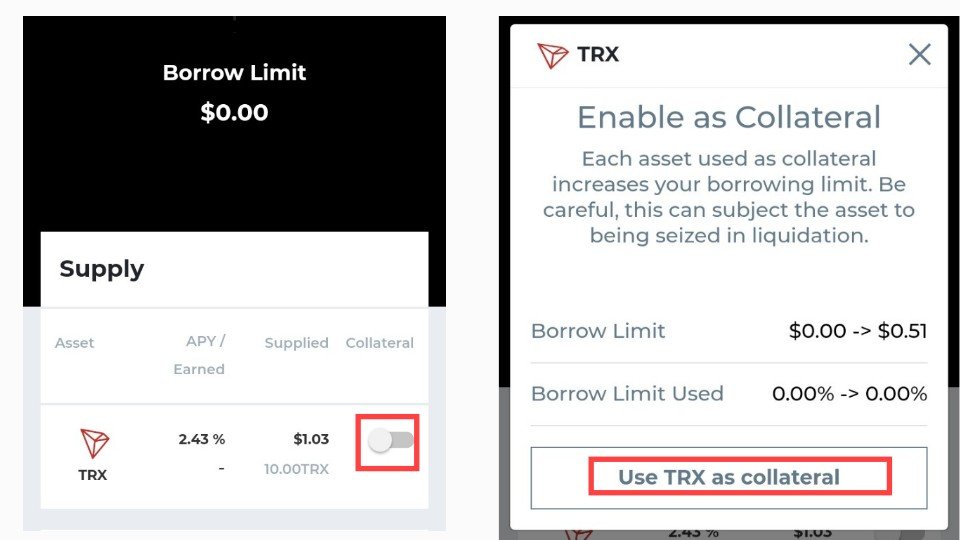

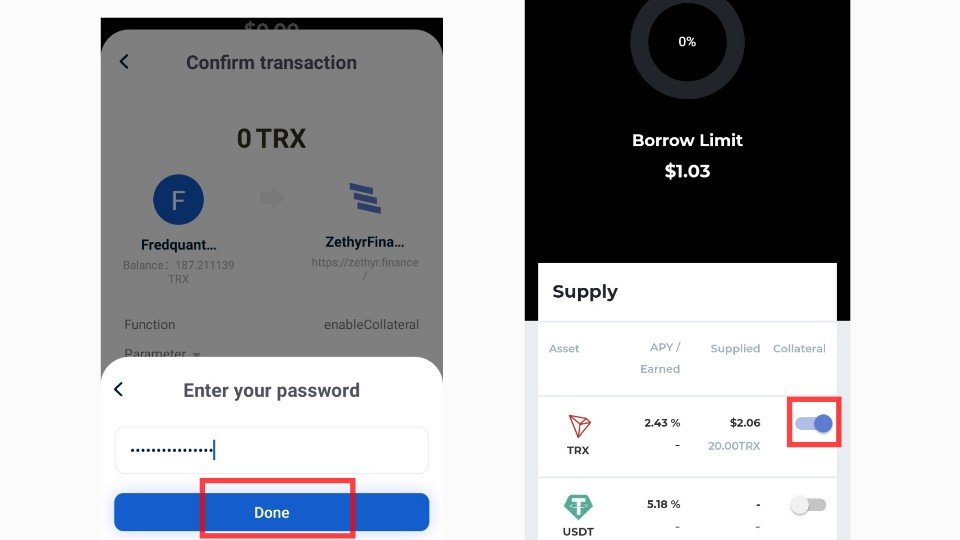

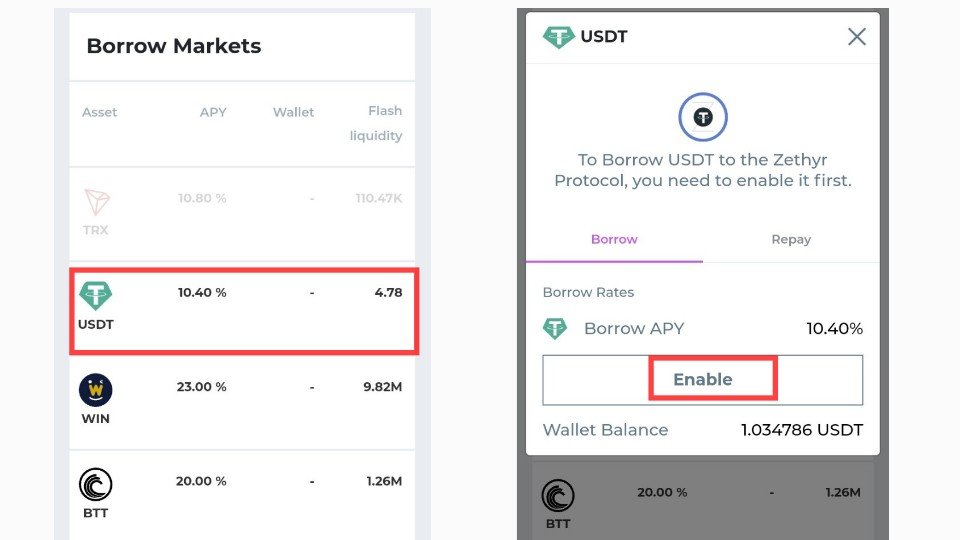

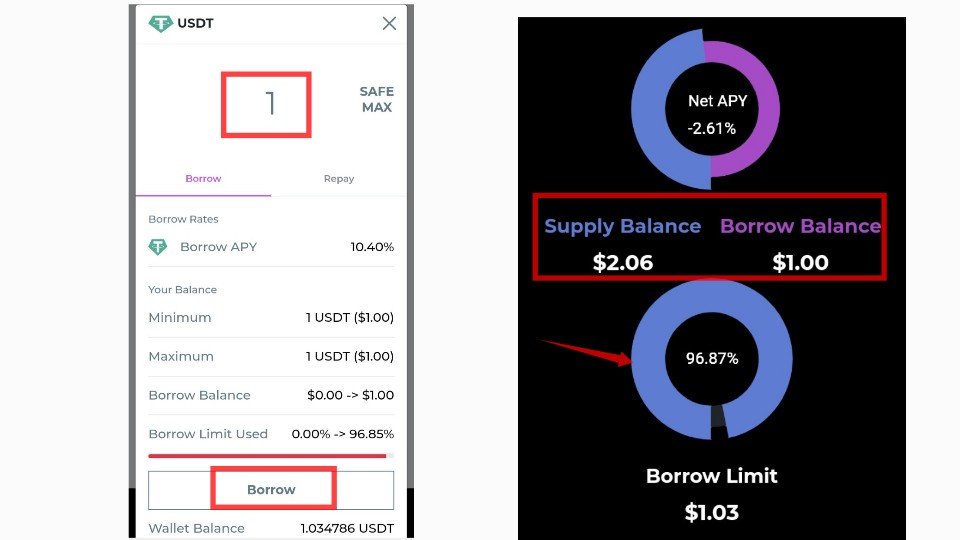

How to Borrow Tron assets on Zethyr Finance

To borrow an asset on Zethyr Finance, then you must have collateralized an asset to unlock the borrowing function. Let's see a few steps involved in borrowing assets on Zethyr Finance.

Note that: Your borrow limit on Zethyr Finance would be approximately half of your total supply that was collateralized, as such you should aim to collateralize enough assets to enable you access at least the minimum borrow limit from the borrowing market. For example, if you supply 2 USD worth of TRX, you would be able to access a borrowing market with a limit of 1 USD and the minimum borrow limit of USDT on Zethyr Finance is 1. Kindly take note.

You can find the transaction details here, d0729ef491fc0c0d461ce20c9a438f6e90b58a76eda4d1a171eacd7b80fd3d45.

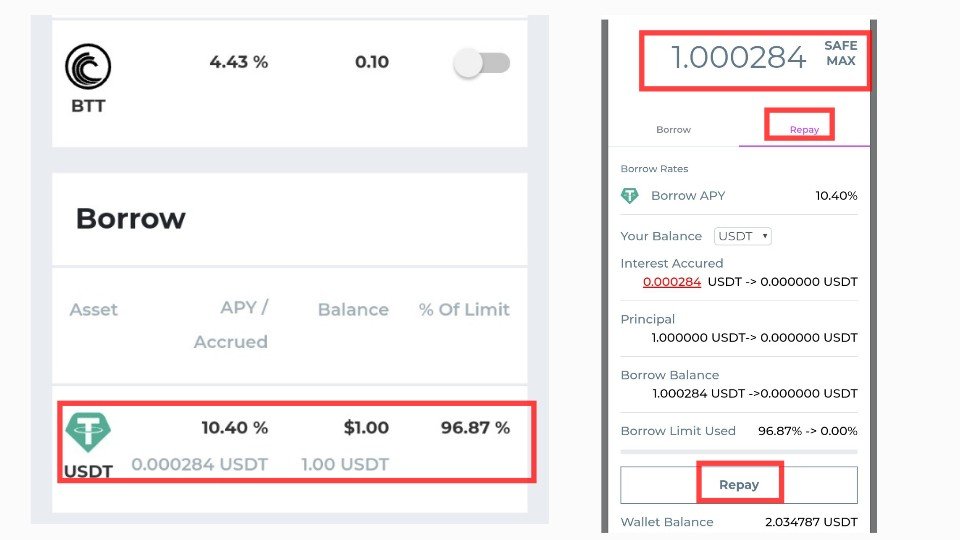

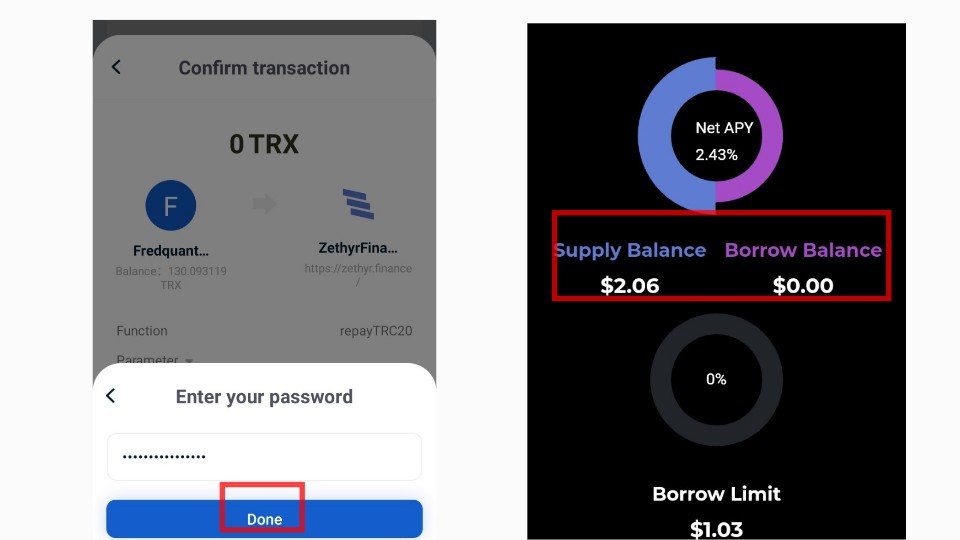

How to Repay the borrowed asset

From the above, I have repaid the borrowed 1 USDT asset with interest accrued to be 0.000284 USDT. You can find the details of the repay transaction here, 54ff27bb8a34557226426c1c7c5e90640d3e61342ddcdb45ff92eda0afc91848.

Conclusion

Decentralized Finance (DeFi) has blessed the crypto ecosystem with several innovations which allow users to make independent transactions on different products. The Tron blockchain has hosted a lot of these products and one of its newest products is Zethyr Finance which is a lending protocol. We have been able to explore some of the features of the protocol to see how we can use them for exchanging Tron assets, lending out assets to improve profitability, and borrowing assets to take care of urgent investment decisions. I hope something is being added today to your knowledge of DeFi products on the Tron blockchain. Thanks for participating in the lecture.

Comments