Steem's two halvings: What does Bitcoin tell us about Steem's future?

9 comments

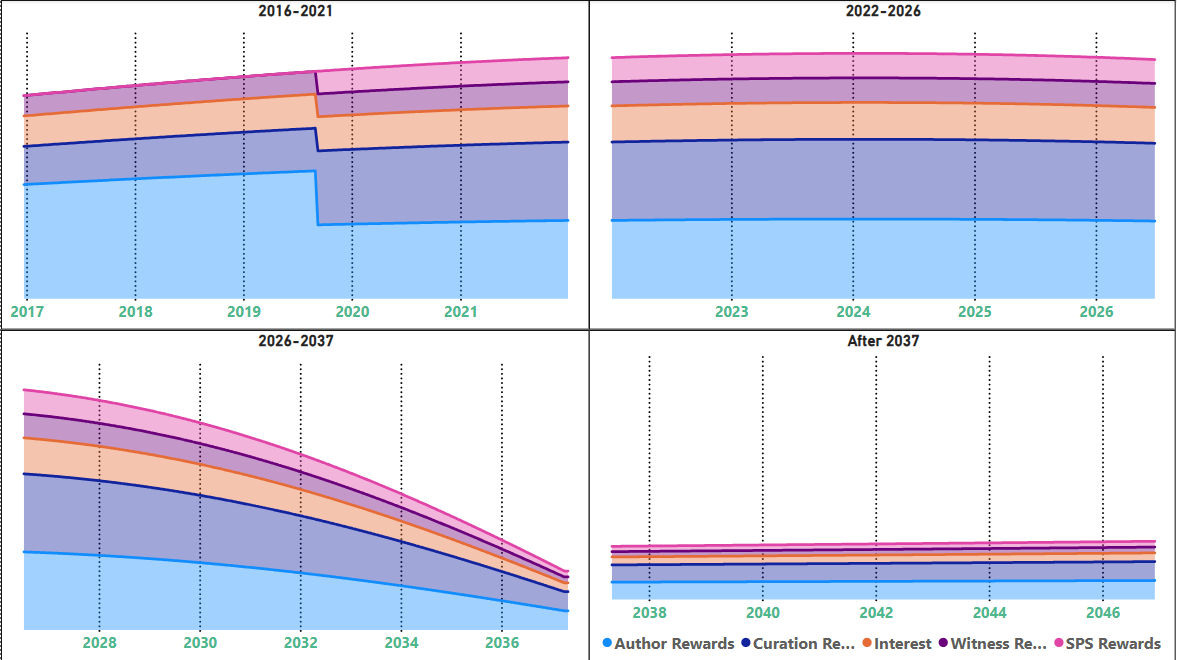

Some time ago, I put together a chart that imagined Steem's blockchain inflation as 4 distinct "eras" (assuming no rule/parameter changes from the witnesses). Here it is:

There are no numbers because it's the shape of the curve that matters. The specific thresholds are affected by the price of STEEM and the amount of burn activity, but the shape tells us what we need to know about the upper boundary of daily inflation. It might go lower, but it won't go higher (under existing rules/parameters). In this model:

- The 2016-2022 era was a time when the upper boundary on expected daily rewards was steadily increasing.

- The time from 2022-2026 is a time when daily rewards are basically flat. Daily rewards peaked in November of 2023, but the slope immediately before and after the peak is very gentle.

- The time from 2026-2037 will be a time when daily rewards decline more and more quickly: From the perspective of daily rewards, that time period will see the equivalent of two halvings (one by 2034, and a second by 2037).

- The time from 2037 forward will be a time of modest and steady increases

Today, I want to focus on the 3rd era (and a little bit on the 2nd).

Point 1: In 2026, the blockchain inflation rate is expected to be around 51/2%.

Point 2: In 2037, the blockchain inflation rate levels off at 0.95%.

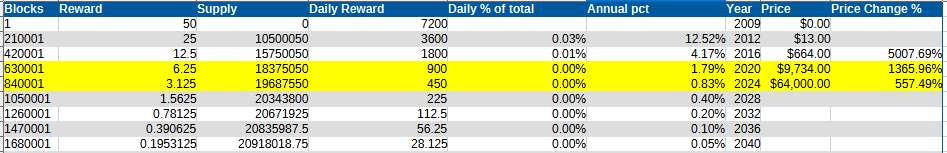

Point 3: I did some "back of the envelope" calculations about Bitcoin's inflation rates and came up with this table:

Point 4: Broadly speaking, STEEM's price declined during the first era and stayed flat during the second, matching the behavior of daily inflation.

So, given all of that, if we believe that inflation (i.e. scarcity) has an effect on the price of Bitcoin, then there's an argument that it also affects the price of STEEM. Thus, in the table above, I looked for reference-years in the halving cycle to see where rates were similar to Steem's 3rd era. It turns out that those years span the 2nd and 3rd halvings, 2016-2024.

So, what happened during those years? Rounding, Bitcoin went up by a factor of more than 13 from 2016 to 2020 and by a factor of 5 from 2020-2024 for a total above 65x the original price (actually 96X without rounding).

So, based on these observations, what can we guess about the future of STEEM?

- All else being equal, it will never be easier to gather Steem rewards than during the time period from 2024-2026. This is a simple conclusion that arises from the fact that fewer new STEEM will be issued every single day.

- If (big IF) we assume that STEEM stays flat during era 2 and then follows the same trajectory as Bitcoin during era 3, that means that the 2034 price of STEEM is $2.73 and the 2037 price of STEEM is $15.20 (based on $0.20 per STEEM).

One other note is this: If the price of STEEM rises above the haircut threshold (currently $0.26) and stays there, then the number of new STEEM per day will go down even faster than this projection. The higher the price goes (above that threshold), the scarcer rewards become and the more difficult it becomes to earn them. This would suggest that prices might adjust faster.

Obviously, it's a wild oversimplification to say that "Bitcoin did this, so STEEM will too". However, I think it's important to understand that we have never seen STEEM's daily inflation behave in the way it will from 2026 to 2037 (and to a lesser extent, starting now). My guess is that the entire ecosystem will see some sort of realignments, similar to the miner shakeouts and usage uptakes that we see in Bitcoin, and it's only a year or two away, so it makes sense for investors and developers to start thinking about that now.

Finally, the grouping that I did into 4 distinct eras was arbitrary. In the months after I created that graph, I've started thinking of it as 3 eras: 2016 to November, 2023 - when new STEEM per day peaked; November, 2023-2037; and 2037 forward. Under that 3-era model, we're already a year into the disinflationary era.

Caveat lector: I slapped the spreadsheet together in just a few minutes, so mistakes are certainly possible. Take all of this with a grain of salt. Also, even if the numbers are right, this is not intended as a prediction or a forecast. I'm just thinking about general patterns. Others can and should draw their own conclusions.

Thank you for your time and attention.

As a general rule, I up-vote comments that demonstrate "proof of reading".

Steve Palmer is an IT professional with three decades of professional experience in data communications and information systems. He holds a bachelor's degree in mathematics, a master's degree in computer science, and a master's degree in information systems and technology management. He has been awarded 3 US patents.

Pixabay license, source

Reminder

Visit the /promoted page and #burnsteem25 to support the inflation-fighters who are helping to enable decentralized regulation of Steem token supply growth.

Comments