Is Steem a deflationary blockchain?

12 comments

Short answer: "No, but..."

Let's look at numbers from coinmarketcap.com

| Date | Market Cap | Closing Price | Market Cap / Closing Price (estimated # tokens) |

|---|---|---|---|

| October 31, 2020 | $56,622,929 | 0.1444 | 392,397,290 |

| November 1, 2020 | $55,706,401 | 0.15 | 392,851,911 |

| October 31, 2021 | $244,921,205 | $0.6237 | 392,690,724 |

| November 1, 2021 | $238,794,601 | $0.6085 | 392,431,554 |

Update: The above table has now been updated with values from November 1, 2021. So, by coinmarketcap's estimation, the number of circulating STEEM tokens declined by 420,357 from November 1, 2020 through November 1, 2021. End Update

And coinmarketcap also shows 392,496,101 tokens in circulation at this moment. If coinmarketcap's numbers at closing time today yield a calculation that's below 392,851,911, then it seems that their measure for Steem's circulating supply will be deflationary (over a 1 year period).

It's off topic, but before moving on, let's just pause and recognize that these numbers show a 4x year-over-year increase in price. When you get caught up in the short term, it's easy to overlook things like that, but a one year increase from $0.15 to $0.60 is nothing to sneeze at. Anyway, back to "inflation" as measured by coinmarketcap...

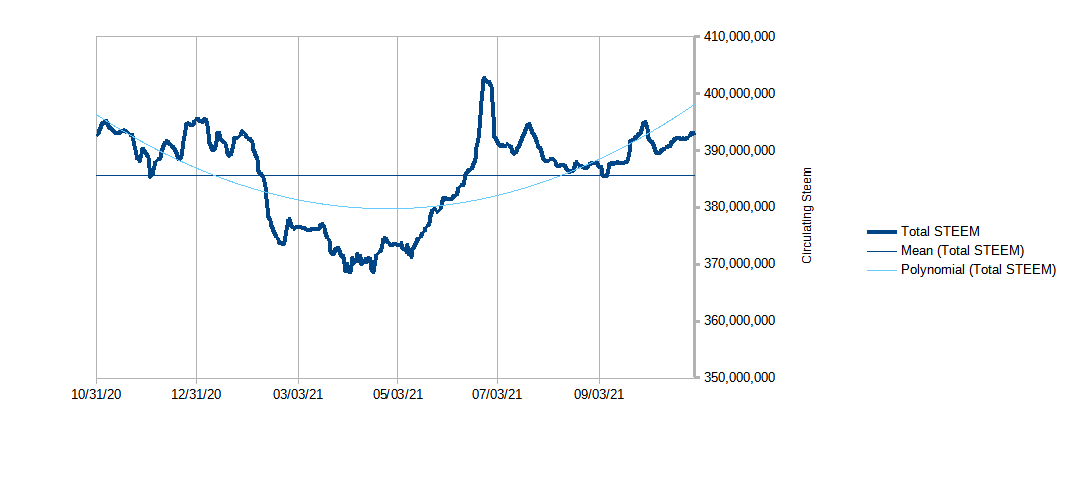

Here is a graph of the calculated tokens in circulation during the last year based on coinmarketcap's historical market cap and closing price records:

I'm the first to admit that this doesn't reconcile with what I think I know about Steem inflation, and I totally don't understand how coinmarketcap is calculating the number of tokens in circulation. They do provide this hint:

Circulating Supply is the best approximation of the number of assets that are circulating in the market and in the general public's hands. We have found that Circulating Supply is a much better metric than Total Supply for determining the market capitalization. The method of using the Circulating Supply is analogous to the method of using public float to determine the market capitalization of companies in traditional investing.

Assets that are locked (via smart contracts or legal contracts), allocated to the team or private investors, or not able to be sold on the public market, cannot affect the price and thus should not be allowed to affect the market capitalization as well.

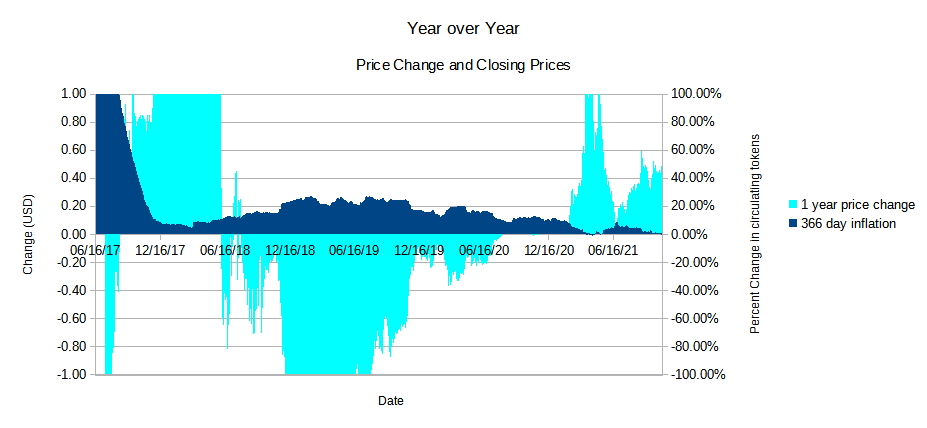

By the same calculation, we actually have seen the year over year inflation go negative earlier, most recently back in April of this year. This interests me because of what I see when I graph closing price against this "inflation" estimate.

I don't know which is cause and which is effect, but it's pretty clear that price growth is inversely correlated with inflation in the circulating supply, as reported by coinmarketcap. It may be interesting to see if this calculation turns negative again in coming days....

Comments