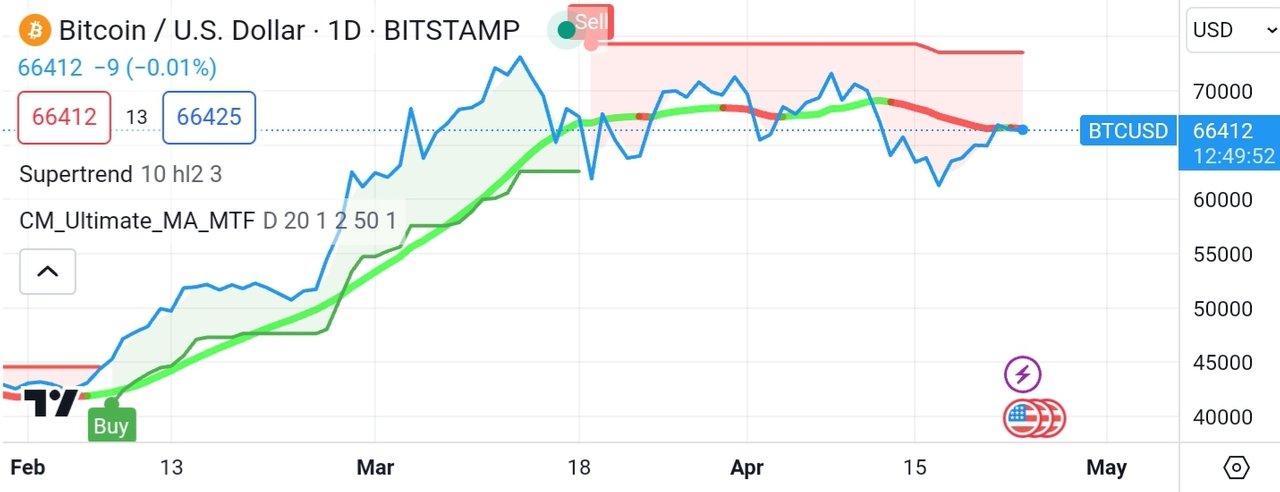

1 BTC = $66,412 USD - Why is it difficult to predict where Bitcoin will go?

2 comments

(Chart by TradingView)

In early February, a key indicator for Bitcoin's price (Ultimate Moving Average) dipped significantly, near $40,000. Although it bounced back, there are signs it might be going down again.

Meanwhile, technical signals used by some traders (SuperTrend) initially suggested buying Bitcoin, but recently switched to selling, indicating a shift in investor confidence.

It's important to remember, cryptocurrency prices can swing wildly, making it difficult to predict where Bitcoin will go in the future.

While the technology behind Bitcoin is interesting, there are risks involved. Carefully consider both the potential gains and losses before investing in Bitcoin.

About Bitcoin (BTC)

Bitcoin (BTC) is the world's first and most famous cryptocurrency. Imagine a digital form of money that operates outside the control of any bank or government. That's Bitcoin in a nutshell. Here's a breakdown in more detail:

Decentralized: Unlike traditional currencies controlled by central banks, Bitcoin relies on a peer-to-peer network of computers around the world. Transactions are secured and recorded on a public ledger called a blockchain, eliminating the need for a trusted third party.

Digital Cash: You can use Bitcoin to buy things online or send it to others, similar to cash. However, Bitcoin isn't as widely accepted as traditional currencies yet.

Limited Supply: There will only ever be 21 million Bitcoins in existence. This finite supply is one factor that contributes to its value.

Mining: New Bitcoins are created through a process called mining. Miners use powerful computers to solve complex math problems and verify transactions on the network. As a reward, they receive a small amount of Bitcoin.

Halving: The number of Bitcoins rewarded to miners gets cut in half every four years or so. This halving event is designed to slow down the creation of new Bitcoins and potentially influence its price.

Volatile: Bitcoin's value can fluctuate significantly. While some see it as a potential store of value, its history is marked by boom and bust cycles.

Bitcoin's innovative technology and its potential to disrupt traditional finance have captured a lot of interest. However, it's important to understand the risks involved, including its volatility and the evolving regulatory landscape.

Assisted by https://gemini.google.com/.

See also:

- Reversteem: merges the strategic thrills of classic Reversi with the decentralized power of Steem blockchain, letting you duel friends through blockchain-recorded games

- @steem.amal: Charity At Your Fingertips

- Maximize curation rewards: follow our trail! Maksimalkan reward kurasi: ikuti trail kami! トレイルをフォローし、キユレーション報酬を最大化!

- Pi Network - Crypto Pertama Yang Dapat Ditambang Di Ponsel

- Piネットワーク — スマートフォンでマイニングできる最初の暗号通貨

Comments