Mastering the Bull Run with Trailing Stops and Multi Timeframe Analysis

2 comments

Hello everyone! I hope you will be good. Today I am here to participate in the contest of Steemit Crypto Academy about the Mastering the Bull Run with Trailing Stop and Multi-Timeframe Analysis. It is really an interesting and knowledgeable contest. There is a lot to explore. If you want to join then:

Question 1: Explain Trailing Stop and Its Usefulness in a Bull Run

Describe how a trailing stop works and why it is especially useful in a bull run. Discuss different types of trailing stops (percentage-based, fixed levels, or ATR-based) and how they protect profits while capturing the upward trend.

A trailing stop is a dynamic risk management tool. It is used to lock the profits. It allows the traders to get benefits from the favourable price movements continuously. It is not like a fixed stop loss. Trailing stop adjusts automatically as the price moves in the favour of the trader. This is especially valuable during a bull run because in the bull run price moves upward over an extended period.

So when the prices move in the upward direction the trailing stop helps us to collect more profit for us. In the bull run we can make good profits but if we sell our assets at the right time. Because of the previous panic corrections sometimes it happens that we sell our assets as they rise and give us a small profit and we book our profit at that point.

But if we use trailing stops we can trail the stop loss as the prices increase in the upward direction. As the market pushes the prices in the upward direction it continues trailing the stop loss by locking more profit in the baskets. And when the price starts declining it stays there and without decreasing the profit it locks the profit at that time.

How a Trailing Stop Works

Setup: The trader sets the trailing stop at a specific distance. The criteria to set the trailing stop is in the form of percentage, fixed amount, or volatility based measurement below the current price.

Dynamic Adjustment: As the price rises the trailing stop "trails" behind the price by maintaining the predefined distance from the highest price achieved.

Stop Activation: If the price reverses by more than the trailing distance the stop loss triggers and it locks the profit and the trade is exited.

I will explain it with an example if I have bought STEEM at $0.15 and the price of the STEEM rises in the upward direction and I have set a take profit order at $0.20 then when the price will hit this area the assets will be sold out. In this way I will make a profit of 33.33%. But later on after selling the STEEM the price went more in the upward direction but I am unable to gain more profit because I have already sold.

But If I use trailing stops then I can make more profit. Because trailing stop will update my stop loss continuously in the trend direction as I have set and as soon as the price will move higher it will be shifted higher by locking more profit in my hands.

Let suppose if the price goes to $0.20 and I am using trailing stop then it will also be trailed further and similarly if it will move further to $0.30 my assets will not be sold but their stop loss or you can say take profit will be updated and in this way my margin of the profit from the trade will increase. And if the price reverses then it will stay at that point and it will save from the decrement in the good profit. So it is really very useful in the bull run to lock more profit.

Why Trailing Stops Are Useful in a Bull Run

If we talk about the benefits and usefulness of trailing stops in the bull run generally we can say:

Profit Protection: Trailing stops help to save the profits in the bull run market.As the price rises the stop is adjusted in the upward direction. It ensures profits are are not eroded by the sudden reversals.

Risk Mitigation: In the volatile markets trailing stops minimizes the losses automatically. Because it exits the trade if the price declines beyond the set threshold level.

Maximized Gains: The trailing stops help to avoid premature exits. It allows the traders to increase the profits on the upward trends without setting rigid price targets.

Emotion Free Trading: Trailing stops eliminate the need for constant monitoring. In this way they reduce emotional decision making. They enable the traders to focus on broader strategies.

Types of Trailing Stops

There are different types of trailing stops which are given below:

- Percentage Based

- Fixed Level

- Volatility Based

Percentage Based

It adjusts the stop level at a fixed percentage below the highest price such as 5%. It is best for the traders who are looking for a simple and adaptable method to gain maximum profit in the different markets.

Example: If the stock price rises from $100 to $120 and we have set trailing stop at 5%. The stop loss level will move from $95 to $114.

|  |  |

|---|---|---|

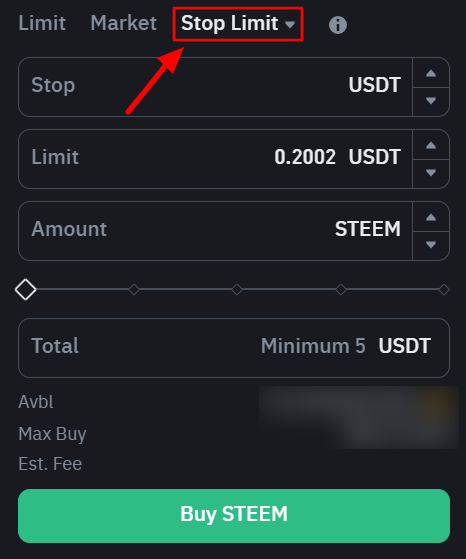

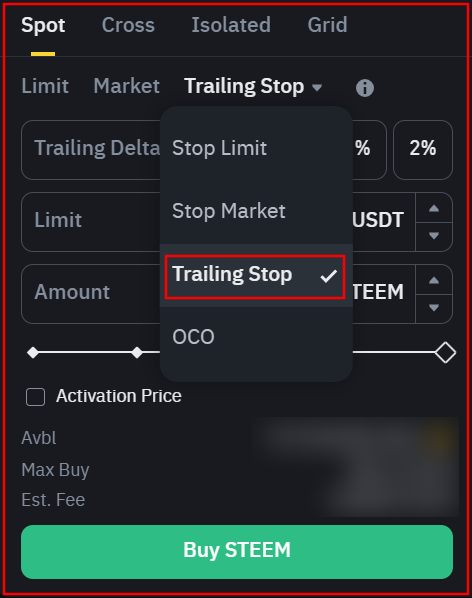

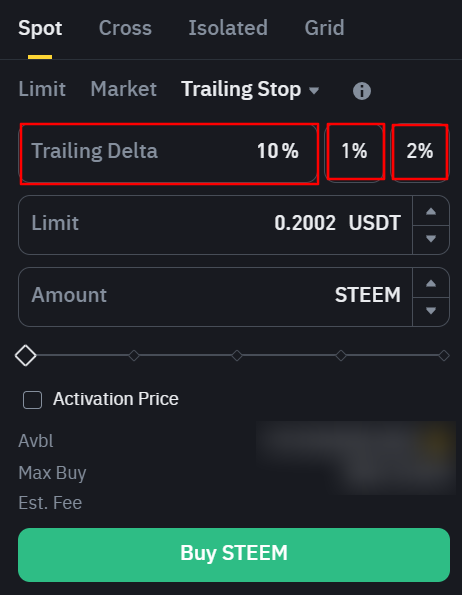

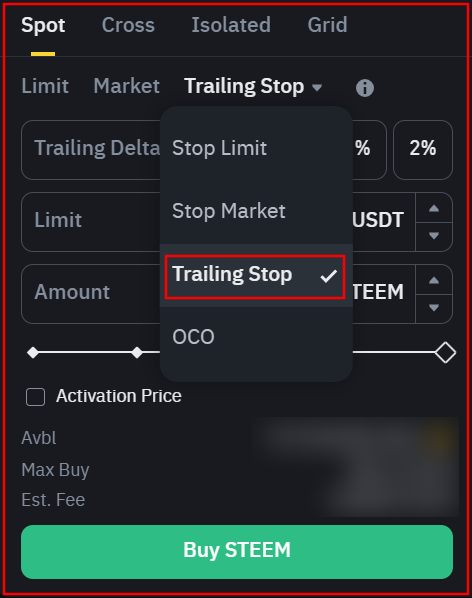

| Step 1 - Click on the limit | Step 2 - Select Trailing Stop | Step 3 - Set percentage |

This is the trailing stop for the buying order we can similarly set for the selling order.

Fixed Level

This is another type of the trailing stop. This type of trailing stops is also known as price based trailing stop. It moves in the pre defined increments with the increase in the price such as it trails by $5 or $10. This trailing stop is useful for the stable assets or when the traders have a clear idea for the price movements in the upward direction.

Example: If the price rises from $100 to $120 then a $10 fixed level trailing stop will be adjusted from $90 to $110. In this way this type of trailing stop works.

|  |  |

|---|---|---|

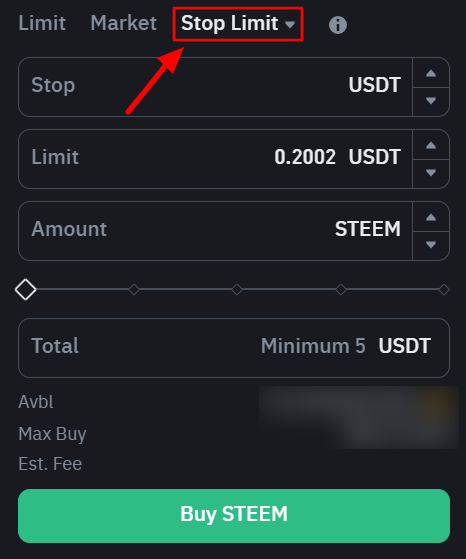

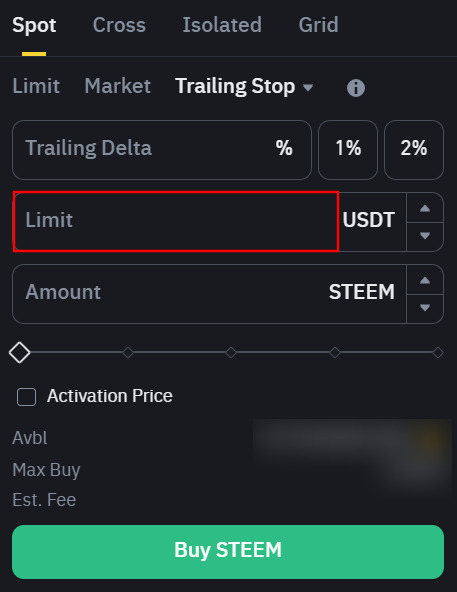

| Step 1 - Click on the limit | Step 2 - Select Trailing Stop | Step 3 - Set the fixed limit |

Volatility Based

This is another important type of trailing stops. This type uses the average true range to calculate the trailing stop distances. It is done by considering the volatility of the assets. This type of trailing stop is ideal for those assets whose price fluctuates continuously. This adjusts the stop loss dynamically according to the change in the market conditions.

Example: If we set ATR $2 by using this volatility based trailing stop then the trailing stop may follow at 2 ATRs below the highest price.

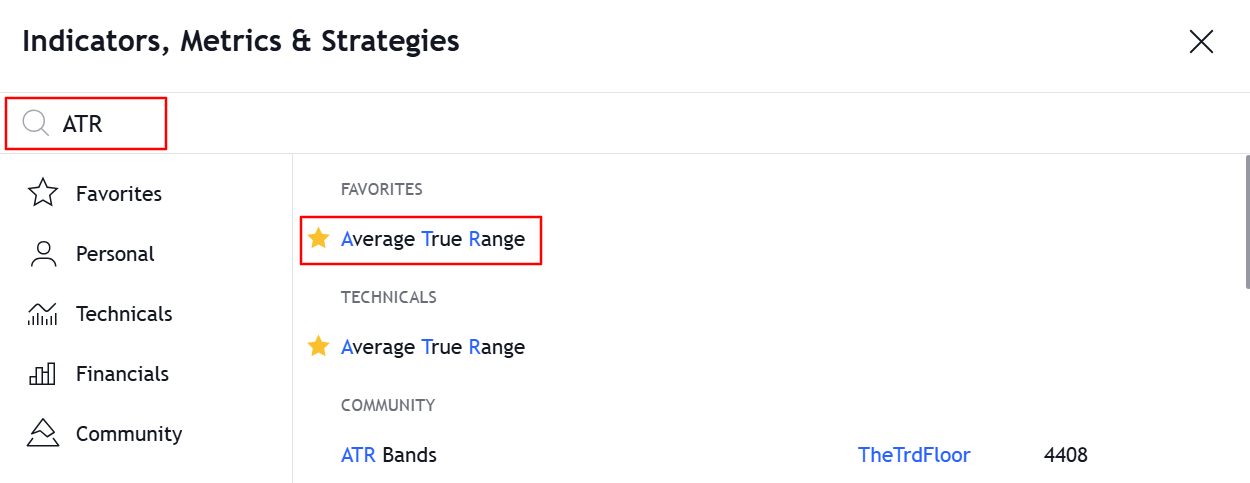

In order to set up ATR based trailing stop we need to enable the ATR indicator. For this purpose I have enabled ATR indicator in the tradingview as you can see below.

In the indicators section search for the ATR indicator to use ATR based trailing stop.

Here you can see ATR indicator is now enabled on the chart. Now I will use this to adjust ATR based trailing stop.

To calculate the trailing stop distance for STEEM by using an ATR multiplier for day trading which is typically 1.5x to 2x ATR we can follow these steps:

This is the chart data according to the ATR indicator:

- Price of STEEM: $0.2009

- ATR: 0.0097

- Multiplier (Factor): 1.5x to 2x

Calculations:

Trailing Stop Distance:

For 1.5x ATR: Distance=ATR×Multiplier=0.0097×1.5=0.01455

For 2x ATR: Distance=ATR×Multiplier=0.0097×2=0.0194

Trailing Stop Levels:

- For a long position (buying STEEM):

- 1.5x: $0.2009 - 0.01455 = $0.18635

- 2x: $0.2009 - 0.0194 = $0.1815

- For a short position (selling STEEM):

- 1.5x: $0.2009 + 0.01455 = $0.21545

- 2x: $0.2009 + 0.0194 = $0.2203

- For a long position (buying STEEM):

So after the calculations these are the trailing stops for the current price of STEEM:

- Long Position Stop-Loss: Between $0.18635 (1.5x) and $0.1815 (2x).

- Short Position Stop-Loss: Between $0.21545 (1.5x) and $0.2203 (2x).

We can choose the multiplier factor based on the risk tolerance and the conditions of the market.

Applications During a Bull Run

There are different applications of trailing stops during the bull run. They are given below:

Ride the Trend: The trailing stops allow the traders to stay in the trade trade as long as prices move continuously in the upward direction.

Lock in Profits: In the bull run if the price goes up and then reverses the trailing stop secures the profits by executing the sell order for the assets.

Avoid Premature Exits: It is not like the fixed profit targets. Trailing stops enable the traders to get benefit from the continued price increases.

Trailing stops are the important tool for the traders to maximize the returns during a bull run. The combine the profit protection while capturing the extended gains. They maintain a balance between the risk and reward. We can choose the right type of trailing stop according to the nature of the market. So the trailing stops are the valuable assets in the trading strategy.

Question 2: Multi-Timeframe Analysis for Steem’s Bull Run

Use multi-timeframe analysis on the Steem/USDT pair by observing trends across different timeframes (e.g., weekly, daily, and hourly). Explain how each timeframe provides complementary insights for refining entry points, stop levels, and profit-taking decisions.

Multi timeframe analysis is a powerful trading approach. We can examine the market by using timeframes to get a broader picture of the market on different events. This strategy provides a holistic market view. It ensures alignment between different trends and easy trading. In the bull run multi timeframe is very valuable. It helps to identify the dominant trend. We can refine entry points. With the help of this broader approach we can set stop loss levels and similarly we can optimize profit taking decisions.

We can choose different timeframes according to the nature of trading. Commonly there are 3 timeframes such as weekly, daily and hourly. If you are a long term trader and can hold the money for long term then you can use weekly time frame. Weekly time frame provides macro trend. Similarly if you are an intermediate trader and want to follow the intermediate trend then you can go with the daily time frame. Moreover if you want to follow the micro trend then you can use hourly time frame. It is best for the scalpers.

Timeframes and Their Role in Analysis

Weekly Timeframe (Macro Trend)

Weekly timeframe provides broader market context and the primary trend. We can use weekly time frame to determine whether the market is in the sustained bull or is is just experiencing temporary consolidations. This time frame highlights long term support and resistance levels. They are critical for the risk management. These support and resistance levels help to set the targets for the trades. Weekly timeframe is used to identify major bullish structures such as higher highs and higher lows. This timeframe provides a broad structure and view for the trading. We can manage the trades in long term by seeing the wider view of the market.

We can use the weekly timeframes to establish the primary biases. We can detect the bullish patterns during a bull run.

As this timeframe provides a long term trend so we can take entry in the market for the long term. On the other hand if the trend is against the long term market then we should avoid taking entry in the market.

Entry Zone: Weekly timeframe confirms the bull run and it defines the major support zone. This major support zone is considered for taking a long entry in the market. Because there is the possibility for the rise of the market from that support zone. The long term traders always wait for the support zone to take entry in the market.

Risk Management/Stop Levels: Weekly timeframe provides a bigger image of the market. We can place the stops below the significant weekly support zones to follow the macro trends. If the price reverses from the weekly support zone further in the downward direction then it can move to the next support zone so it is better to use it as the stop loss level to avoid more risk.

Profit Taking: Weekly time frame targets resistance zone for taking profit. The resistance zone is considered as to take profit in the weekly timeframe. We can also implement Fibonacci levels for the long term gains. Because when we use fibonacci levels we can further confirm the trend and we can maximize our profit.

This is the broader view of the STEEM/USDT trading pair in the weekly timeframe. We can observe strong resistance and support levels in this broader view. The price is always moving in the key resistance and support levels. The key resitance level in this timeframe is about $0.3450 and similarly if we look for the support level that is around $0.1450.

This is the complete chart of analysis in the weekly timeframe. Here is the detail of the weekly timeframe analysis of the chart:

Entry Point: In this long term timeframe the support level is for the entry points. We can see each time the price is touching the support level it is giving buying opportunity. We can consider this major support as an entry level.

Stop Levels: Stop levels are very important for the risk management. The support level is the key area for the risk management. In this long term timeframe if the price moves below the support level then it is considered as the stop level because after breaking down the support level the price can go further downward and in order to save your funds it is better to use this area as a stop level. Moreover if the price moves in the upward direction then we can set stop level below the local resistance level that if the price reverses then the trailing stop can exit the trade by locking the profit.

Take Profit: This is an important thing to be considered in the crypto trading. If we do not take profit wisely then we cannot grow our portfolio. I have implemented 3 different points for taking the profit in this timeframe.

- TP1: The most recent local resistance is the first take profit area which is at the price level of $0.2025 so this is the good area where one can make reasonable profit by taking entry at the price level of $0.1450.

- TP2: I have set the next take profit level at the price level of $0.2517. I have considered it as the next recent resistance after the first resistance zone which is now acting as a support level with respect to this resistance. So if the trader takes an entry at the base support level and exit trades at this point then he can make a handsome profit.

- TP3: If a trader is long term and have patience to wait for the long term then the exit point can be considered the major resistance level in this timeframe. As this timeframe is for the long term so the last taking profit level is ideal and the traders can wait to make mind blowing profit.

Moreover if we talk about the trend of the STEEM in the weekly timeframe we can say that the STEEM is in the bull run because it is forming higher highs and higher lows. I have used Bollinger bands for the determination and confirmation of the trend. We can see that the price has already crossed the upper band which represents the bullish trend.

Daily Timeframe (Intermediate Trend)

Daily timeframe tracks intermediate or medium term price behaviour such as breakouts, pullbacks and the consolidation phases. It pinpoints key levels where the price may stall or reverse. It reveals actionable patterns like the bull flags. It also helps to identify the ascending triangles or the bouncing of the trend lines. It asses momentum shifts that signal potential opportunities. Some more applications of daily timeframe are given below:

It aligns trades with the daily trend that supports the weekly bias.

It look for pullbacks to daily support or continuation patterns for entries.

It uses daily pivot points to set realistic profit targets and stops.

Entry Zone: In the daily timeframe we need to wait for the pullback to a support zone or the breakout above the resistance level. When the price pullback from the support level or breakout the resistance level it confirms the trend ans we can consider this breakout or pullback zone as an entry level.

Risk Management/Stop Levels: Risk management is crucial factor in the trading. We can use swing lows for the stop levels in the daily timeframe. It ensures adequate room for the fluctuations while protecting the profits.

Profit Taking: In the daily time frame we can take partial profits while still staying in the trade. We can use daily resistance levels to secure gains while leaving the position open for the further upside.

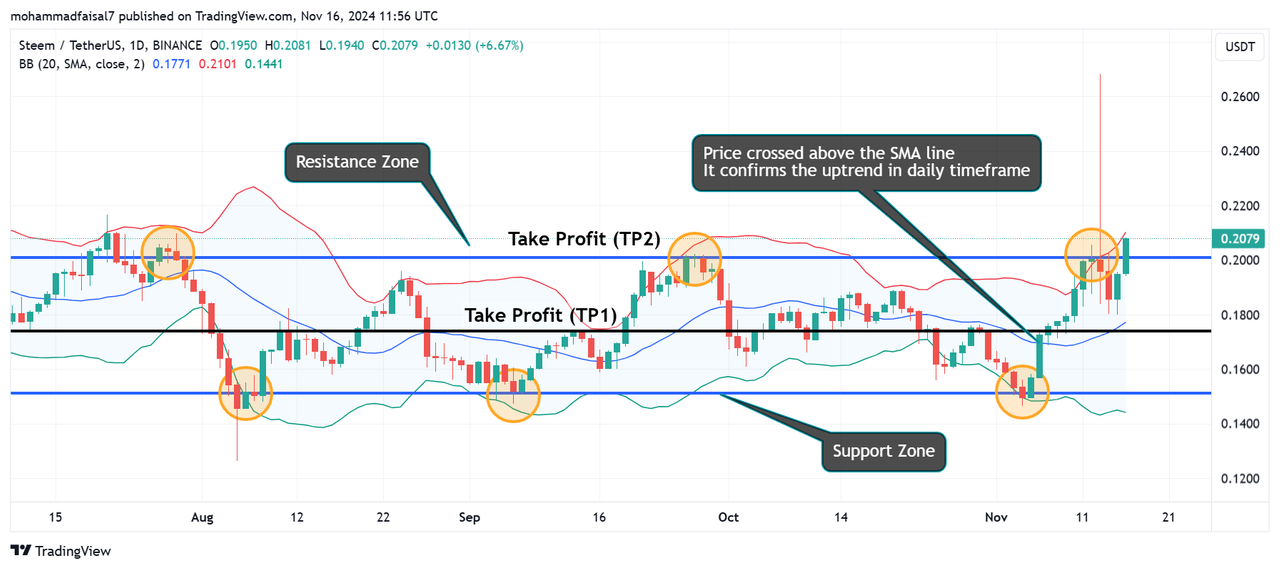

In the daily time frame this is the STEEM/USDT chart where the support and the resistance levels are highlighted with the help of the blue line. We can see the price is moving in the zig zag movement. The price touching the support level and the resistance level and it is moving in between the support and the resistance level. In this daily timeframe the support level is at around the $0.1522 and the resistance level is at the $0.20.

This is the complete chart of analysis in the daily timeframe. Here is the detail of the daily timeframe analysis of the chart:

Entry Point: You can see that the support level is the key area to enter in the market to take a long entry in the STEEM/USDT trading pair. At each support level it is the opportunity for buying and taking a long entry. The support level is the strong buying zone as we can see that after each support zone the price is bouncing from the support level and it is going in the upward direction. So in the daily timeframe the traders can consider it as a buying or entry level.

Stop Levels: In the determination of the stop levels support is again important in the long entry. If the price moves down the support level after the little spike then it suggests that the trend is reversing and the market will fall down. So in order to stay safe implement stop levels lower than the support zone.

Take Profit: In the daily time frame we can make partial profits and we can still stay in the trade as well. The most recent resistance level in the chart right after the support level can be considered as the first point to take profit. We can exit our entry partially at this point while still staying in the trade. It lowers the risk ad help to grow the portfolio without facing loss. But if you are a good holder then the last exit point can be considered the major resistance level in the daily timeframe. We can see each time the price has hit the daily resistance level it has come down to retest the market.

If we look carefully the Bollinger bands is suggesting uptrend in the STEEM market. The price crossed above the SMA line and it confirms that the price moving in the upward direction. A bull flag pattern is forming and it is indicating the continuation of the trend.

Hourly Timeframe (Micro Trend)

This timeframe is suitable for the scalping and the scalpers use this timeframe to determine the precise entry and exit points in the short term. It helps to track the intraday price movements. It identifies micro-support and resistance levels, candlestick patterns and volume spikes. It detects reversals or continuation setups at finer levels. It has these applications:

It execute trades at key hourly levels that align with daily and weekly trends.

It confirm entries using candlestick patterns like bullish engulfing or hammer formations.

It is used for the fine tune stop loss placements based on hourly swing lows or highs.

Entry Zone: It helps to take entry using the bullish candlestick patterns. We can take entry after the confirmation of the breakouts. In the hourly timeframe the surges in the volume also helps to take entry.

Risk Management/Stop Levels: In the hourly time frame we use intraday level to set tight stops for the high precision during the entry or trade management because of the volatile market. As the price moves we can also adjust the stop levels by using trailing stop.

Profit Taking: In the hourly timeframe we use trailing stops for the profit taking. We can trail the stops to capture the short term moves. This trailing helps to lock profits as the trend advances in the favour of the trader.

Here you can see the overbiew of the market in the hourly timeframe where the support is at around $0.1846 and the resistance is at around $0.2045 and the local resistance is at around $0.1950.

In this chart we can see complete analysis for the hourly timeframe. It is for the short term and especially used for the swing trading and scalping. It is used for the confirmation of the trend.

Entry Point: The support level is the key area for taking a long entry in this timeframe. But for taking entry we need to wait for the confirmation of the trend when the price moves upward from the support zone then it is considered for the valid entry. Moreover if we want to take second entry then we can consider the recent resistance zone as a support level and if the price moves above the support level we can take second entry as well if we missed the first entry.

Stop Levels: As this is for the short term but still there is the high need of the risk management. We need to set some stop levels for the management of the risk. If the price moves below the support zone it is the sign that it can retest the next support zone and we can fall prey to loss so it can be considered as a stop level in the hourly timeframe.

Take Profit: For taking profit in the hourly timeframe we can use trailing stops. As the market advances in the desired trend we can move our take profit zone manually or we can use trailing stops. But if we consider technically take profit area then the most recent resistance zone after the first support level is the key zone to take profit partially. And then we can continue while staying safe from the pullback in the price in the downward. And when the price touches the major resistance level then it can retest the recent support level so it is the area to take profit. And after re testing we can take another entry after the confirmation of the trend.

If we see the overall trend then we can see that STEEM/USDT is in the bullish pattern in the hourly timeframe as well. The bollinger bands are confirming the breakout as the price has already crossed the SMA blue line. It suggests that the price will follow the uptrend.

Question 3: Adjusting Trailing Stops Based on Multi-Timeframe Analysis

Show how to adjust trailing stops based on information gathered from multiple timeframes. For example, a stop based on weekly ATR can offer enhanced security in a long-term context, while a daily stop adjustment can closely track the trend. Use examples to illustrate.

Adjusting trailing stops by using the insights from the multiple timeframes ensures a balance between securing the profits. It allows the traders to ride favourable trends. The adjustment process involves tailoring stop loss levels to the broader trend in the weekly timeframe, intermediate trend in the daily timeframe and precise and short term movements in the hourly timeframe.

Multi-Timeframe Approach to Trailing Stops

The weekly timeframe provides a macro level perspective. It shows the dominant trend and key support levels. Trailing stops based on this timeframe ensure trades remain active during broader fluctuations.

Trailing stops dynamically adjust to lock in profits as the price of an asset moves favorably. By integrating multi-timeframe analysis we can optimize trailing stop strategy for the Steem/USDT pair. It ensures better alignment with the prevailing market trends.

Weekly Timeframe

The weekly chart provides a macro view of the trend. It is ideal for setting broader stop loss levels. Suppose the Average True Range (ATR) for STEEM on the weekly timeframe is $0.02. If STEEM is trading at $0.2694 then a trailing stop of 2x ATR ($0.04) below the current price at $0.2294 offers sufficient room for long-term fluctuations without exiting prematurely.

Calculation of ATR:

- ATR: $0.02

- Multiplier: 2

- Weekly high: $0.2694

- Stop level: $0.2694 - (2 × $0.02) = $0.2294

Daily Timeframe

On the daily chart ATR might reduce to $0.01. It reflects short term volatility. Here is a tighter stop loss. We can say 1.5x ATR ($0.015) could be set. For example, if STEEM rises to $0.2694 we can adjust the trailing stop to $0.2544. This captures more of the upward momentum while maintaining a balance against smaller pullbacks.

Calculation of ATR:

- ATR: $0.01

- Multiplier: 1.5

- Daily high: $0.2694

- Stop level: $0.2694 - (1.5 × $0.01) = $0.2544

Hourly Timeframe:

The intraday traders focuses on the hourly chart where rapid price movements occur. It can dominate the ATR so it may be as low as $0.005. A tighter trailing stop of 1x ATR will be suitable. If STEEM spikes to $0.209. Then we can set trailing stop at $0.204. It ensures that we can secure profits if the price reverses suddenly in the downtrend.

Calculation of ATR:

- ATR: $0.005

- Multiplier: 1

- Hourly high: $0.209

- Stop level: $0.209 - (1 × $0.005) = $0.204

Here I have concluded another hypothetical example to understand it better in different timeframes that ow can we trail the stops in different timeframes. If STEEM starts at $0.21 and rallies to $0.30 over a week:

- Weekly Stop: Adjust from $0.2294 to $0.2494 as price trends upward.

- Daily Stop: Adjust progressively in smaller steps from $0.2544 to $0.275, shadowing daily price action.

- Hourly Stop: Tight adjustments on minor moves ensuring quick reaction to intraday reversals.

This strategy combines the stability of higher timeframes with the precision of shorter intervals. It helps in protecting profits while allowing the trade to ride the trend.

Benefits of Multi-Timeframe Stop Adjustments

- Macro Security with Weekly Stops: Ensures trades align with the dominant trend, avoiding premature exits.

- Intermediate Flexibility with Daily Stops: Locks in profits during pullbacks or consolidations.

- Precision with Hourly Stops: Maximizes gains by closely tracking intraday movements near key levels.

Adjusting trailing stops using multi timeframe analysis provides a strategic edge. It align stop loss levels with market conditions across timeframes. Weekly stops offer long term security, daily stops track intermediate trends and hourly stops allow for precise profit taking. This approach maximizes gains while minimizing risk. It makes it indispensable during a bull run.

Question 4: Develop an Advanced Trading Strategy for a Bull Run

Create an advanced trading strategy for Steem's bull run by combining trailing stops and multi-timeframe analysis. Describe your entry and exit criteria, adjusted trailing stop levels for each timeframe, and methods to optimize gains while minimizing risk.

Advanced Trading Strategy for a Steem Bull Run

This strategy combines trailing stops and multi-timeframe analysis to capitalize on Steem's bull run. The goal is to maximize gains while systematically managing risk by aligning trade decisions with macro, intermediate and micro market trends. So in order to develop an advance trading strategy I will follow the following steps:

Identify Trends

In order to develop the trading strategy it is necessary to first identify the trend of the market. Because there are two options while developing the trading strategy. The market can go upward as well as downward. I want to develop trading strategy for the upward trend to take a long or buying entry. In different timeframes it is how I will detect the bullish pattern of the market:

- Weekly Timeframe: Confirm a strong uptrend with higher highs and higher lows.

- Daily Timeframe: Look for bullish patterns like breakouts from key resistance levels or moving average crossovers.

- Hourly Timeframe: Use RSI or MACD to detect short term momentum in alignment with the larger trend.

Entry Point

After the successful detection of the trend now it is the time for the suitable entry because entry timing matters a lot. As we want to take long entry after the detection of the bullish pattern we can follow this criteria to take a good long entry in the market:

We can use a breakout strategy to enter when the price breaches the resistance supported by volume. For example if Steem breaks above $0.23 on strong volume it signals a potential continuation of the bull run.

Trailing Stops and Risk Management

Risk management is very important factor in trading so it should be taken care greatly. We need to set trailing stops to avoid loss and to collect bigger gains. We should adjust trailing stops dynamically based on the insights from the multiple timeframes:

Weekly Timeframe

- Stop Level: In order to adjust the stop loss level in the weekly timeframe we need to use the weekly ATR such as $0.02 to set a wide trailing stop of 2x ATR below the current price. It will really help in the development of the advance trading strategy.

- Example: If Steem reaches $0.25we can place the stop at $0.21. This allows for the long term price swings without prematurely exiting from the market.

This is how we should set wider trailing stops to absorb the local fluctuations and while staying in the trade by following the trend.

Daily Timeframe

- Stop Level: In the daily timeframe we need to set stop level in the intermediate way. We can set a tighter trailing stopby using the daily ATR such as $0.01 trailing at 1.5x ATR below key support levels.

- Example: If the price is at $0.26 then we can place the stop at $0.245 to secure profits while allowing moderate fluctuations.

Hourly Timeframe

- Stop Level: In order set the stop loss in the hourly timeframe we can use hourly ATR such as $0.005 for precision in intraday adjustments. We can trail the stop at 1x ATR below hourly support.

- Example: If the price is at $0.27 then we can set the stop at $0.265 for short term profit protection.

Profit Optimization

After the trend detection and the good entry now it is the time to define the good points for the taking profit. After the successful entry if we are unable to take profit at the good levels then our trend detection and good entry will be of no use. So in order to make good profit we need to optimize our our profit by following the given strategies:

Partial Exits:

- We should scale out portions of the position at predefined resistance levels. For example we can sell 50% at $0.30 while letting the rest ride further with adjusted trailing stops.

Re-entry Opportunities:

- We should use hourly or daily pullbacks to re-enter positions during strong bullish trends. We can monitor Fibonacci retracements such as 38.2% or 50% as potential entry points.

Dynamic Adjustments:

- We can tighten stops aggressively near psychological levels such as $0.30, $0.35 or when bearish reversal patterns emerge on shorter timeframes.

Example

Entry:

- We can enter at $0.23 after a daily breakout with rising volume. It can be a good entry in this zone.

Trailing Stops:

- Weekly: Start with a stop at $0.19 (2x ATR).

- Daily: Move the stop to $0.215 after a consolidation near $0.24.

- Hourly: Tighten to $0.225 as Steem approaches $0.26.

Exit:

- Take partial profits at $0.30 and adjust the remaining stop to $0.28, securing gains while allowing further upside.

Benefits of the Strategy

- Combines Macro and Micro Analysis: Reduces risk while capturing both long term trends and short term price movements.

- Dynamic Profit Protection: Trailing stops secure profits incrementally without fully exiting the bull run.

- Flexibility: Re entry strategies ensure traders do not miss out on additional upside during retracements.

By integrating trailing stops with multi timeframe analysis this advanced strategy enhances the ability to take profit from Steem’s bull run while safeguarding against sudden reversals.

Question 5: Precautions and Limitations of Trailing Stops and Multi-Timeframe Analysis

Discuss the limitations and risks associated with trailing stops and multi-timeframe analysis in a bullish market. Provide tips to avoid being prematurely stopped out and interpret trend reversal signals across multiple timeframes accurately.

Trailing stops and multi-timeframe analysis are powerful tools for trading in bullish markets but come with specific limitations and risks. Here’s a detailed breakdown:

Limitations of Trailing Stops

Market Volatility:

- Tight trailing stops may trigger premature exits due to minor price fluctuations, especially in volatile markets like cryptocurrency.

- Solution: Adjust the trailing stop based on ATR (Average True Range) to accommodate volatility on your chosen timeframe.

Lagging Adjustments:

- Trailing stops depend on past price data, which might lead to delayed adjustments during rapid price changes.

- Solution: Use faster timeframes or consider a manual approach for dynamic markets.

False Breakouts:

- A trailing stop may get triggered during fake reversals or sudden price spikes caused by news events.

- Solution: Combine trailing stops with other indicators (e.g., moving averages or volume) to confirm the strength of a breakout.

Risks in Multi-Timeframe Analysis

Contradictory Signals:

- Trends across different timeframes may conflict. For example, a bullish daily trend may clash with a bearish signal on the weekly chart.

- Solution: Prioritize higher timeframes (e.g., weekly) to determine the primary trend, using shorter timeframes for entry and exit points.

Overanalysis:

- Too much focus on multiple timeframes can lead to analysis paralysis, making it difficult to execute trades confidently.

- Solution: Limit analysis to three key timeframes (e.g., weekly, daily, and hourly) for clarity.

Delayed Reactions:

- If trends shift across timeframes, traders might miss reversal signals or react too late.

- Solution: Monitor price action at critical support/resistance levels for early warning signs of trend changes.

Precautions to Avoid Premature Stops

Adjust Stop Distance:

- Use ATR to calculate appropriate trailing stop levels based on the timeframe. For example:

- Weekly ATR: 2x for long-term trades.

- Daily ATR: 1.5x for medium-term trades.

- Hourly ATR: 1x for short-term trades.

- Use ATR to calculate appropriate trailing stop levels based on the timeframe. For example:

Avoid Setting Stops on Round Numbers:

- Many traders set stops at round numbers such as $0.20, $0.25 which are often targeted by market moves.

- Tip: Place stops slightly above/below these levels such as $0.198, $0.248.

Monitor Liquidity and Spread:

- High spreads in low-liquidity markets can prematurely trigger stops.

- Tip: Trade during high-volume sessions to reduce the impact of spreads.

4. Interpreting Trend Reversal Signals Across Timeframes

Confirmation Across Timeframes:

- Wait for alignment between timeframes to confirm a trend reversal. For example: A bearish weekly candlestick such as engulfing pattern combined with a break of daily support confirms a likely reversal.

Use Complementary Indicators:

- Combine tools like RSI, MACD, or Bollinger Bands with price action to validate reversal signals across timeframes.

Look for Divergences:

- A divergence such as higher price highs but lower RSI highs across timeframes can indicate weakening momentum before a reversal.

Conclusion

While trailing stops and multi-timeframe analysis can significantly enhance trading decisions, their effectiveness relies on proper calibration and avoiding common pitfalls. Traders should regularly review market conditions, adjust strategies to reflect volatility, and combine stops with robust trend-confirmation techniques to optimize their performance during a bullish market.

Disclaimer: All the chart screenshots for the explanation have been taken from TradingView otherwise stated.

Comments