Mastering Steem Market Volatility Using Bollinger Bands

3 comments

Hello everyone! I hope you will be good. Today I am here to participate in the contest of Steemit Crypto Academy about the Mastering Steem Market Volatility Using Bollinger Bands. It is really an interesting and knowledgeable contest. There is a lot to explore. If you want to join then:

Question 1: Explain the Components of Bollinger Bands

Describe the three main components of Bollinger Bands: the simple moving average (SMA), the upper band, and the lower band. How does each component contribute to understanding market volatility and making trading decisions?

Bollinger bands are the technical analysis tool. This is used to measure market volatility. It is used to identify the overbought and oversold conditions in the market. It has three main components.

These main components are given below:

Simple Moving Average (SMA)

The SMA is the central line of the Bollinger Bands. It is set to a 20-period average. It represents the average price over a specific time period. It shows the price fluctuations. Simple moving average allows the traders to see the trends more closely. It assess the price movements as compared to the overall trend.

Upper Band

This is another main component of Bollinger Bands. The upper band stays above the SMA. It stays away at a certain number of standard deviations. This upper band acts as a resistance level. It represents the upper limit of the price movement. When the prices approach or exceed the upper band then it gives the overbought signal. And this overbought signal represents the reversal in the price. At this point the market can also take correction. But if the price has a strong move with the upper band then it indicates the bullish momentum.

Lower Band

The lower band is always available below the SMA. It is also set at the specific standard deviation. This band serves as a support level. It indicates the lower limit of the normal price movement. When the price touch the lower band or fall below the lower band then it signals an oversold condition in the market. It indicates a buying opportunity. On the other hand if the price move along the lower band then it can cause bearish momentum.

Contribution to Understanding Volatility and Decision-Making

Bollinger Bands help to understand volatility of the market. We can make god decisions based on the Bollinger bands.

Market Volatility

The distance between the upper and lower band suggests the volatility in the market. We can divide this distance between the bands and expansion in two ways to understand the market volatility easily. Because these bands contracts and expands based on the market volatility.

If the distance between the bands is wide then it suggests higher volatility in the price movements.

If the distance between the bands is less or the bands are narrow then it suggests lower volatility in the price movements.

Trading Decision

When the price reach the upper or lower band or the price breach the bands then it indicates the reversal or continuation in the market. We can divide it it two ways to better understand the market behaviour and to make the trading decisions accordingly.

When the price touches the upper band then the traders can consider it a selling signal because a pullback can happen at this moment. Actually the upper band behaves as a resistance and the resistance can push the price back. So in order to avoid loss the traders can take the decision to sell their assets at this point.

When the price touches the lower band then the traders can take this as a buying signal. The market can rebound from this spot. The lower band works as a support level and this support pushes the price in the upward direction. So the traders can take this buying opportunity in the market to make profit.

Question 2: Analyzing Market Conditions with Bollinger Bands

Using a historical chart of Steem/USDT, analyze market conditions based on Bollinger Bands. Explain if the market is in an overbought, oversold, or neutral state. Provide examples of how Bollinger Bands can signal potential buying or selling opportunities.

We can analyze the market conditions with the help of the Bollinger Bands. We can spot the overbought, oversold and neutral state. I will explain how we can find the signals based on the position of the price action relative to the three main components which as Simple Moving Average, upper band and lower band.

Step-by-Step Analysis of Bollinger Bands for Steem/USDT

Identifying Overbought State

As I have explained it earlier that when the price consistently touches or breaches the upper band then it suggests an overbought signal in the market. This overbought means that the price of the STEEM has risen quickly. And this quick rise in the price can cause a pullback in the price.

In the historical chart of STEEM/USDT we can see an overbought condition. On May 30, 2024 price of the STEEM moved significantly and it breached the upper band of the Bollinger Band. The price closed above the upper band for 2 times. It suggested the reversal in the trend. The momentum of the market became weak at this point. This overbought condition set the price to move in the downward direction. It caused a significant downward movement.

I have used price measurement attribute to show the change in the price after the overbought condition. We can see that the price moved downward 49.60%. After breaching the upper band the price touch $0.3350 and after this overbought condition it was pushed downward hardly to touch $0.1680. So it is how an overbought condition can be identified with the help of the Bollinger bands specifically with the upper band.

So overbought condition alerts us for the selling opportunity because from this the price can move downward. The traders can take this opportunity to get out of the market while staying in profit. It is how we can identify selling points with the help of Bollinger bands.

Identifying Oversold State

It is completely against the overbought condition. When the price reaches near the lower band or it dips below the lower band then it is the strong indication for the oversold condition. It suggests that the price of the asset has dropped significantly. And this suggests a bounce in the price.

Again if we move back in the historical chart of STEEM/USDT we can observe that the oversold condition. On 23 January, 2024 the price of the STEEM/USDT dips below the lower band. It suggested an oversold condition at that time. During this period the price moved below the lower band 3 times. It was a strong signal for the oversold. This oversold in the market led the price to move in the upward direction.

If we see more keenly we can observe that the first oversold was at the price of $0.2098 and the most dip was at the $0.20. And this oversold proved to be a trend reversal in the market. The price started moving upward. In this movement the price started moving from $0.20 and it reached at the highest of $0.3992. And if we see the growth of the price with the price measurement we can see that the price moved around 100% in the upward direction. It is how we can spot an oversold condition in the market with the help of the Bollinger bands. In this oversold condition the lower level is very important and it is a decision making band.

So we can say that each successful oversold condition gives us the buying opportunity. The traders can take a long entry or buying entry at this point and can wait for the price to boom.

Identifying Neutral State

When the price moves within a specific range of price then it is known as a neutral zone. The price do not breach the upper band nor dips below the lower band. It just moves within the upper and lower band. The upper band serves as a resistance and the lower band serves as a support level. The price moves between this support and resistance level. This state is also known as the consolidation state before the next big move.

Here if we see the historical price chart of STEEM/USDT then we can see a neutral state in the market. I have highlighted the neutral zone starting from 14 August, 2023 to 19 October, 2023. In this time period the price is just moving within the support and resistance level. The price is just moving between $0.19 to $0.1483 in the daily chart.

STEEM/USDT during this period is moving in the consolidation zone. The market is preparing itself for the next big move in the upward direction. We can see after the neutral state of the market there was a big move in the upward direction. So in each neutral state the market prepares itself by absorbing the selling pressure and moves in the upward direction.

The whole neutral state is the buying opportunity. Most importantly when the price touches the support level the trader can take buying entry in the market and then the trader should wait for the next upward move to take profit.

Question 3: Identifying Volatility Patterns with Bollinger Bands

Explain how Bollinger Bands indicate market volatility. Use a real example of Steem price action where the bands expanded or contracted, signaling a potential breakout or trend change.

Bollinger bands help us to understand the volatility of the market. The expansion and contraction in the bollinger bands represent the volatility of the market. It is based on the standard deviation of the price action. There are two cases:

When the bands are wide they suggest high volatility in the market. Actually the price can move within in that wide range unexpectedly. Moreover when the price moves significantly then the bands adjust themselves according to the increased volatility.

When the bands are narrow it suggests low volatility in the market. The price moves in that narrow area so it cannot move with high volatility. Moreover this narrow range of the price often leads to a big breakout in the price.

Real Example of Steem Price Action

Band Contraction

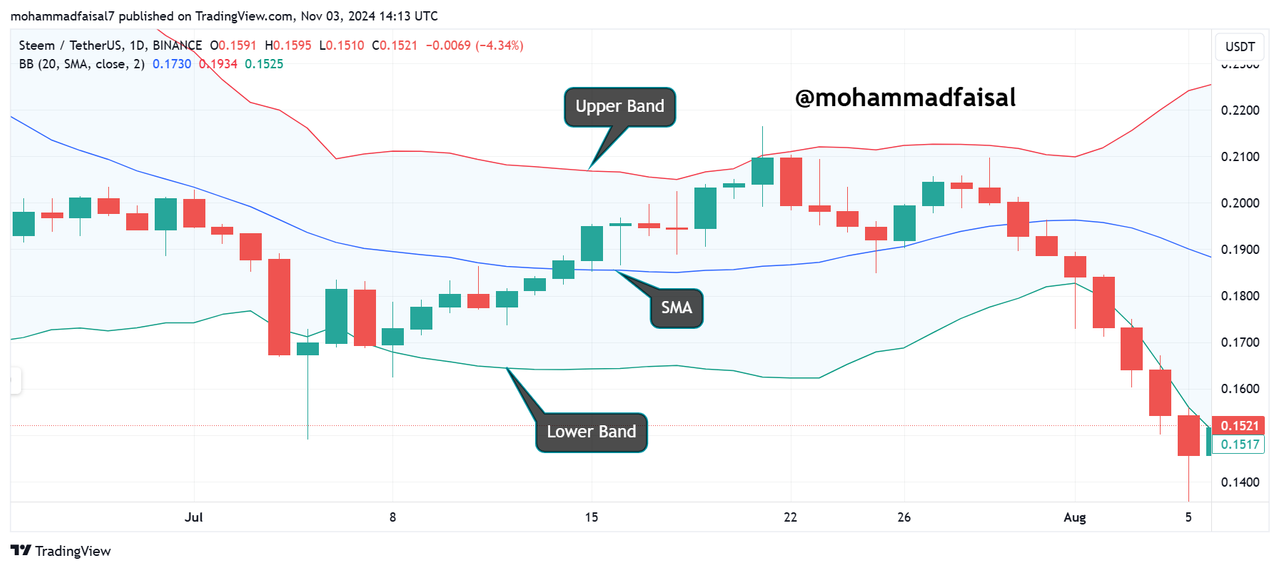

If we move back to the STEEM/USDT chart we can observe the contraction in the band. I am using 1 day time frame for the chart.

In the above chart of STEEM/USDT if we take a closer look then we can see that the bands in the chart are contracting as they are moving ahead with the change in the price. The Bollinger bands are contracting gradually. As the bands are contracting the volatility of the market is also decreasing.

Moreover the trend in the chart is also changing as the bands are contracting. When the bands are wider then the price is in the uptrend but with higher volatility. As soon as the bands are contracting then the the trend is changing and the price is becoming down gradually. And after some time with this gradual decrease in the price and contraction on the bands the price started moving in contracted bands with less volatility.

So we can say as the bands start contracting the price also starts decreasing. And this contraction in the bands also suggests the an upcoming breakout in the price.

Band Expansion

Here in the above chart you can see that the bands are going on steadily with the contraction. And the in the contraction zone there is no high market volatility. But suddenly the price breaks out the upper band with the high volume. This makes the bands wide and it suggests a new trend in the market. Now the market has become more volatile. You can see that the trend in the movement of the price has changed. After this sudden expansion in the bands the price dropped significantly. The price dropped from $0.2537 to $0.1387. It was just because of the high volatility in the market.

The larger the Bollinger bands the larger the volatility of the market.

In the above examples we have seen contraction and expansion in the bands. In the first example of contraction we can see STEEM/USDT is entering the low volatility phase and it will then work for the next breakout in the market.

In the second example the market is entering the high volatility phase from the low volatility phase. As soon as the bands starts expanding the volatility in the market increases. But with this increased volatility the price moved significantly from a higher level to lower level.

This shows how we can use Bollinger bands to identify the periods of low volatility and high volatility. We can also confirm the change in the trend when the bands starts expanding or contracting.

Question 4: Developing a Trading Strategy with Bollinger Bands

Create a trading strategy using Bollinger Bands for the Steem token. Describe entry and exit points based on band interactions, such as price touchpoints or midline crossings. Support your strategy with a real chart example.

Here is the trading strategy for the STEEM/USDT pair by using Bollinger bands. I will design the complete trading strategy to show the entry and exit points.

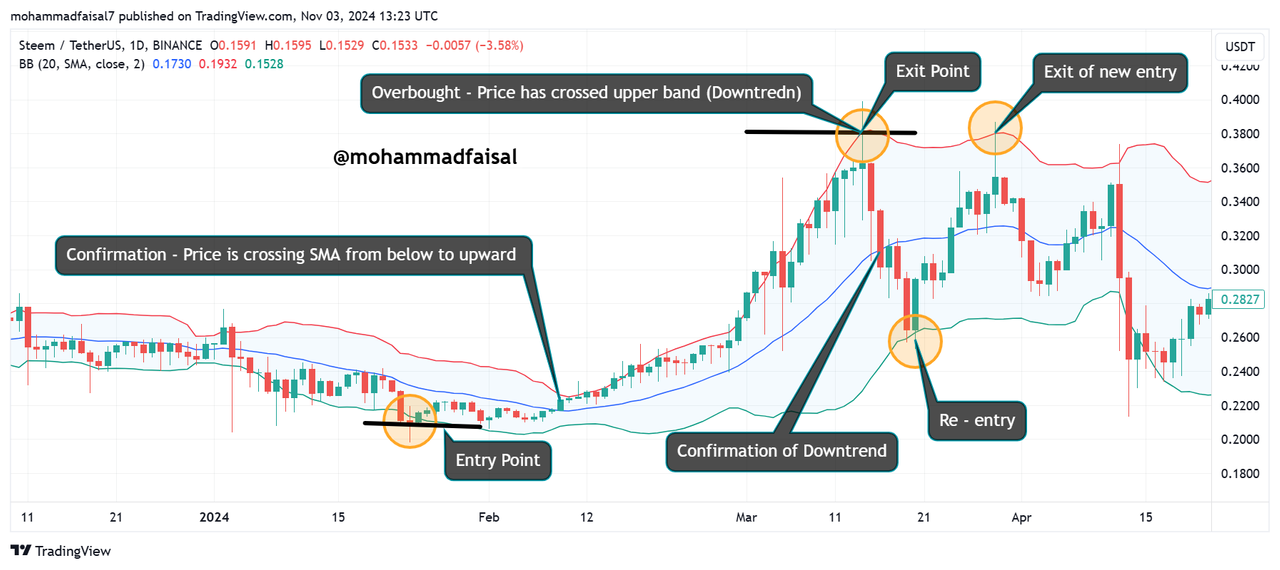

Here you can see the historical price chart of STEEM/USDT pair. Fiorst of all if we want to take an entry specifically a long entry we should watch the chart and the Bollinger bands carefully to spot the good entry in the market. If the price dips below the lower band then it suggests an oversold condition as we have studied earlier in the above section.

According to the above chart and price action the price dips below the lower band at $0.2171 on 22 January 2024. It was a good entry point so we can take entry in the market at this point. The entry level is $0.2095 for the long position.

Further in order to confirm the reversal in the market we should watch the SMA line carefully. The blue line is representing the SMA line. We can see that the price is moving in the upward direction by crossing the SMA line from below. So it is the confirmation of the upward trend and the reversal of the price.

When the price touches or moved above the upper band then it suggests the change in the trend. It represents the overbought condition. It is the point from where the price starts moving in the downward direction.

After taking the successful entry by using the knowledge of bollinger bands and implementing it on the lower band now our next target is to exit the entry wisely without loss but in the profit. If we see carefully in the chart the price has crossed above the upper band and now the next move of the market will be in the opposite direction. So it is the ideal exit point for the long trade. The traders can take out their assets from the trade with huge profit. In the current trading strategy by taking entry at the said point and exiting trade at the said point the traders has made almost 100% profit.

Moreover if someone wants to wait to confirm the downtrend then see the movement of the price further. If the price crosses below the SMA line which is the blue line then the downtrend is confirm and do not take more risk and you can exit your trade without the loss.

This is the complete trading strategy for the STEEM/USDT trading pair including the entry and exit points with the help of the Bollinger bands. I have further enhanced the chart to get the second entry in the market after getting a possible entry point. And then according to the second entry there is a new exit point by following the bollinger band strategy.

In this way we can prepare a trading strategy with the help of the upper band, lower band and SMA line which is also known as middleline.

Question 5: Predicting Price Movements with Bollinger Bands

Apply Bollinger Bands to forecast future price movements of Steem. Discuss how the bands’ positions and movements suggest potential support and resistance levels and what these predictions imply for Steem's upcoming price behavior.

We can apply Bollinger bands for the forecasting of the future price movements. We can do it by analyzing the historical data and by checking the past movement of the price. In order to forecast the future movement of the STEEM/USDT trading pair I will use the upper band, lower band and the SMA line or the middleline.

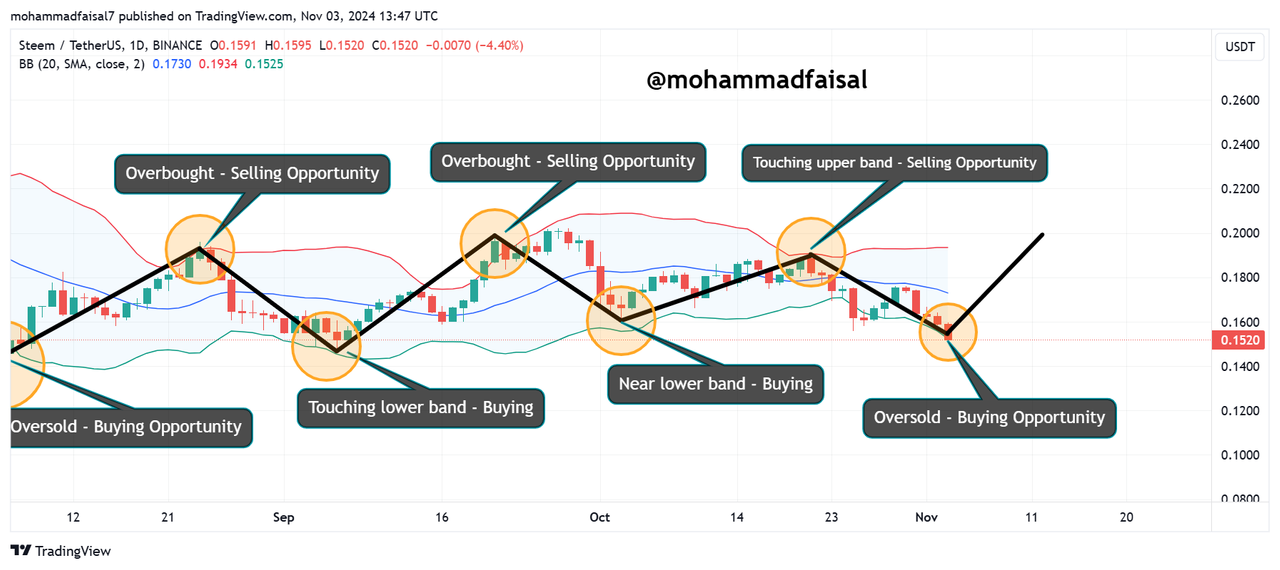

If we see the recent historical data for the STEEM/USDT trading pair then we can see that the price has moved in different trends. I am analyzing the chart in the 1 day time frame. We can see that whenever the price moved below the lower band or touch the lower band it gave an oversold signal. And we know that in the oversold signal the trend reverses. Each time the trend was changed and the price started moving in the upward direction.

On the other hand if we see the chart we can analyze that whenever the price touch the upper bandor crossed above the upper band then it was an overbought condition of the STEEM/USDT trading pair. After each overbought condition the price changed its trend and it moved downward.

Here if we see carefully the upper band is behaving as a dynamic resistance and the lower and is behaving as a dynamic support. The resistance and the support is continuously changing with the change in the price with respect to time. When the price is touching the support level it is going up and similarly when it is approaching the resistance the price is coming downward.

Upcoming Behaviour

By analyzing the future price movements if we see the current situation of STEEM market then we can suggest that the STEEM is currently staying at the dynamic support. The price has crossed below the lower band. And this cross of lower band is suggesting the oversold condition. It is the buying opportunity for the traders and the price can move in the upward direction from this point. This is a short term view regarding the STEEM/USDT trading pair.

According to my analysis with the help of the Bollinger bands the STEEM/USDT will move in the upward direction from this support level.And currently it is giving a good buying opportunity for the traders.

If we see STEEM/USDT trading pair in the long term then we can say that the market is in the consolidation phase and it is preparing itself for the next big move. The price is just moving in a fixed range. This consolidation period has run around 4 months. After this consolidation phase we can expect an upward move in the price of the STEEM/USDT. So if you are looking for short term or long term STEEM/USDT is looking good for both the conditions. You can take entry and then you can wait for the big move to take good profit.

Comments