The Methods I Used To Handle Volatility In The Crypto Market

3 comments

Hello fam,

It is your favorite blogger @mato445 and I am happy to come before you all today again to share a useful cryptocurrency content.

Today, we shall be examining the different methods I used to handle volatility in the crypto market.

INTRODUCTION

If cryptocurrency isn't volatile, it won't be profitable. Bitcoin has increased about 30% so far this year. It started 2024 at $38.5k and shot up to $73.7k in less than three months. Additionally, the price dropped from _73.7k to $60.8k. This represents 10% in less than a day.

The infamous volatility of cryptocurrencies is unrivaled. I don't believe I have ever seen a TradFi asset exhibit such behavior. Although it can be a nightmare, volatility is also the source of excitement. If you ask any experienced cryptocurrency investor, most would rather be liquidated during an extremely erratic bull market than endure an illiquid bear market. (Because in a volatile market, it's possible to recover your losses in a matter of hours.)

METHODS I USE TO HANDLE VOLATILITY IN THE CRYPTO MARKET

How do I handle the volatility of cryptocurrency? My experience over the years has taught me to just adjust. We cannot demand more graceful movements in asset values. We are merely able to play along. I'll go over a few of the strategies I employed to handle the volatility of cryptocurrencies in today's piece.

TAKE PROFIT AND STOP LOSS

Honestly, my best strategy for managing the volatility of cryptocurrency is to set a stop loss and then take a profit. God candlesticks can show either an upward or downward trend in a volatile market due to the great probability of seeing them. It either works in your favor or against you whenever something takes place. What are the best ways to manage volatility with stop loss and take profit? When I buy a coin, for example, I set both a sell limit order and a stop limit order. What's the work of the take profit? Since the market is volatile, there's a good chance that the coin will pump high, setting a take profit will give me hedge, whenever there's a crazy pump there's a high chance that the coin hit my take profit target and will sell automatically. What's the work of the stop loss? The stop loss will automatically protect my investment and assist me cut my loss during a significant decline, acting as risk management.

To properly utilize this take profit and stop loss method, you must understand R:R:R. What is your rewards if the market moves in your favor, and what are you ready to risk if it moves against you? I've found that using this method has really helped me remain ahead of the market and deal with market volatility in cryptocurrency.

TECHNICAL ANALYSIS

Cryptocurrency prices actually rigorously adhere to a set rule, regardless of how random you may think their movements are. Rather than being tossed around by the market like a ship without an anchor in a storm, Technical Analysis equips you with the means to at least understand it. It will predict price tops and bottoms as well as rejection and bounce points. Technical analysis is something I do using a variety of indicators, but support and resistance is the one that I find works best. Prior to trading a coin in a volatile market, I will make sure to look up the resistance and past support levels. I may set my take-profit and stop-loss orders using this indicator at the prior resistance and support, respectively.

You can find more indicators on the cryptocurrency chart that can assist you in analyzing the market and providing you with a buffer to deal with volatility. To ascertain the movement of the coin, you must comprehend how to employ and utilize the indicators correctly. This puts you ahead of the market and will undoubtedly assist you in managing the volatility of the cryptocurrency market.

HEDGE MODE

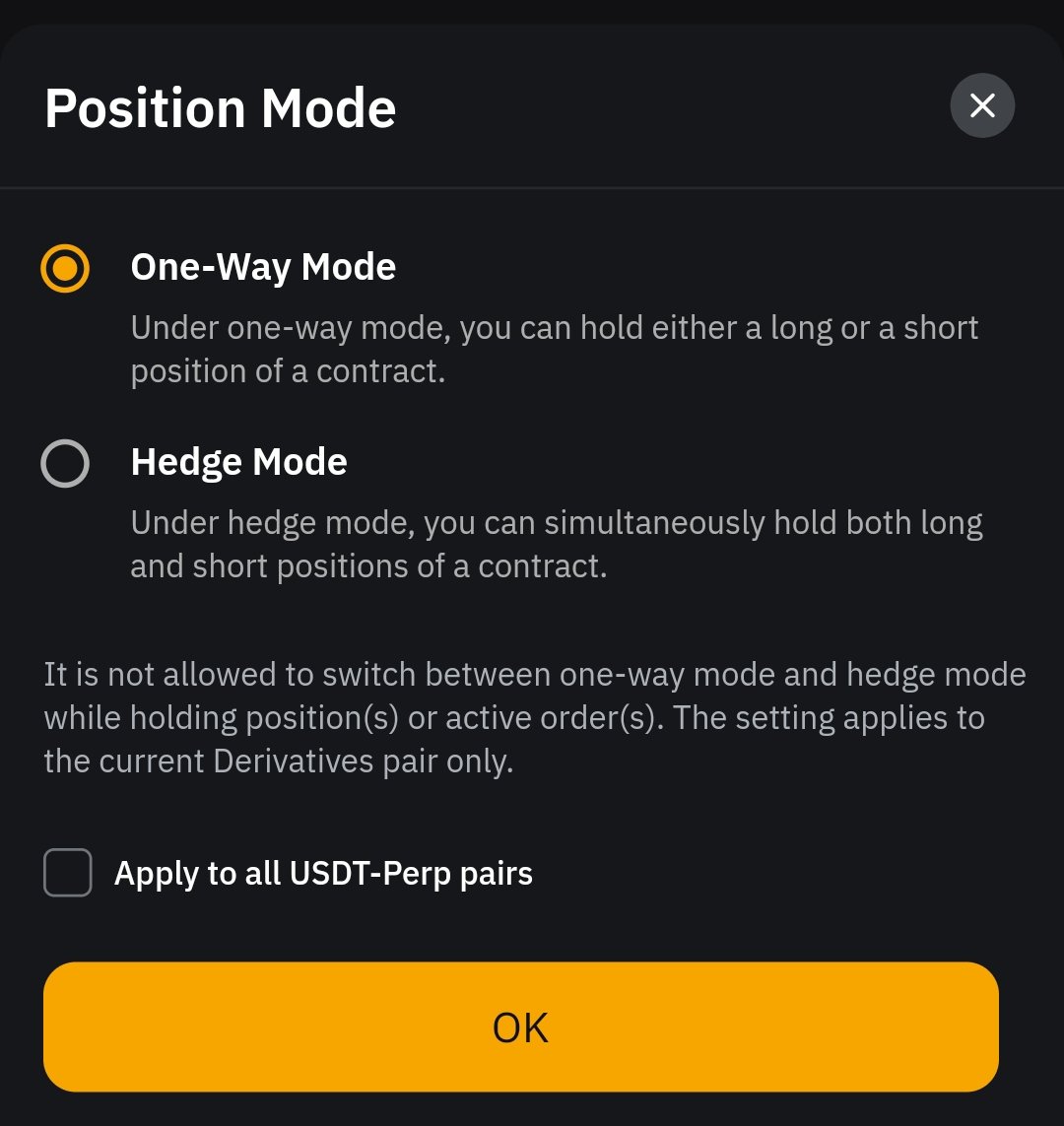

The market has the potential to move against you regardless of your direction (long or short, bullish or bearish), or how strong you believe your technical analysis to be. Hedge mode is therefore a fantastic way to handle the volatility of cryptocurrencies.

Hedge strategies come in various forms, but my preference is to take the opposite position of an ongoing trade because it's so straightforward. As an illustration, if you are buyiny Bitcoin, you will also be selling Bitcoin.

Note: this method only applies to perpetual trading (futures trading)

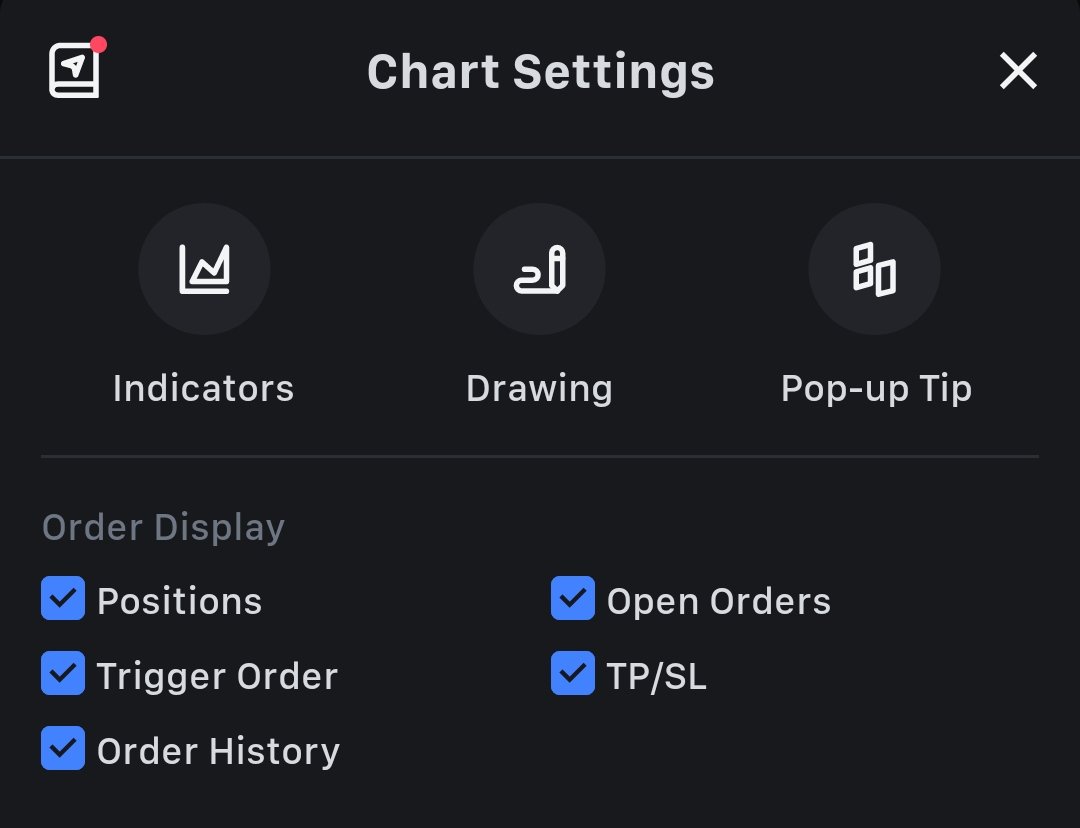

The hedge mode is available on your trading app. And it's so easy to navigate.

Screenshot From Bybit App

Screenshot From Bybit App

Cryptocurrency volatility seriously affects your emotions and sense of reason, which might cause you to make poor financial decisions. Think about how everything goes by so quickly that you hardly have time to reflect. Imagine a situation where an asset saw a decline and then recovered, as was the case with Bitcoin and how traders were frequently taken by surprise.

In this case, hedging will eliminate the requirement for you to employ take-profit or stop-loss orders. You also don't have to worry about the flush causing liquidation. given that you are trading both directions.

Your chances of closing your position are decreased. Since you are winning on one side. Instead of just losing and watching your investment plunge.

USING BOT TO TRADE

We are living in the AI era. Why not give our machines some intelligent work to do?

Even while I'd prefer not to deal with a particular kind of cryptocurrency volatility, I still want to profit from it.

The most recent instance is the trading of meme currencies. Considering meme coins are mostly low cap market coins, a buying or selling force will drive up the price, and vice versa, meaning that meme coins have the potential to X100 in a matter of hours.

Bots are a set-and-forget method. You only need to specify the %, amounts, and price you want it to buy at, and it will handle the rest. You may also specify the selling limit, including the percentage, price, and quantity you want it to sell. There is no need for you to be online or active because everything is done automatically.

A bot is best used for:

- incredibly unpredictable zig-zagging assets where you may consistently make money by purchasing local low and selling local high.

- Assets that you'd like to trade but aren't passionate about enough to trade directly, or those you need to establish a basic thesis for in order to gain the conviction required to purchase and hold. (In my instance, strangely, those would be memes of Solana chain)

Without doing much study or research, you just want to play around with the asset. Mainly degen trades.

DO NOT TRADE

Lastly, the best method to handle volatility is to just choose not to trade. This usually occurs for me on purchase and hold only transactions, during periods of extreme volatility (such as the Bitcoin pump or dump), or at the end of a market shift (weekend or month-end). Additionally, I try to stay away from the volatility that comes with recently listed or released tokens. The greatest risk-free method is probably to avoid trading. All you have to do is watch the market or take a break and do something else, like go shopping, watch a movie, or hang out with your family.

CONCLUSION

The method to handle cryptocurrency volatility should ultimately fit your trading style. Looking over my list, you can see that every method I listed above is essentially a way to at least have some control over uncertainty, be ready for any eventuality, seize chances, and take calculated risks all while maintaining a semblance of peace of mind. These techniques have been incredibly helpful to me in overcoming my fear and making a profit over time. Please take note that the majority of my methods have some risk, therefore if you plan to apply any of them, you must properly understand risk management.

Comments