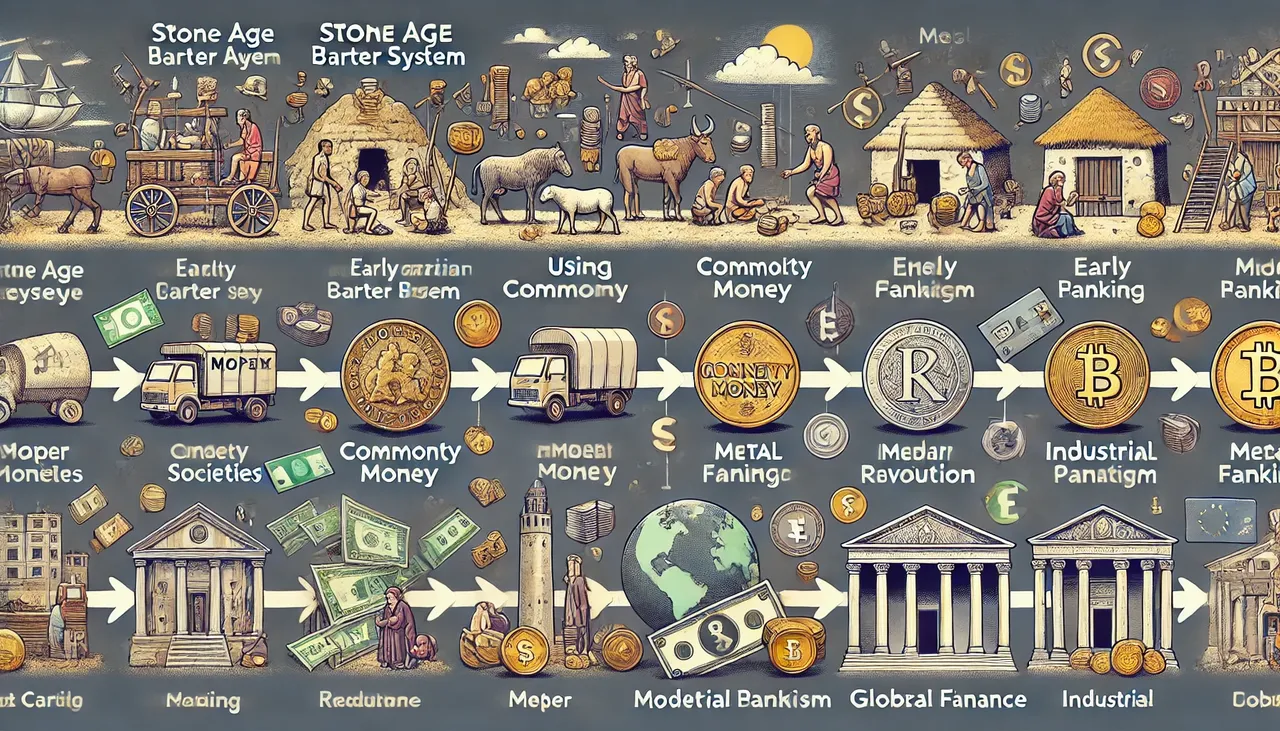

The Evolution of Money and Finance: From Stone Age to Modern Times

1 comment

The Evolution of Money and Finance: From Stone Age to Modern Times

Stone Age (Prehistoric Times)

Barter System 🪨:

- Concept: The earliest form of trade was based on the barter system, where people exchanged goods and services directly.

- Example: A hunter might trade meat with a farmer for vegetables.

- Limitations: The barter system required a double coincidence of wants, meaning both parties needed to have what the other wanted.

Early Agrarian Societies (Around 9000-6000 BCE)

Commodity Money 🐄🌾:

- Concept: As societies became more complex, people started using commodity money, which had intrinsic value.

- Examples: Livestock, grains, and shells were common forms of commodity money.

- Advancements: These items were more universally accepted and made trade easier compared to barter.

Ancient Civilizations (3000 BCE - 500 CE)

Metal Money and Coinage 🪙:

- Concept: The use of metal objects as money began, evolving into the minting of coins.

- Examples: Early coins were made from precious metals like gold, silver, and bronze.

- Significance: Coins had a standardized value and were durable, portable, and divisible, which facilitated trade over longer distances.

- Notable Cultures: Mesopotamia, Ancient Egypt, Greece, and Rome.

Medieval Period (500-1500 CE)

Paper Money and Banking 🏦📜:

- Concept: Paper money and early forms of banking emerged.

- Examples: China was the first to use paper money during the Tang Dynasty, while Europe saw the rise of banking institutions in Italy.

- Developments: Banks began to issue promissory notes, which acted as early forms of paper money and credit.

Renaissance to Early Modern Period (1500-1800 CE)

Development of Modern Banking and Finance 💰:

- Concept: The establishment of more sophisticated financial systems, including banks, stock exchanges, and national currencies.

- Examples: The Medici Bank in Italy, the Bank of England, and the Amsterdam Stock Exchange.

- Innovations: Introduction of central banking, government bonds, and the birth of modern financial markets.

Industrial Revolution (1760-1840 CE)

Industrial Capitalism and Modern Banking 🏭🏦:

- Concept: The rapid expansion of industry led to increased demand for capital, which was met by the growth of modern banks and financial institutions.

- Examples: Expansion of stock exchanges, development of investment banks, and the use of checks.

- Impact: The financial system became more complex, with new instruments like stocks, bonds, and insurance.

20th Century to Present

Digital and Global Finance 💻🌐:

- Concept: The advent of technology revolutionized finance, making it faster, more efficient, and accessible worldwide.

- Examples: Electronic banking, credit cards, online trading platforms, cryptocurrencies, and mobile payment systems.

- Globalization: Financial markets became interconnected globally, allowing for the free flow of capital across borders.

- Current Trends: Cryptocurrencies, blockchain technology, fintech innovations, and the rise of decentralized finance (DeFi).

Key Takeaways

- From Barter to Commodity Money 🪨➡️🐄🌾: Early trade was based on direct exchange, evolving to the use of commodities with intrinsic value.

- Coinage and Standardization 🪙: The introduction of coins standardized money and facilitated broader trade.

- Paper Money and Banking 🏦📜: The emergence of paper money and banking systems allowed for more complex financial transactions and credit.

- Modern Financial Systems 💰: The development of modern banking, stock exchanges, and investment instruments supported industrial and economic growth.

- Digital Revolution 💻🌐: Technology has transformed finance, making it more efficient and global, with new innovations continuing to shape the future of money.

The evolution of money and finance reflects humanity's progress in creating more efficient and sophisticated means of facilitating trade, investment, and economic growth.

Comments