Steemit Crypto Academy | Summary On Homework Task Week3-Season5

4 comments

December 04, 2021 was the deadline for the third week of Season 5 to accept homework, I would like to thank the 54 students who tried and worked this week by submitting their essays to answer the assignment and to get the highest ratings.

This week we introduced the Alligator indicator which is considered more of a metaphor than an indicator, due to its behavior which remains similar to that of an aligator.

It is composed of three lines, superimposed which represent the jaw, teeth and lips of the beast, it was created to help investors identify the presence of a trend as well as its meaning.

The Alligator Indicator can also help traders detect the correction and impulse phases of the stock market.

According to Bill Williams, the market is organized and he thinks that to be successful in trading, a scalper or trader must understand this organization of the market which for him is broken down into several configurations such as rest, acceleration, deceleration, the zone of balance, momentum, and fractal.

Through this oscillator he approaches the relation of rest, from the behavior of the alligator.

Indeed, Bill Williams compares this market structure to the behavior of an Alligator, namely a period where the rest phase follows the hunt for hunting prices, according to him the more the rest phase is important the greater the waking phase. or price variation.

For Bill Williams, the market functions like an alligator that wakes up to hunt and returns to sleep once it has finished feeding.

I hope that all users who have studied this week will benefit from the set of information and analysis provided to use about how much of an asset is usually moving in a given period of time to set profit targets and decide whether or not to try trading.

We always state that the main objective of our Steemit Crypto Academy community is to ensure knowledge and promote opportunities for quality learning that are equitable and inclusive in the cryptocurrency field for all.

Next, I asked the students a few questions to assess how well they understood the topic and to assess the cognitive gains they made from reading the lesson.

The questions to be answered are:

1. Discuss your understanding of the use of the Alligator indicator and show how it is calculated?

2. Show how to add the indicator to the chart, How to configure the Alligator indicator and is it advisable to change its default settings ?. (Screenshot required)

3. How do we interpret this indicator from its 3 phases: the period of rest(or sleep), awakening, and the meal phase?(Screenshot required)

4. Based on the layout of its three moving averages that make up the Alligator indicator, how can one predict whether the trend will be bullish or bearish (Screenshot required)

5. Explain how the Alligator indicator is also used to understand sell / buy signals, by analyzing its different movements.(screenshot required)

6. Do you see the effectiveness of using the Alligator indicator in scalping trading style? Explain this based on a clear example.(Screenshot required)

7. Is it necessary to add another indicator in order for the indicator to work better as a filter and help get rid of unnecessary and false signals? Use a graph to support your answer.

8. List the advantages and disadvantages of the Alligator indicator:

9. Conclusion:

Discuss your understanding of the use of the Alligator indicator and show how it is calculated?

The alligator indicator is a classic moving average based signaling system (moving average signals discussed in detail here) based on the fact that if the short-term moving average intersects the long distance, a reception signal is obtained, while the short-term moving average intersects the long-term moving average. , we will get a sales signal.

There are many trading techniques based on moving average signaling with different long and short moving average parameters, and the advantages and disadvantages of the methods are the same. One of the advantages is that we get an objective buy and sell signal, in the case of trend-moving prices we get very good signals, but we get the signal late, because the moving average follows a trend, so it goes after an established existing trend. Late arrivals can be particularly problematic in situations of high volatility (see below for an example). One of the disadvantages of moving average strategies is that a moving average crossing strategy can cause significant losses in paging because it enters and exits the trader countless times.

The alligator indicator examines the intersection of three moving averages and gives a signal based on this. The three moving averages are as follows.

- The smoothed moving average of period 5, marked 3 days ahead, is marked in green, offset. This is the lips of the alligator.

- The smoothed moving average of period 8 is marked in red, with 5 candles pointing forward. This is the alligator's tooth.

- The smoothed moving average of period 13 is marked in blue, with 8 candles pointing forward, offset. And this is the alligator's jaw.

How do we interpret this indicator from its 3 phases: the period of rest(or sleep), awakening, and the meal phase?(Screenshot required)

Step 1: Crocodile sleeps

The sign of a sleeping crocodile is when the three indicator lines are close to each other. This means low volatility. At the same time, the market did not have the opportunity to trade with the trend. Therefore, investors should avoid trading during these lulls.

Step 2: Crocodile wakes up

Usually, this is when the alligator's lips (green line) meet the teeth (red line) and jaw (blue line). If the lip crosses the other two lines upwards, we have an awakened Growth Crocodile. If the lips cross the other lines in a downward direction, we have a bearish alligator awake.

Step 3: Crocodiles eat

When the trend begins, crocodiles can start eating after waking up. The signal for a hungry alligator is that after completing the Awakening phase, the price reaction pattern will change. Specifically, a bullish candle closes below or above the three indicator lines of the Alligator trend system. This is when we should start our trend trading strategy.

Based on the layout of its three moving averages that make up the Alligator indicator, how can one predict whether the trend will be bullish or bearish (Screenshot required)

Now let's see how it is possible to understand what will be the direction of the trend when the crocodile "wakes up", as well as to understand what will be its strength or intensity. Two situations:

- Blue at the top, red at the center, green at the bottom: downward trend

- Green at the top, red at the center, blue at the bottom: increasing trend

If the lines come too close or overlap, it means that there is a closed situation (sleeping crocodile). In this situation, it is not advisable to place orders because there is a lot of uncertainty and of course there is no trend. In any case, even in this case the crocodile can wake up suddenly and it is therefore necessary to remain vigilant and to always be ready for this event. Hence the choice of the crocodile as a reference figure.

Explain how the Alligator indicator is also used to understand sell / buy signals, by analyzing its different movements.(screenshot required)

By offering you the chart proposed above, we provide you with important information to remember regarding buy and sell signals:

- If the crocodile shows a downtrend (blue top, red center, green bottom) and the price goes below the green line, it is a strong buy signal.

- If the crocodile shows an uptrend (green at the top, red in the middle, blue at the bottom) and the price crosses above the green line, it is a strong sell signal.

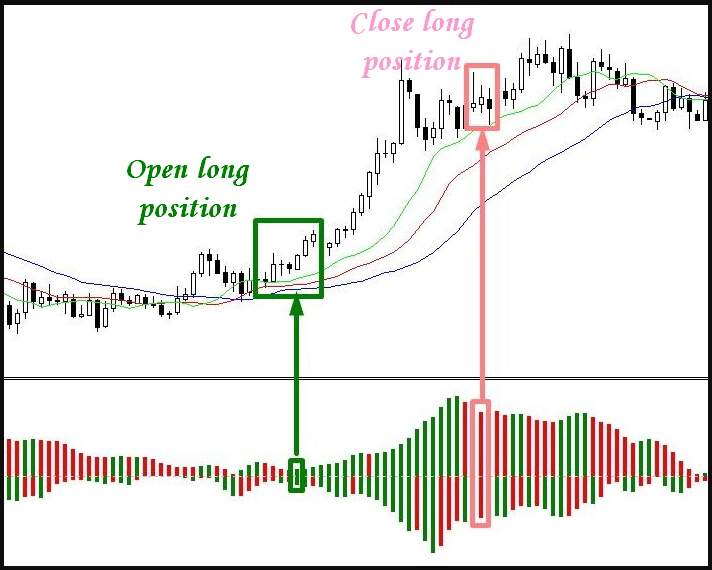

Is it necessary to add another indicator in order for the indicator to work better as a filter and help get rid of unnecessary and false signals? Use a graph to support your answer.

The other way to make this indicator work would be to supplement it with the Gator Oscillator. That is, not only the above must be completed, but there must also be confirmation from the alligator. See the Gator Oscillator

Let's look at an example of a long signal. The rule for entering a long position is that the short term lines (green and red) are above the long term (blue) and in that order. That is to say first green, then red and finally blue. And, in addition, that the Gator oscillator marks the lower and upper bars in green. To close the position, two red bars must appear at the same time.

In the case of a short position, the trading rule is exactly the same. The difference is that the short-term moving averages (green and red) must be below the blue line.

The Alligator indicator has the same advantages and disadvantages as any trend indicator. When the market is trending, the indicator works great, but in parallel markets there are many crosses of false averages. That is to say crossings of averages which do not give rise to a new stock market trend.

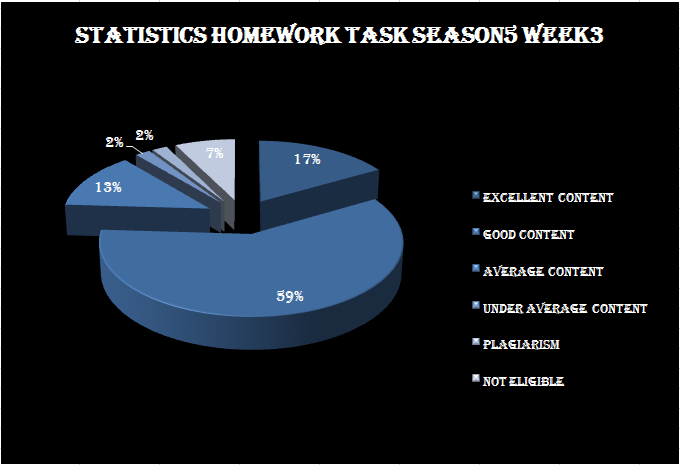

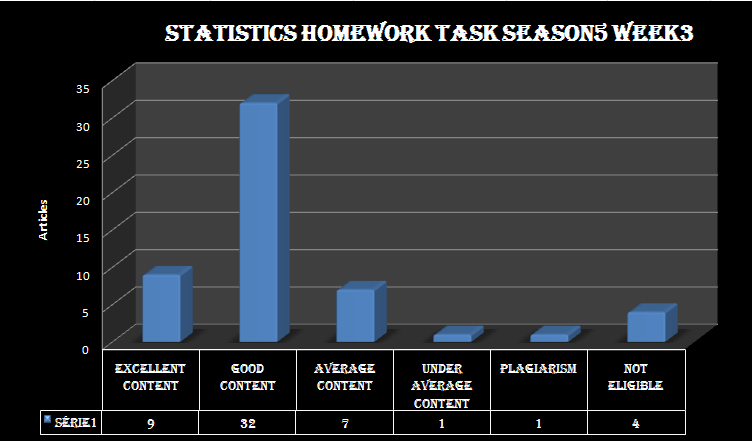

The third week of Season 5, which took place from November 27 to December 04, 2021, saw a spike in entries after changing the terms of this season to urge users to raise their reputation and influence SP in favor of the platform and users alike.

We notice a decrease in the percentage of articles with excellent content, reaching 17% of the total writing, a decrease of 14% compared to the previous week, with a high percentage, as usual, of articles with good content reaching 59%, an increase of 10%, to witness articles with medium content Slightly up 2%, it was rated at 13%.

Thus the percentage of successful homework with a positive overall vote exceeded 89% versus 2% who failed to score above average, and if that is anything to be said, the earnestness with which students get what they are asked and how eager they are to learn and make Do their best to get the highest score and best results.

We also see 2% of plagiarism posts that we are looking to combat and it remains our great hope that students will continue to write articles without these practices which remain the number one and most dangerous enemy towards improving their level and developing their knowledge.

7% were rated out of competition due to non-compliance with the conditions of participation, and it must be remembered that the conditions of participation require a reputation of 65 and 900SP with respect to the expiration time and the fulfillment of conditions for participation in the #club5050 event, so we invite participants to adhere to it. Conditions so that no preparation effort is wasted without getting evaluation and reward.

We would like to first thank all the participants for their challenges and inspiring achievements, and we hope that the spirit of this competition will continue for as long as possible, and we hope that the culture of challenge and facing obstacles will spread in all communities.

We are pleased to announce the names of the three winners of the 3rd week of the 5th season competition :

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

Comments