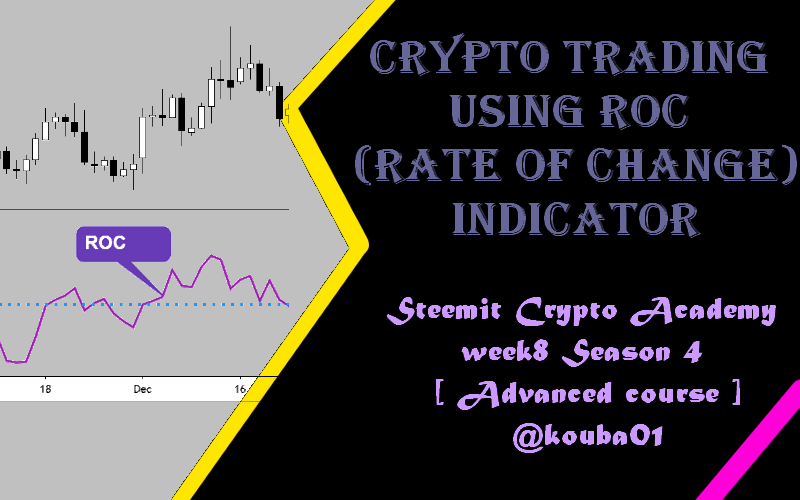

Crypto Academy Season 4 [ Advanced course ] week 8: Crypto Trading With Rate Of Change (ROC) Indicator

9 comments

As you probably already know, the market is often in a "lateral" phase, ie without a defined trend in progress. When one shows up, however, it is in that moment that lovers of technical analysis can make the difference .

We have already seen other indicators of this type, such as the RSI or MACD , which help us determine the strength of a trend and when it is likely to reverse.

As we will see better in this course, however, the ROC has characteristics that make it very different from all other technical analysis oscillators .

As we have mentioned, the ROC indicator is used to better understand the trends . In particular, it can help us when we need to understand if:

- A new trend has just been born or the market is still in a lateral phase;

- The current trend still has strength to continue;

- A reversal is on the way.

These three things are fundamental for any trader, so any indicator useful for the objective should be considered.

This indication is represented as a number : depending on how the price has moved in recent periods, this can be a positive or negative number.

The number, which as we will see better in the next paragraph is a percentage, is also expressed on the graph by a line . This line follows the exact path of the percentages along the candles, creating a path that helps us get different kinds of signals.

Some signs that we can extrapolate from the ROC indicator are:

- Overbought and oversold , that is situations in which the bullish or bearish trends have gone beyond the real market equilibrium;

- Crossover , that is, moments in which we are going through an inversion of the current trend;

- Continuation , which indicate the probable continuation of the current trend.

We will soon see better how to read and interpret these signals. First, however, we must focus on the method of calculating this indicator. Knowing the mathematics behind technical analysis tools is always very useful.

We will never stop repeating this thing: knowing the math behind the indicators is crucial .

Most of the novice traders, pushed by the rush to go to the markets, overlook technical things and focus only on the trading signals of the various indicators.

If you want to build lasting and sustainable trading success with technical analysis, this is absolutely a mistake to avoid . Only by knowing the science of indicators will you be able to fully understand them and combine them into complete trading strategies .

It is worth noting that there are actually very simple calculations behind the ROC. In fact, the price of this indicator is calculated as a simple percentage price change.

ROC = (current price - price of N periods back) / Price of N periods back * 100.

For example, suppose you want to calculate the 12-period ROC of a stock that is now worth $ 1000 and 12 periods ago it was worth $ 967.5.

ROC = (1000 - 967.5) / 967.5 * 100 = 3.359%

As you can see, this indicator in its purest form only tells us the price change .

Buy or sell signals can be taken depending on when the ROC moves above or below the zero line. Of course, using this method requires some experience, as not all crosses with a zero line are the same.

If the Rate of Change turns around its 0 line, this marks a phase of indecision and indicates to us that there is no trend.

The stronger the progression of the indicator, the more powerful the bullish movement.

Conversely, the faster the Rate of Change falls, the stronger the downward movement will be.

A buy signal is given when the Rate of Change crosses straight 0 upwards.

However, for the signal to be confirmed, it is advisable to wait until the price shows signs of slowing down, for example when the indicator turns upward as the price continues its downtrend.

A sell signal is given when the Rate of Change crosses straight 0 downwards.

However, for the signal to be confirmed, it is advisable to wait until the price shows signs of slowing down, for example when the indicator turns downwards as the price continues its uptrend.

You can find an example in the graphic below.

Overbought and oversold signals are more reliable when prices move in a market without a trend or when prices follow identical highs and lows.

In a trending market, it is better to take trend direction signals as they have a higher hit percentage.

For example, if the trend is bullish, it is better to take a long position and when prices fall, this will cause an oversold signal and the market should then move up.

When the ROC indicator exceeds a spread of plus or minus 3 to 4%, a trader may interpret it as an overbought or oversold zone, so taking a position is not recommended.

However, a trader can use this area to sell if one is in an overbought area, similarly when the ROC enters oversold areas a trader may avoid selling because the main part of the downward movement is may have been performed.

A trader may then instead have an interest in buying.

Below is a chart that illustrates the notion of oversold for The ROC Oscillator.

Likewise, the levels depend on the period observed. The larger it is, the greater the variations will be. For example, the ROC will show higher data on a weekly chart than on a daily chart.

In the ROC, the most suitable time intervals to recognize the overbought and oversold phases are the 12 periods for the short term and 25 days for the medium or long term. However, as with other indicators of this type, it is recommended not to immediately open a position on the signal and wait for either the actual trend reversal or a further confirmation of the same by another indicator.

When an instrument is in a bullish or bearish trend, the Rate of Change can be used to indicate that a trend is weakening or reversing by signaling a divergence.

A divergence between the Rate of Change line and the price alerts us to whether the bullish or bearish movement is weakening or reversing.

Bearish divergence materializes when prices hit new highs while the Rate of Change line fails to break past its previous highs, as shown in the chart below.

A bullish divergence materializes when prices hit new lows while the Rate of Change line fails to break past its previous lows.

It is important to note that divergences tell us that the trend is weakening, but they do not necessarily indicate that the trend has changed.

For this, you need to have a confirmation or the signal must come from a chart configuration such as the break of a trend line.

Breakouts usually appear due to strong momentum. But it cannot be taken as a general rule as not all of them are successful, so using the ROC oscillator helps the trader to identify "True" breakouts.

The chart above shows the ROC indicator strategy used as a range breakout confirmation determinant.

Within the price action, a limited consolidation range appeared initially. Note that the upper line indicates the range resistance level, while the lower line shows the range support level. The price attempted to test the resistance line again shortly after rising from the support level, but this time it was breached, and the breakout occurred to the upside.

Throughout the consolidation period, the ROC indicator (shown below) has been plotted just above the zero line. However, on the bullish breakout of the consolidation area, it recorded a reading high below zero.

The ROC certainly does not enjoy the fame of other indicators that have written pages of history, such as the Bollinger Bands . However, it enters our list of favorite indicators by right .

As we have shown through real and randomly selected charts, its signals turn out to be very often correct and offer interesting insights to anyone who wants to study a trend.

As always, remember that no indicator is infallible; combining it with other tools to create a complete strategy must always be our target.

Maybe you will need a little training to understand when the market is overbought and oversold, or to understand which indications on the birth of a trend are more reliable.

1. In your own words, give an explanation of the ROC indicator with an example of how to calculate its value?And comment on the result obtained.

2. Demonstrate how to add the indicator to the chart on a platform other than the tradingview, highlighting how to modify the settings of the period(best setting).(screenshot required)

3. What is the ROC trend confirmation strategy? And what are the signals that detect a trend reversal? (Screenshot required)

4. What is the indicator’s role in determining buy and sell decicions and identifying signals of overbought and oversold؟(screenshot required)

5. How to trade with divergence between the ROC and the price line? Does this trading strategy produce false signals?(screenshot required)

6. How to Identify and Confirm Breakouts using ROC indicator?(screenshot required)

7. Review the chart of any crypto pair and present the various signals giving by ROC trading strategy. (Screenshot required)

8. Conclusion:

Try to read the lesson and the assignments carefully before you start editing.

You must write an essay that contains at least 600 words.

Make sure that you post your homework into the SteemitCryptoAcademy community, and your homework title format like this "[Title]- Crypto Academy /S4W8-Homework Post for kouba01

Please do not add the tag #club5050 if you do not interpolate all the conditions to participate in this initiative.

Use copyright-free images with mention of its source, if possible, produce your own.

Plagiarism is forbidden in Steemit Crypto Academy, and its perpetrators may face serious penalties.

This homework assignment will run until 30th October'2021, Time- 11:59 PM UTC.

Include in your post among the first five hashtags #kouba-s4week8 and #cryptoacademy.

Users who are powering down will not be voted and considered excluded from participation.

Additionally, users with a reputation below 65 and/or haven't at least 600 SP in their wallet won't benefit from voting for their homework.

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

Comments