Debt Ratio's Impact on the Authors' Rewards on Steem- Understanding the Current Situation

114 comments

Introduction

Many Steem users would be concerned about the state of rewards on the Steem blockchain at the moment as SBD reward vanishes, users would be bothered about what's going on and questions like what has happened to my account? and so on, would arise.

You don't have to panic, rather it's a time for you to get closer to the Steem blockchain and understand what is termed the debt ratio, I will take you on a ride about the concept today and I hope you'd have it all clear in the end.

Designed with Adobe Photoshop

Debt Ratio on the Steem blockchain

You are familiar with rewards distribution on the Steem blockchain and various settings you'd like to set your rewards to on an article. For example, 100% Power up means you are receiving your rewards purely in SP, 50%/50% implies your rewards would be in 50% SBD and 50% SP but this is also determined by the debt ratio at any point in time.

Authors are the ones that receive SBD rewards on the Steem and it was specifically created for that, curators take their rewards in SP, likewise, locked STEEM (SP) interest is also in SP. As such, SBD is backed by an equivalent STEEM on the blockchain to reward authors.

That being said, the debt ratio comes in to ensure that the printing rate of SBD is put under control based on the STEEM/SBD ratio (debt ratio) depending on the amount required to back SBD. Let's see how authors receive rewards in line with the debt ratio at any point in time.

- If the debt ratio is less/equals 9%, authors receive rewards in SBD and SP.

- If the debt ratio is between 9% - 10%, authors receive rewards in STEEM, SBD, and SP and the printing of SBD for rewarding authors declines linearly.

- If the debt ratio is greater than 10%, authors receive rewards in STEEM and SP. With no more SBD rewards.

The debt ratio in a bullish market phase is always around 9% or below which means fewer STEEM tokens are required to back SBD, as such author gets their rewards in SBD and SP for 50%/50% reward settings.

In addition, in a bearish market phase, especially an extreme one, the debt ratio tends to exceed 10% which requires more STEEM to back SBD, the printing of SBD declines. The printing rate of SBD starts from 100% and declines linearly with the debt ratio and at a point, it hits 0%, there would be no more printing of SBD as such authors get their rewards in STEEM and SP alone for a 50%/50% settings.

Where are We?- The Debt ratio has exceeded 10%

At the moment of writing this article, the debt ratio has exceeded 10% and there would be no SBD rewards for now. To know the current state of the debt ratio, we would need to know the market capitalization of STEEM and SBD to calculate debt ratio.

- STEEM Market Capitalization = Virtual Supply of STEEM X Current Price.

- SBD Market Capitalization = Total Supply of SBD X Current Price.

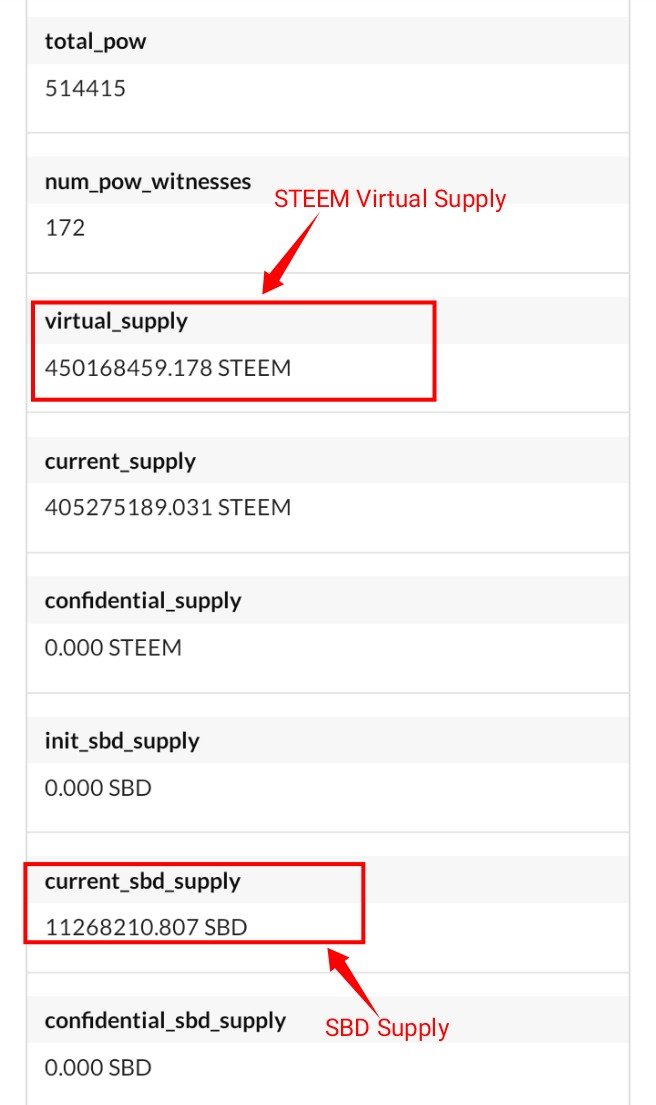

Let's explore a tool to get the supply of the assets in question here and calculate the market capitalization. I will be using https://steemdb.io/.

https://steemdb.io/

From the information above, we can easily calculate the market capitalization and the debt ratio. Now we have;

- STEEM Market Capitalization = 450168459.178 X $0.2283 (Market Price) = $102,773,459.2303374.

- SBD Market Capitalization = 11268210.807 X $1 (Assuming the $1 peg) = $11268210.807

Now the debt ratio would be calculated using SBD Market Capitalization value/STEEM Market Capitalization value. As such;

- 11,268,210.807/102,772,459.2303374 = ~ 0.1096 (10.96%). Now, the debt ratio is well above 10% which indicates there is no printing of SBD for now on the blockchain.

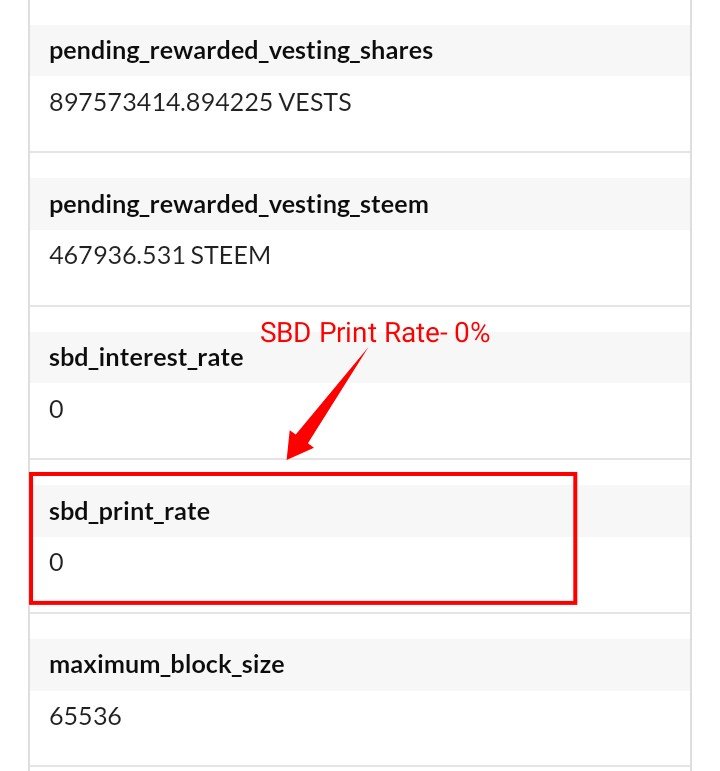

https://steemdb.io/

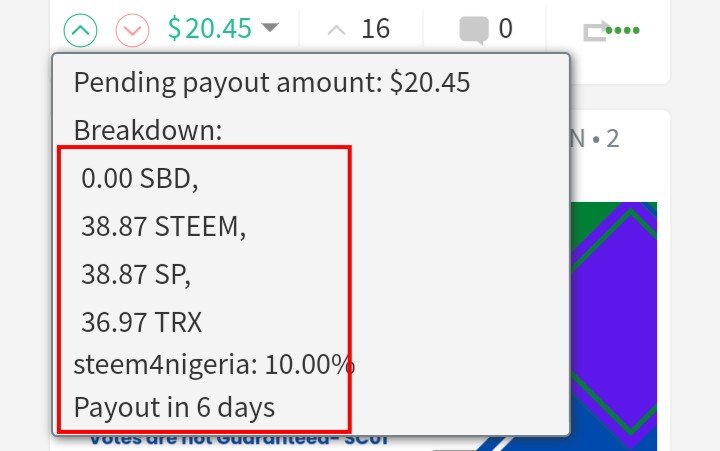

The debt ratio is now at 10.96% which implies that the printing rate of SBD would be 0% and it's evident from the tool above. As such, the authors' 50%/50% reward settings now would be received in STEEM and SP and you can see that on one my articles pending payout below.

Image Source

The authors' rewards can only come back to SBD and SP for 50%/50% settings when the debt ratio drops to 9 and below, and it increases linearly as the debt ratio is reducing, which means at 9% - 10% that is > 9% to 10%, the percentage of SBD received would be fewer while the remaining is paid in STEEM, until it hits 9 below when SBD printing rate would return to 100%. The bullish market of STEEM would be the way to achieve such a lower debt ratio again.

Conclusion

In conclusion, we have been able to address the current state of author rewards as attributed to the debt ratio and I hope you now understand the debt ratio and its effects on the rewards. There is nothing wrong with your Steem account, it's how the Steem blockchain works and we have just witnessed a season like that again due to the extreme downtrend that occurred in the crypto ecosystem a few days ago. Thanks for reading today and #Steem-on.

Written by;

@fredquantum

Comments