Mastering Steem Market Volatility Using Bollinger Bands

1 comment

Greetings Steemit friends

Explain the Components of Bollinger Bands

Bollinger Bands is not different from most of the popular tools used for technical analysis. It is used by traders to analyze the volatility of the market movement and to pick trading opportunities. When you apply you find three lines and each of these lines passes different messages because of their positions. Bollinger Bands consists of three components when applied to a market situation.

- Simple Moving Averages (SMA)

SMA is the component at the center (line in the middle) which represents the average price of the asset during a given period. The SMA is usually over 20 days. It helps traders predict possible trading directions in the market. The SMA will cut the candle sticks when the market trend is changing, either bullish or bearish movement. The moment the SMA cuts above the candles, the trader can predict a bearish trend in the market. In the case where the SMA cut below the candles, the trader can predict a bullish trend in the market.

- Upper Band

The upper band is the component above, the line running above the candle sticks. It is obtained by adding two numbers to the SMA (standard deviation). The line tells traders when the market price is at the point to sell and take profit. When the line touches the candlestick, the market is in a bullish stage, and the moment it moves away. It tells the trader to make a possible decision to sell. The Upper Band helps to indicate Overbought in the market and tells when the threshold of a high price has been reached.

- Lower Band

The lower band is the component above, the line running above the candle sticks. It is obtained by subtracting two numbers from the SMA (standard deviation). The line tells traders when the market price is at the point to buy. When the line touches the candlestick, the market is in a bearish stage and the moment it moves away. It tells the trade to make a possible decision to buy in. The Lower Band helps to indicate oversold in the market and tells when the threshold of a low price has been reached.

Understanding market volatility: The distance between the candlesticks and the upper and lower bands gives possible reliable information about the volatility of the market. The moment a trader sees a wider band created, that is a high possibility of volatility in the market and a time to show some level of consolidation.

Understanding making trading decisions: Making trading decisions is solely the trader. But then again, from the three components, a trader can predict possible and comfortable buying and selling points in the market. The movement the SMA is cutting below the candle sticks, the upper bands start touching the candle sticks, and the lower band moves away from the candle sticks. The trader can make it possible to buy points to get into the market.

Analyzing Market Conditions with Bollinger Bands

Using the technical analysis of Bollinger Bands, we can easily point out some situations where the market was overbought, oversold, and neutral states. I have placed a green square at the point where we have the upper band keep touching the price candlesticks indicating an overbought for STEEM. So at this point, if the situation continues for a while, that is a possible suggestion to sell as the market may enter a reverse position.

I have placed a red square at the point where we have the lower band keep touching the price candlesticks indicating an oversold for STEEM. So at this point, if the situation continues for a while, that is a possible suggestion to buy as the market may enter a reverse position.

A neutral state is a situation where the price sticks stay in between the upper and lower band without any significant touch. During this period, it is extremely difficult to make buy and sell decisions and it will be better to wait. At some point, they will be a breakout, and possibly the best to make any decision.

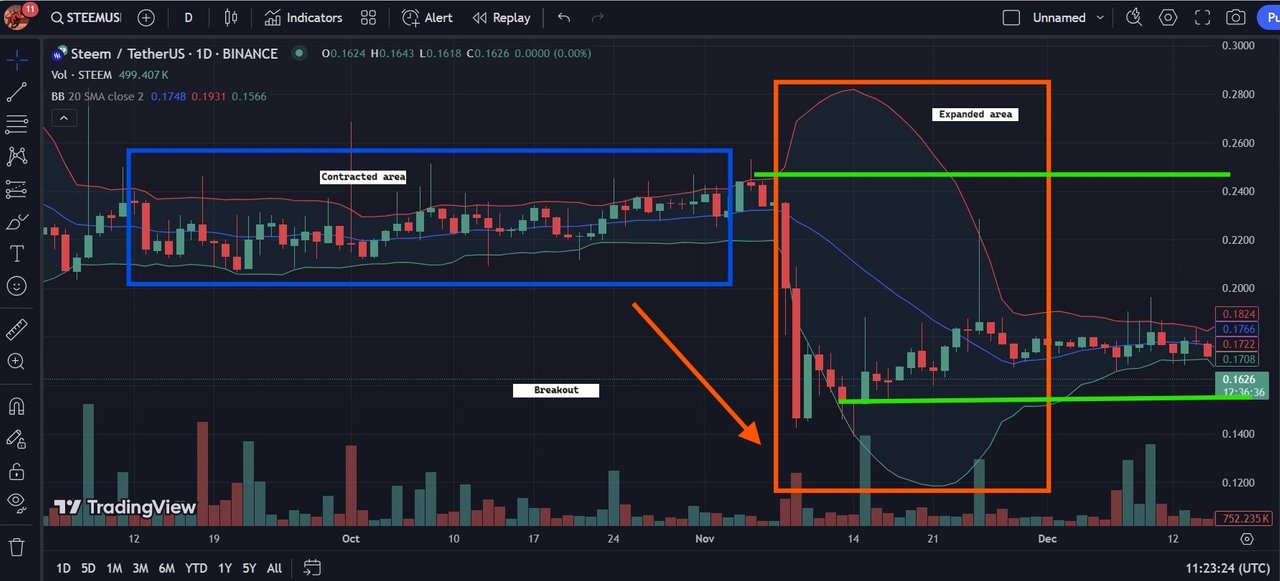

Identifying Volatility Patterns with Bollinger Bands

Bollinger Bands helps to identify the volatility of a market situation and predict reverse or correction points in the market. Using the expanded and contracted points in the market, we can be able to point-pick potential breakouts or reversals in the market.

Band expansion is when the upper and lower bands move away from the candlestick. The bigger the distance, the higher the volatility in the market, and vice versa when the distance is reduced. The point where we have the distances decrease is called contraction and indicates low volatility in the market.

In the chart below, I will highlight the contracted area and expanded area in the market.

In your area in the blue, the market was in some of a neutral state and the distance between the price sticks and bands was small indicating a contracted period in the market. At this point, a trader should wait for a breakout. This will eventually create an expanded period as the band will move away from the price sticks. On the chart, you can see that the upper band moves away from the candlestick creating a large distance. At this point, we can see a clear breakout point in the market and a potential sell point for traders. Here we can see an increase in volatility in the market and a clear downward trend.

Making use of the Bollinger band, a trader can easily figure out potential breakout points by following the movements of the bands.

Developing a Trading Strategy with Bollinger Bands

Making use of Bollinger bands to create a possible trading strategy, pointing out the entry and exit points. As I mentioned above, Bollinger bands are usually set at 20 days SMA. As for the timeframe, it depends on the trader. For better and more significant signals, make use of a 4-hour or daily chart. I'm making use of the daily chart for this course.

Entry Point

As you see on the chart, the moment the price candlestick touches the lower band. That indicates a potential reversal, and time to predict a bullish trend in the market. Here the trader can clearly see a buying signal to jump into the market.

Next in mind, is the selling signal in the head of the trader. As soon as the price candlestick touches the upper band. This indicates a reversal and a possible bearish trend in the market. Here the trader can clearly see a selling signal in the market.

Exit Point

This is the point where the trader is looking at taking profit or stopping loss from the current situation in the market. From the chart, I make use of the SMA. I feel comfortable placing the take-profit point at the point where the SMA cuts the candlestick and moves above. Next, I placed the take loss at the point where the SMA cut the candlestick and moved below.

Predicting Price Movements with Bollinger Bands

From my understanding so far of Bollinger Bands, we can suggest the possible direction of the current market situation for STEEM. The current market price is at 0.1608 USD

I will pay attention to the upper, and lower bands and the SMA. The upper will help to see the currently Overbought situation of the Steem asset, and the lower band if the asset is Oversold. The distance between the price candlestick will tell us about the volatility situation in the market. The upper is far away from the price, while the lower band is moving close to the price candlestick. I have given a lot of explanations above emphasizing when the price candlestick touches either the upper or lower bands and when the SMA cuts through.

In my opinion, the current situation of the STEEM market tells me we are in a bearish situation and will continue for a while. As you can see, the market is currently facing an oversold, and pushing the upper bands from the current market price candlestick. The SMA is above the price candlestick telling that the market is currently bearish and could see a potential bullish trend. The distance of the lower band is not too significant, meaning the market can go in either direction. If the upper band was close, I would be thinking of a possible bullish trend. That is not the current situation with the steem market.

As mentioned, in my opinion, the current steem market is in a bearish trend and will stay that way for a couple of days. But then again, it will be preferable to do your analyses and take my opinion with a pinch of salt.

Cheers

Thanks for dropping by

@fombae

Comments