SLC | S21W2 | Costs For Entrepreneurs; Cost Elements

1 comment

|

|---|

Hello friends, I would love to welcome you all to my article in the great SLC S20/W2 I would be actively taking part in the program immediately.

I would be sharing the relationship between coast and financial accounting.

Expense Visibility: Financial accounting comes with lots of cost which could be identified as expenses when generating revenue for a big firm. The cost would be known as expense during this period as it is the main reason why the firm would need an accurate financial record to track the expenses and also profits too.

Financial Disbursement Trademark: The cost is crucial in asserting the amount of financial power the firm has which is vital in disbursement of finances to different departments. Financial accounting uses the track record of cost in the accurate allocation of finances to various branches. The net profit is gotten and difference in expenses and cost could be easily achieved. This is a great financial trademark.

The financial accounting is more concerned with tracking the finances of a firm, to ascertain the profitability margin through the track records, while the cost of accounting is concerned with fishing out the cost of things which would be documented to ascertain whether there is profits gotten overtime.

The financial accounting prepares relevant financial statement for investors who could love to participate in business to have an overview, knowing what they stand to gain the financial success of the brand and other enticing offers they stand to gain. The cost accounting is basically for the use of the firms spotting it's profit and loss, knowing cost increase in some basic raw materials and knowing how to adjust to remain relevant in the business while being profitable.

sourcerelationship between cost & financial accounting sourcerelationship between cost & financial accounting |

|---|

I would be explaining the variable cost and fixed cost in the best possible way to achieve the goal required.

Fixed Cost: This is the total cost of a business which is not subject to change or rise or fall in the economic conditions. The fixed cost is basically stagnant, not changing. The fixed cost is not affected by inflation or other economic set back in the economy.

scenario;

The salary scale of workers in a big company is about #40,000 monthly. The economy gets bad and inflation hits the economy, yet it still gets paid no matter the odds. This a typical example of fixed cost. Electricity bill allocated to the company is about #4,000 monthly. Therefore if the company has backlogs and are less financial equity. The electricity bill must be paid at a fixed price either annually or monthly respectively.

Variable Cost: Variable costs are costs that increase by a percentage amount per unit of product. The variable cost is a function of increase in production. In other words variable cost is directly proportional to the concurrent increase in production costs.

- scenario;

The cost of paying workers hourly at a construction site is #500 per day, that means at the end of 30 days it would cost about #15,000

Cost of importation of phone accessories increase for #100 to #200 for each of about 50 accessories. The new cost incured increased from #5000 as bulk price to #10000 due to increase in importation tariff.

sourcedifferences in financial cost is crucial sourcedifferences in financial cost is crucial |

|---|

Talking about a burger store and production of the snacks. I would be sharing my thoughts in producing and selling the snacks.

Direct Cost: There are cost portioned to the production of the burger snack which could easily be highlighted.

Raw materials; it involves cost of buying the flour, sugar, butter, oil, topping and other raw materials needed in the production process.

Work force; it involves cost of paying workers, salary scale, wages and other cost incured for settling service providers including the chef and others who makes the day to day running of the brand a success.

Indirect Cost: These are cost incured to the company not as cost of production of a unit, but rather cost incured as a function of the overall production of burger.

- Utility Bill: This involves cost of electricity in running the bakery, cost of diesel for the big machines, cost of repairs and importation of special machines, water bill, just to mention a few. Facilities cost is also important room the cost of all these is incorporated in the utility bill.

|

|---|

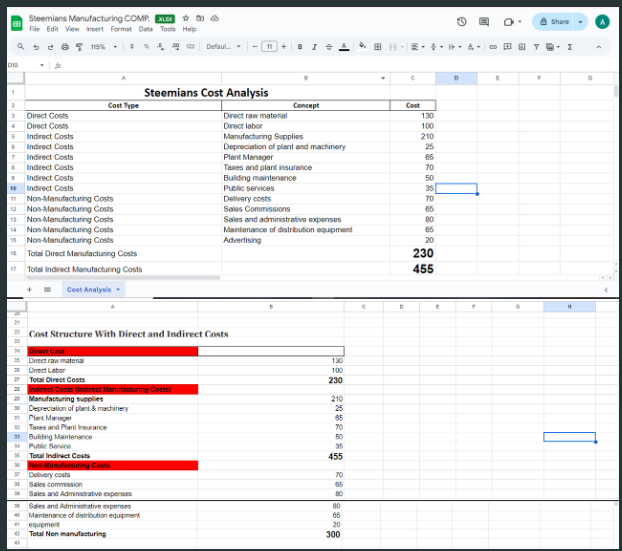

From the above total manufacturing cost is about 230 Total Indirect Manufacturing cost is about 455 Total Non Manufacturing Cost is about 300

This aids the management in tracking the expense and for in the production and overall running of the business.

Cc;

@jolvijn

Comments