How would the economy be affected if Big Pharma lowered medication prices?

0 comments

People would have far less medical debt and be far less likely to go bankrupt from said debt, which is the current leading cause of personal bankruptcy in the U.S. The greatest relief would probably be felt by diabetic patients who have the second most common chronic disease in the U.S. behind obesity afflicting 1 in 8 Americans with almost a third of Americans having blood glucose levels considered in the per-diabetic range. As I mentioned in Geonomics vs. Socialism, the CDC estimates that 90% of healthcare spending, or about $4 trillion, is spent treating people with chronic diseases and mental disorders. By some estimates 48% of the congressional budget is either directly or indirectly spent on healthcare. Lower drug prices would not only cut into Big Pharma profits, it would also make the U.S. appear poorer (on paper) by cutting into the healthcare spending portion of our GDP. Of course, Big Pharma would never voluntarily give up their precious IP and lower prices. In theory capitalists love competition because it raises quality and lowers prices; in practice, capitalists hate competition because it cuts into their profits which they have a fiduciary duty to maximize. Pharma capitalists are no different in their efforts to Stave off generic competition. Just three conglomerates (Sanofi, Eli Lilly and Novo Nordisk) control 90% of the global insulin market and they don’t maintain their hegemony through “free market” competition. As I mentioned in Patents and Evergreening Sanofi maintained their monopoly over Lantus, even though their primary patent for it expired in 2015, by filing several secondary patent applications through a process colloquially known as evergreening. They also hiked the price of Lantus 18% annually for the last few years of the primary patent, likely as a contingency plan for having their secondary patent applications rejected. The USPTO recently rejected a challenge by generic drugmaker Mylan Pharmaceuticals to two patents for Wegovy and Ozempic maintaining Novo Nordisk’s monopoly over semaglutide. Novo Nordisk has sued several other generic drugmakers who want to produce semaglutide to preserve their monopoly and thus the ability to charge exorbitant prices for it.

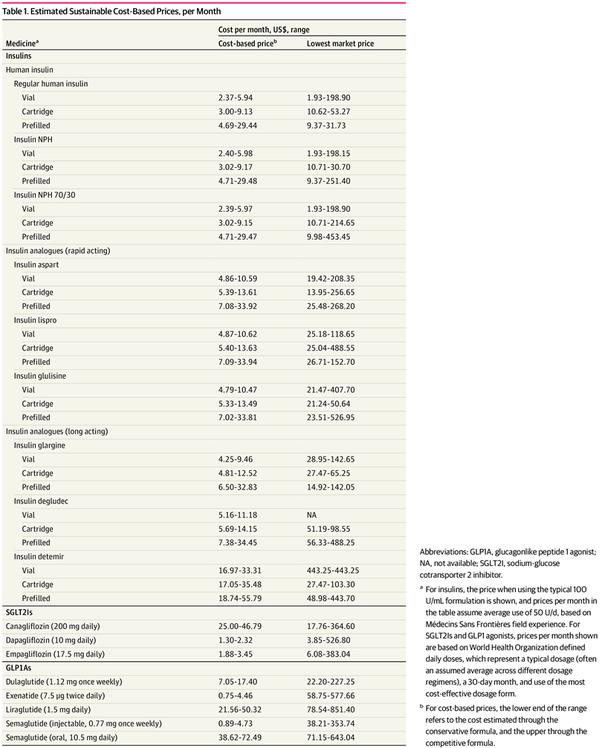

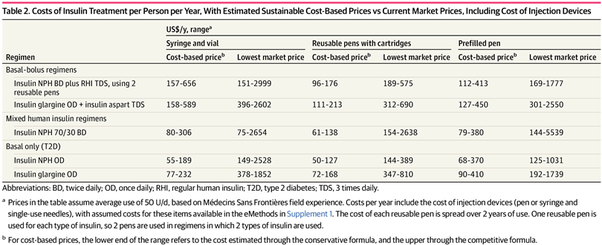

A sustainable cost of manufacturing evaluation published in the Journal of the American Medical Association found that a sustainable cost based price for GLP-1 agonists such as semaglutide could be as low as 89 cents to $4.73 per month in injectable form (e.g. Wegovy and Ozempic) and $38.62 to $72.49 per month in oral form (e.g. Rybelsu), while a cost based price for NPH Insulin would be between $61 to $111 per person annually which is still much lower than the Medicare cap price of $35 per month per person or $420 annually. As the authors point out Doctors Without Borders procures regular human insulin for $2.48 per cartridge, $2.00 per vial, and $3.70 per prefilled pen which are within the range of estimated cost based prices and 61-98% lower than the lowest market price for cartridges and 52 to 96% lower than the lowest market price for pens.

The study concludes that ‘nearly all insulins, SGLT-2 inhibitors, and GLP-1 agonists, in nearly all countries surveyed, prices could be reduced substantially if robust generic/biosimilar manufacture was enabled.’ Although 40 companies sell insulin products globally, all but 10 are under licensing or supply agreements with Sanofi, Eli Lilly or Novo Nordisk. The authors point to the same culprit I pointed out last year: evergreening. Even though this medicine is over a century old it is still concealed under several patent paywalls.

While most patents covering insulin compounds have expired, secondary patents (ie, patents that cover modifications including formulation, derivates, or method of use) play a role in delaying access to insulin biosimilar products. For example, in the US, plans for launch of one biosimilar insulin glargine product, which had already been approved by the FDA, were aborted following a patent infringement suit. More than 70 secondary patents have been filed on insulin glargine in the US In addition, many insulin injection devices are still covered by patents.

The patent infringement suit mentioned here is the same one I mentioned in the beginning for Lantus which Sanofi has successfully extended through 74 secondary patent applications despite getting approval for it nearly a quarter century ago. While a solution as radical as abolishing IP altogether is as politically infeasible as a land value capture there are more moderate solutions in a prior answer such as abolishing evergreening (secondary patent applications) or using compulsory licenses to allow essential medicines like the various aforementioned blood glucose regulating treatments to be sold at reasonable prices.

Comments