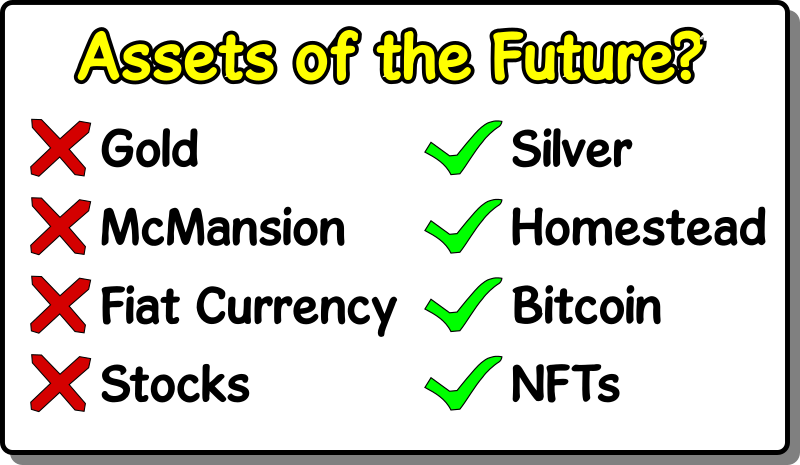

Let Go Of Old Assets Before They Drag You Down, Watch For New Paradigm Assets To Make Life Better

1 comment

Over the next year, every one of these old assets will show how worthless it is, and the new assets will have taken off to huge levels. (except maybe gold)

Before the end of next year, i believe we will see stock market crashes. And we will see stock market shenanigans and fraud. Once the fraud is widely known, tokenizing of the stocks (NFTs) will be the obvious solution.

The housing market is already seeing huge price cuts. And it will be the McMansions that take the biggest cuts. While this is happening, more people will be looking to get out of cities and into a homestead will be increasing.

And, of course, the dollar is inflating into nothingness, while bitcoin keeps going up in value. And by this Christmas will be over $100,000. And next year, even higher.

We are at the point where innovation is going to be mainstream. The old ways are going to die. New solutions are going to become the norm. Bitcoin changing money is just one step. More are coming, so do not hold onto the past junk.

Gold vs Silver

This is a hard one to see, because it really isn't in the charts. It is about new technologies that will be based around silver.

Silver becomes so important that many nations classify it as a strategic metal. Mining it and shipping it overseas will be prohibited without govern-cement authorization. Silver will become extremely valuable. Like, 20x to start.

Gold, on the other hand is mostly useless except that it is shiny and doesn't corrode. (making it good for jewellery and electrical contact coating)

Further, gold isn't that rare. There is so much of it in Rotschild vaults that they could set the price by selling it (not to banks) into the market for $20 an ounce. And supply jewellers for a 100 years.

In the further future, all the gold bugs will have died off, or come to the realization that digital scarcity is real, and gold scarcity isn't. So, the hoarding of gold is pretty much worthless. And further, we get vibrational mining. Meaning you take your boom box out to the desert, and let the gold pour out of the stones until you have enough for what you want to do.

And for all the sceptics, the gold silver ratio is over 80 still. When it is mined out of that ground at 8 to 1… ish. And then silver is used, and gold is hoarded. So, this ratio should be the other way around. And, in my opinion will be.

McMansion vs Homestead

Suburban real estate is going to become worthless. Especially in coastal blue cities.

These cities are becoming cesspits. Crime is rampant. Jobs are drying up. Restaurants are closing or hiking their prices. Basically, there are becoming fewer and fewer reasons to stay in these cities.

Along with this, housing prices are the highest they have ever been, and mortgage applications are really, really low. Trump may get the Fed to lower interest rates, and encourage banks to loan to sub-prime borrowers, but this only makes the coming crash more inevitable and worse. Just like they did, just before the 2008 crash.

Mansions won't even see a bump in their prices, but McMansions will see the biggest crash. These are owned by either, people who are waaayy over-leveraged, and any downturn in the economy will put them into foreclosure, or top paid professionals who will easily move to a better city to avoid the drugs and the crime.

While this is happening, more and more people are getting the bright idea to move out to the country and grow their own food. The country is where to go to grow, food, families and children. Just like homeschooling is becoming a bigger and bigger thing. The homesteading movement is growing.

Stocks vs NFTs

No, i am not talking about Apes or Cyber punk, i am talking about Non-fungible Tokens, or the tokenization of stocks. (and the tokenization of many other assets)

The stock market is corrupt. Seriously corrupt. A lawsuit happened where a company was bought up, and the buying company gave less per share than what they were worth. The judge agreed. The problem was that there were more people suing for their loss on the stocks, then there were stocks outstanding. And this is not the only such happening.

So, it is just a matter of time before the people realize that there are shenanigans going on. And they will demand that it be fixed. Fortunately, Reggie Middleton has already worked out much of the infrastructure for tokenizing stocks. And govern-cement will come to Reggie to get the stock markets fixed quickly, because… well, people think the DOW is the economy.

The problem we all see with this, is that once we tokenize the stocks, what do we need a stock market for?

Look out for falling stock markets.

Fiat Currency vs Bitcoin

The blockchain is soooo much better, cheaper, safer, faster… then SWIFT.

The banks know this. And it is only a matter of time before the banks are using Ripple to do inter-bank transactions.

Similarly, bitcoin is so much better than all those ATMs we have to do transactions with banks. Bitcoin uses less electricity too.

It is only a matter of time before bitcoin wins. Even against CBDCs, bitcoin will win.

Fiat currency is in the process of killing itself. All over the world, fiat is in a race to the bottom.

Bitcoin, this bull market, will get to stupid high numbers. No one is expecting the "rush to own" that is coming. Michael Saylor and Max Keiser will be shocked! Shocked i tell you, with the prices that bitcoin achieves.

Just because it has been "money for thousands of years" (not true) does not mean it will be money in the future.

Just because we have bought and sold real estate all our lives, and think this is the way of things, does not mean they will be that way in the future.

This will be a recurring theme over the next decade. The old assets become junk, and the new assets are somethings the elite can't even conceive of.

So, bet on the new, if it looks like something that will actually solve problems. And let go of the old. It is turning to dust. But, before then, it can drag you to the bottom of the ocean as these financial storms circle the earth.

Comments