Bitcoin Breaks Record for ETFs, Open Interest, and Price

1 comment

Bitcoin Hits All-Time High: $1.36 Billion in Spot ETF Inflows Following US Election

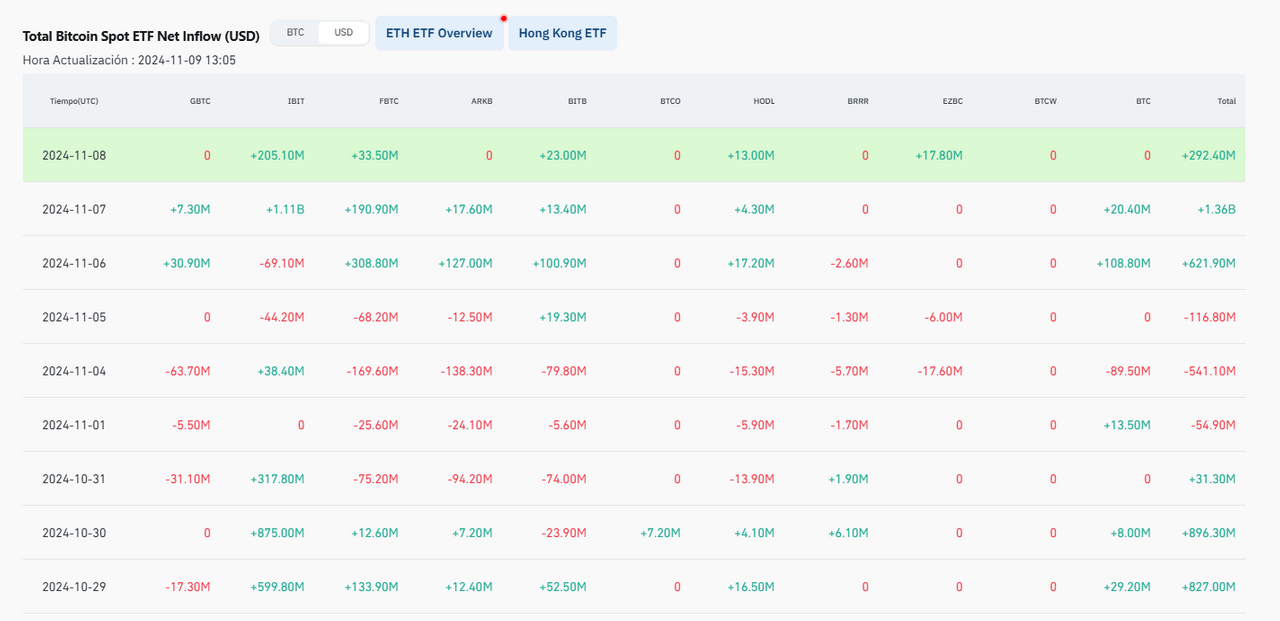

On Thursday, Bitcoin (BTC) recorded a new record for net capital inflows into spot ETFs, with an impressive $1.36 billion inflow. This milestone, the highest in a single day in the ETF market, occurred against a backdrop of political and economic changes in the United States, marking a defining moment for cryptocurrency investors.

Bitcoin hits new all-time high for ETF inflows following Donald Trump's election victory / Coinglass

A Decisive Boost for Bitcoin

The remarkable and record-breaking capital inflow into Bitcoin ETFs is mainly due to IBIT, the BlackRock ETF, which led the flow with $1.11 billion. In total, net flow into Bitcoin ETFs closed this week with three consecutive days of inflows, totaling $292.40 million, and $621.90 million on the previous day.

Since late September, capital flows into bitcoin ETFs have been growing, driven by the start of a cycle of interest rate cuts by the US Federal Reserve. This cut weakens the dollar, strengthening assets such as bitcoin. Trump's recent election victory served as a catalyst, leading the cryptocurrency to surpass recently established all-time highs. The accumulated capital in bitcoin ETFs amounted to $33.23 trillion.

A booming market

Despite the growth in ETFs, trading volume on the bitcoin spot market remains relatively low. In the past 30 days there was a positive net flow of more than $900 million, according to Coinglass data. However, the price increase comes from derivatives: open interest in options records 66.19% of buy transactions versus 33.81% of sell transactions, indicating that traders are betting on an increase in the value of bitcoin.

Open interest hit an all-time high on Thursday, rising to $46.74 billion, while total volume in the options market also set a high of $32.57 billion.

Resistance Breakout

Bitcoin managed to break through a resistance zone located at $72,000, moving 8.94% higher amid election uncertainty. This rise has continued for three consecutive days, consolidating above this barrier. Currently, the cryptocurrency is above crucial moving averages (ema25, ema50, ema100 and ema200), pointing to a clear bullish trend in its price.

With renewed momentum and positive market dynamics, the future of bitcoin looks promising. Growing interest and activity in the derivatives segment could bring about a substantial change in investors' perception regarding cryptocurrencies. Analysts continue to watch how fluctuations affect the capitalization and use of digital assets in an increasingly adverse financial environment.

Disclaimer: This article is for informational purposes only and does not constitute professional investment or trading advice.

Comments