Steemit Crypto Academy Contest / SLC S22W1 : Mastering Trading Psychology: Emotional Discipline in Cryptocurrency Markets

3 comments

Hello everyone! I hope you are all doing well and enjoying life with the blessings of Allah Almighty. I am happy to take part in the exciting challenge hosted by SteemitCryptoAcademy community . So, without any further delay, let's dive right in! Shall we ? ........, Okay , Okay😊! .

Question 1: Identifying Emotional Triggers in Trading |

|---|

Fear is, by far, one of the greatest psychological trading culprits. It creeps in whenever markets start to dip. All those decisions you ever made come into question in an instant. You'll spend countless minutes staring at a screen asking yourself, "Do I sell now before my portfolio turns to dust?" This fear clouds judgments and frequently results in sellings when things are even worst.

Greed is the sneaky cousin of fear. When prices get too high, greed starts whispering, "Hold a little longer, you can make more!" But the market doesn't care about your new car dreams. Before you know it, prices plummet, and greed leaves you holding losses instead of profits.

Overconfidence? That's a slippery slope. After a few winning trades, traders often feel invincible, thinking they've unlocked the secret of the markets. Spoiler alert: they haven't. The market humbles everyone eventually, often with a loud crash.

Impatience is another silent killer of the trader. Some individuals jump into trades without proper analysis, thinking "I can't miss this opportunity!" Spoiler: not every opportunity is golden, and impatience often leads to regretful decisions.

Revenge trading is the emotional equivalent of yelling at your laptop after a bad trade. It's driven by frustration and the urge to "win back" losses, but often results in even bigger losses.

FOMO (Fear of Missing Out) is the trader's worst enemy. Witnessing others making profit on a coin you do not have is a painful thing to go through, but actually getting into it late is even worse. FOMOs rarely profit.

Lastly, doubt is the constant companion of every trader. Even when you’ve done your research, the little voice in your head says, “What if I’m wrong?” Overthinking every move can paralyze decision-making and turn trading into a nightmare.

Fear During a Market Crash

Imagine Bitcoin is crashing, and your portfolio is down 30%. Fear kicks in, and you start thinking, “If I don’t sell now, I’ll lose everything!” Panicked, you sell at the bottom, only to watch the market recover the next day.Greed in a Bull Run

During a bull run, a trader sees a coin surge 200%. Greed whispers, “What if it goes up another 200%?” Instead of securing profits, they hold on, only to see the market reverse sharply.Overconfidence After Winning Trades

After a few successful trades, a trader believes they’re a market genius. Without proper research, they pour money into a random altcoin, confident it will double in value. Instead, it tanks 50%, reminding them that luck isn’t a strategy.Impatience in Sideways Markets

In a slow-moving market, a trader grows restless. “Nothing’s happening—I need action!” They jump into a high-risk trade for the thrill, only to face an immediate loss when the market moves against them.Revenge Trading After a Loss

A trader loses $1,000 in a bad trade. Frustrated, they double their position in a similar trade, determined to recover the loss. Instead of bouncing back, they lose another $2,000.FOMO in Parabolic Moves

When a coin suddenly skyrockets, social media is buzzing with posts about massive gains. Feeling left out, a trader buys at the peak. Hours later, the coin crashes, and they’re left holding an overvalued asset.Doubt in Winning Trades

Even when a trade is performing well, doubt creeps in. “What if this profit disappears?” Acting on doubt, they close the trade too early, leaving significant gains on the table as the market continues upward.

Question 2: Overcoming Psychological Barriers |

|---|

Trading is not about charts and numbers; it's about managing your mind. Emotions like FOMO, overconfidence, and loss aversion can lead to impulsive decisions that ruin your profits. The key to success in the markets is developing mental discipline and learning to control these psychological triggers.

By using simple techniques like creating a solid trading plan, setting stop-loss orders, and journaling your trades, you can conquer these emotional barriers.

Let's explore practical strategies for staying calm, focused, and making more rational decisions when trading.

Create a Trading Plan

To beat FOMO, the first step is to stick to a well-thought-out trading plan. Write down your goals, entry, and exit points. When emotions try to take over, just remind yourself, “I’ve got a plan for this!” A solid plan gives you confidence to not chase every coin just because your friends on Twitter are posting charts.Set Realistic Expectations

If you're struggling with loss aversion, it’s crucial to accept that losses are part of trading. Acknowledge it before you even start, and set a limit on how much you’re willing to lose. When the market moves against you, don’t panic—remind yourself, “Losses are just stepping stones to better trades.”Embrace Small Wins

Overconfidence often comes after a few successful trades, making you feel invincible. To avoid this, celebrate small wins and keep a humble mindset. Instead of thinking, “I’m a genius,” remind yourself, “I got lucky this time, let’s keep it going slowly.” Stay grounded, or the market will quickly knock you back down to earth.Use Stop-Loss Orders

A simple way to manage fear and impulsive reactions is by using stop-loss orders. These automatic sell orders protect your investments if the market takes a nosedive. Knowing your losses are limited helps keep emotions in check. It’s like having a safety net while walking on a tightrope.Avoid Revenge Trading

After a loss, it’s tempting to dive straight back into the market for “revenge trading.” Instead, take a break. Go for a walk, have a coffee, or do anything that clears your mind. Don’t let frustration drive your decisions. Remember, the market’s not personal—it’s just doing its thing.Journal Your Trades

To avoid doubt and improve discipline, journaling your trades can be a game-changer. Write down why you entered a trade, how you felt, and what you learned. This helps you spot emotional patterns and become more self-aware. You’ll look back and say, “Wow, I was really overthinking that one!”

A Good Trading Strategy Is the Key to Success

When it comes to trading Steem/USDT, having a solid plan is crucial. Without one, you're just gambling. My thoughts? A clear strategy is the difference between confidence and chaos in trading. So, let’s break it down—what would my strategy look like, and how would I keep calm during the madness?

I pay attention to the Volume Profile Indicator at all times when using TradingView. To my mind, it is X-ray vision for the market. It shows me where the big players are active and where there is strong support and resistance levels.

TradingView TradingView |

|---|

Looking at this chart, I clearly see a support zone between $0.19 and $0.20. It's important because historically, it has been where the price held up. My thinking here is pretty simple: it's like a trampoline—if buyers jump in here, the price will probably bounce back up.

Where is my play region? 😘 Where is my play region? 😘 |

|---|

Solid support level from August to November first , and i do believe that 0.19 support level should not be ease task for steem . Solid support level from August to November first , and i do believe that 0.19 support level should not be ease task for steem . |

|---|

Here's my play: if Steem's price hits the $0.19-$0.20 region and I see it has strong buying pressure—green candles and rising volume, for instance—I will open a long position. I believe in it? It's like catching a ball just before it rebounds back up.

What if support level (0.19$-0.20$) break ? What if support level (0.19$-0.20$) break ? |

|---|

Weekly timeframe : If support level breaks , my sentiments will be change accordingly from long to short . Weekly timeframe : If support level breaks , my sentiments will be change accordingly from long to short . |

|---|

But wait, what if this support breaks? If I see the price crash through this level with strong red candles and high selling volume, I'll flip my bias and go short. In my view, broken support often turns into resistance, and the sellers may push the price even lower.

Now, here's the tricky part—keeping calm. At such moments, nerves can ruin a good plan. I remind myself: stick to the strategy, no matter what. No chasing trades, no revenge trading—it's not worth it.

I will put clear stop-loss orders in place for my protection. That will prevent me from losing too much. Honestly, when the market gets a little wild, I'm stepping away—I mean, no trade is worth losing my mind over.

The chart never lies; it always provides a clear story. To my knowledge, support, resistance, and volume are my guiding lights. I will walk by them, remain disciplined, and let the market do its thing.

How Will I Control My Nerves in This Setup?

Stick to strategy. I have devised my plan of action—that is, enter long from support or short if broken. There is no need overthinking. Over-thinking kills confidence faster than a bad trade.

Second, I use stop-loss orders. This way, I will not lose more than I can afford to lose. It's like having a safety net while walking on the tightrope. If things go against me in the trade, I am out—the drama and panic are minimal.

Third, I look at the chart, not at my feelings. Volume Profile and candles do tell the story. When there are obvious signs of buy or sell pressure, the data speaks to me louder than my pounding heart does.

When nerves creep in, I draw a breath. Sometimes, taking a minute's step away from the screen really helps. I think to myself: the market isn't running away on me. A clear head makes better decisions.

Finally, I accept that losses are part of trading. It's not the end of the world; it's a lesson. By staying calm, I give myself the best chance to win—or at least, to fight another day!

Question 3: Developing a Trading Routine |

|---|

Trading cryptocurrency, especially pairs like SOL/USDT, requires more than just staring at charts all day. A disciplined routine that includes technical preparation, psychological readiness, and constant evaluation is the key to long-term success. Let’s break it down into a step-by-step plan, using the current charts of SOL/USDT for reference.

Daily time frame Daily time frame |

|---|

Weekly timeframe Weekly timeframe |

|---|

Morning Preparation

Start your day by reviewing multiple timeframes for SOL/USDT. I always look at the 1-Day (1D) and the 3-Day (3D) charts for a broader picture.

- On the 1D chart, I immediately notice a critical resistance zone between $215 and $220. If SOL price gets rejected here, I prepare for a short trade.

Support level about to break Support level about to break |

|---|

Daily timeframe : Planning for short Daily timeframe : Planning for short |

|---|

- On the 3D chart, I see a strong support level around $145 to $150. If the price drops to this range and I see signs of buying (green candles with increasing volume), I’ll look for a bounce and go long.

|

|---|

My rule here? Never trade blindly—always mark out key support and resistance zones to plan my trades effectively. I also double-check the Volume Profile (VPVR), which confirms areas of high activity and interest.

Psychological Preparation

Before I even think about placing a trade, I spend 5-10 minutes practicing mindfulness. This could be as simple as closing my eyes and taking deep breaths. Trading is a mental game, and I remind myself of three golden rules:

- Stick to the plan.

- Respect stop-loss levels.

- Don’t chase the market.

Emotions like fear and greed can easily cloud judgment. By taking a moment to clear my head, I give myself the best chance of making rational decisions.

Journaling My Trades

After identifying the setup for the day or week, I log everything in my trading journal. This is a non-negotiable habit. For each trade, I write down:

- Entry point: For example, I might write, “Entered long at $150 support after noticing bullish pressure.”

- Exit point: My take-profit level might be set near the $215-$220 resistance zone.

- Reasons for the trade: Support bounce, increasing volume, or candlestick patterns like a bullish engulfing.

- My emotions: Did I feel nervous? Did I hesitate? Understanding how I react during trades helps me improve.

By the end of the day or week, this journal becomes my guide. It highlights what worked, what didn’t, and where I let emotions take control.

Setting Realistic Goals

Every trader loves the idea of catching a massive move, but setting small, realistic goals is far more sustainable. For example:

- If SOL bounces off $145 and heads towards $215, I don’t get greedy and hold for an unrealistic target. I take profit within the defined resistance zone.

My aim? Consistent, small wins.

Weekly Reflection

At the end of the week, I take 30 minutes to review my trades. I ask myself:

- Did I stick to the plan?

- Did I respect my stop-loss levels?

- Did I identify support and resistance zones accurately?

If I made mistakes, I learn from them. There’s no room for ego in trading—learning and adapting are the keys to growth.

Mindful Breaks

When things get volatile, I step away. Watching the price dance around support and resistance can trigger nerves. But staring at the chart won’t change the outcome. A mindful break—whether it’s a walk, coffee, or fresh air—helps me return with a clear head.

By combining technical analysis, psychological preparation, and a solid routine, I stay ahead of the game. With SOL/USDT’s current price movements, having discipline in this setup helps me navigate both opportunities and challenges like a pro!

Question 4: Case Study on Emotional Trading |

|---|

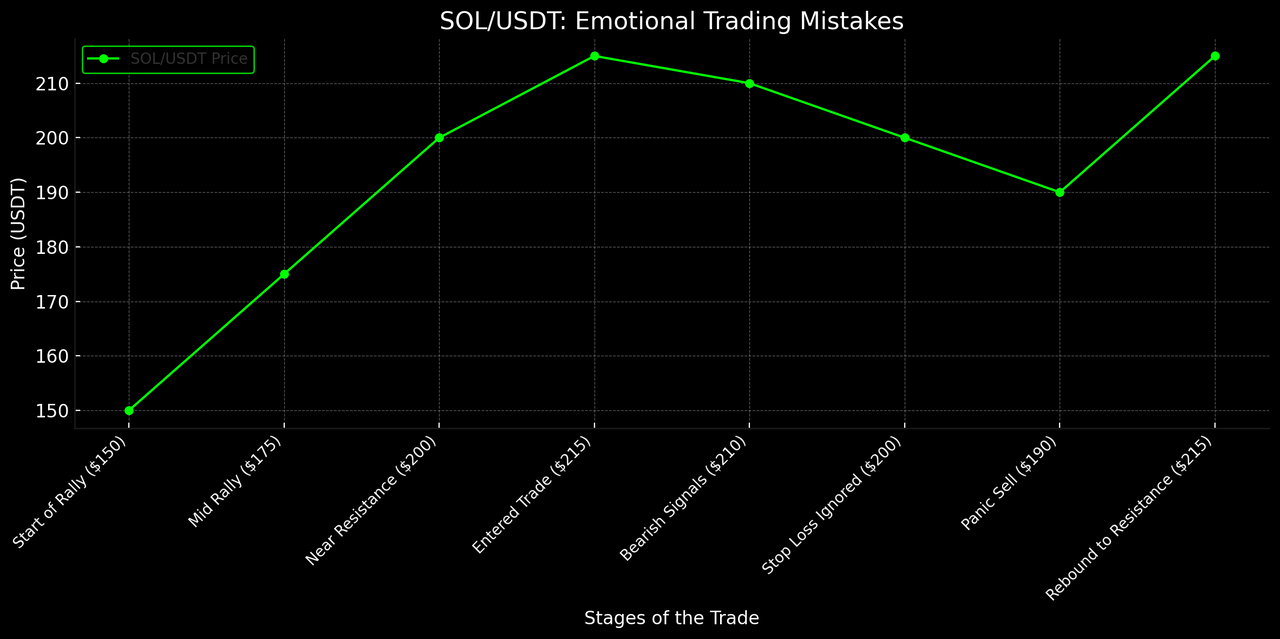

Let’s walk through a hypothetical yet realistic trading scenario involving SOL/USDT, where emotions like FOMO (Fear of Missing Out) and greed caused a major trading blunder. This example highlights how even a good plan can fail if emotions take control.

The Setup

Imagine SOL has been on a massive rally for the past week, rising steadily from $150 to $215. The hype is everywhere—on Twitter, Telegram groups, and news headlines screaming, “SOL to $300 incoming!”. Traders are piling in, and volume is surging.

Now, the logical move here would be to identify the key resistance zone, which sits between $215 and $220 (as shown on the charts). Smart traders know to wait for a breakout confirmation or prepare for a potential rejection.

Emotional trading mistakes Emotional trading mistakes |

|---|

The Emotional Mistake

Let’s say I enter the market at $215—not because of solid technical analysis, but because of FOMO. I think, “What if SOL really hits $300? I’ll miss out on massive profits!”

Here’s what happens next:

- Instead of breaking through resistance, SOL starts showing bearish signals—red candles appear, volume begins to drop, and sellers take control.

- At this point, a rational trader would cut losses and stick to their stop-loss plan. But I hold on because of greed and overconfidence, telling myself, “This is just a dip. It’ll bounce back!”

As SOL retraces further to $200, panic sets in. Fear of losing more takes over. I finally sell in frustration—locking in a significant loss—just before SOL finds support at $190 and bounces back.

The Aftermath

This emotional spiral resulted in three big mistakes:

- Chasing FOMO: Entering the trade near the resistance zone without confirmation.

- Ignoring Stop-Loss: Overconfidence stopped me from cutting my losses quickly.

- Emotional Exit: Selling at the worst possible time—near support—out of panic.

What’s worse? After I sell, SOL rises back to $215! The market didn’t fail me—I failed to control my emotions.

The Lessons

This scenario teaches critical lessons:

- Plan the Trade: Always mark support and resistance levels before entering. If SOL is near $215 resistance, wait for confirmation of a breakout or prepare for rejection.

- Set Stop-Losses: A stop-loss at $205 could have limited my losses when the trade didn’t work out.

- Control Emotions: FOMO and greed cloud judgment. I should’ve reminded myself, “The market will always give opportunities—patience is key.”

Conclusion

This experience underscores the importance of emotional discipline in trading. The market doesn’t care about your emotions—it rewards strategy and patience. Next time, I’ll stick to the plan, respect my stop-loss, and remember: Trading is a marathon, not a sprint.

Question 5: Building Resilience in Volatile Markets |

|---|

Mental resilience is the key to thriving in the unpredictable world of trading, where emotions can run high and volatility can test one's limits. Building this resilience requires a combination of mental discipline, strategic preparation, and healthy habits.

1. Mindfulness and Meditation

The key technique is mindfulness and meditation, which allows the trader to be more emotionally balanced. Regular mindfulness reduces anxiety, sharpens focus, and allows traders to respond to market movements in a clearer manner rather than impulsive ones. During times of high stress, deep breathing exercises can restore calm and prevent hasty decisions.

2. Risk Management

Another pillar of resilience is risk management. In this regard, setting up predefined stop-loss levels and using proper position sizing helps prevent losses and maintain control irrespective of the market conditions. Knowing the exact amount of risk in each trade also reduces fear and builds confidence in long-term strategies.

3. Journaling Trades

Maintaining a trading journal is an invaluable habit for emotional stability. Reflecting on past trades, analyzing mistakes, and celebrating small wins foster self-awareness. This process enables traders to understand their emotional triggers and adjust their approach to avoid repeating errors.

4. Healthy Lifestyle

Other roles played in this regard include physical and mental health. Healthy living with regular exercises, adequate nutrition, and enough rest ensures that the traders have clear thinking in a stressing situation. A sound body directly contributes to a sound mind, thus improving their decision-making abilities.

5. Continuous Learning

Last but not least, continuous learning prepares the trader to respond. Whether in terms of market trends, technical analysis, or trading psychology, continuous education minimizes uncertainty and gives traders the capacity to remain calm under volatility.

With these techniques in place, traders can be focused and disciplined even at times of market turbulence. Resilience is not about avoiding stress but being able to handle it to achieve long-term success.

kind Regards

@artist1111

Adieu, folks!

May the winds of fortune

carry you to greatness!

May the winds of fortune

carry you to greatness!

Comments