SLC | S21W4 | Costs for entrepreneurs - Budgets

0 comments

Budgeting is estimating and planning how to allocate resources for a business. It's setting up financial targets and predicting future expenses so that a business will remain profitable and manage its resources efficiently. A budget acts as a financial guide, helping to predict what revenue might be and therefore ensure that costs are controlled.

Costing is very closely related to budgeting. It involves the actual expenses associated with producing a product or delivering a service. Costing identifies each direct and indirect cost incurred in a business activity, thus allowing for proper pricing and establishing profit margins. Understanding costs allows businesses to construct more accurate budgets.

For instance, a bakery that bakes cakes will require computing cost of inputs such as ingredients, labor, and overhead such as electricity and rent. If the cost to manufacture a cake is $15 while the owner would like a 30% profit margin, this budget will ensure that all costs are covered, and selling price leaves room for making money.

Budgeting makes use of the costing information to forecast future expenses. For example, if the bakery intends to produce 100 cakes per month, budgeting will compute expected expenditure, thus helping determine the amount of cash required to sustain its activities.

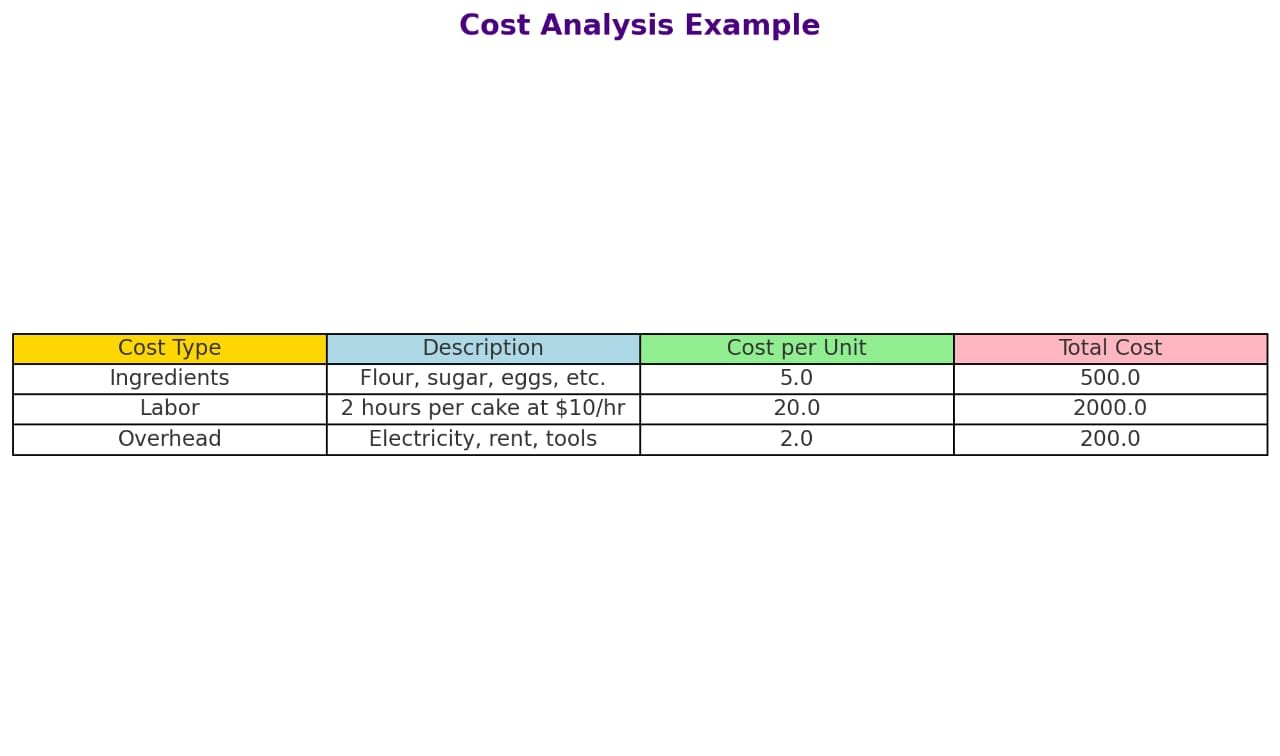

Cost Analysis Example:

| Cost Type | Description | Cost per Unit | Total Cost |

|---|---|---|---|

| Ingredients | Flour, sugar, eggs, etc. | $5.00 per cake | $500.00 |

| Labor | 2 hours per cake at $10/hr | $20.00 per cake | $2,000.00 |

| Overhead | Electricity, rent, tools | $2.00 per cake | $200.00 |

| Total Cost | $2,700.00 |

Cost Analysis Example , chart view Cost Analysis Example , chart view |

|---|

In this example, knowing the costs helps the business owner create a budget that accounts for production expenses and sets appropriate financial targets.

Budgeting is the process planning how much money is available and how to allocate it across various expense categories. It encompasses setting financial goals, estimating income, and figuring out how much it will cost to achieve them. This helps one understand how much money has been made and spent so that one does not spend more than he or she earns.

Costing, on the other hand, is considered budgeting to identify and calculate all the actual costs that go into the producing of a product or service. It involves tracing all expenses in materials, labor, and overheads, which clearly states how much it costs to produce each item. This helps businesses set the right prices or decide if the product will be profitable.

It could be a bakery making cakes; budgeting would then estimate how much it intends to spend on the necessary ingredients, equipment, labor, and other expenses for the month. Costing will then break down that cost into each cake so that the price set will account for the expenses and still leave a room for profit.

By comparing the budget with actual costs, businesses can adjust strategies. If the costs for ingredients rise, they might need to update the budget or find cheaper alternatives. This goes on continuously to keep track of finances.

From the above table, costs to produce cakes are categorized into three main types: Ingredients, Labor, and Overhead. For instance, the ingredients include flour, sugar, and eggs. Labor counts time for each cake to be baked. Overhead captures indirect costs like electricity and rent. It contributes towards the total in each category to ensure the bakery understands how much it has to spend at a minimum.

|

|---|

Budgeting is an essential determinant for costs. It outlines a proper framework through which one is to manage their financial resources and make informed decisions. With budgeting, business enterprises can estimate the cost of running an operation, thereby giving them a detailed overview of exactly how much money is needed to produce a product or deliver a service.

A well-planned budget identifies costs early on, allowing businesses to allocate funds appropriately. Such foresight helps avoid unexpected expenses and ensures all the required resources are accounted for. In addition, it aids in making accurate cash flow forecasts. As such, this will ensure that there is adequate money to meet production costs without being short of cash.

Budgeting means comparing estimated costs with actual spending, leading businesses to analyze where adjustments might be needed. If the actual costs go above the budget, then it explains areas where expenses can be reduced or managed better. This encourages people to have a better cost control and financial discipline.

Setting prices for products and services is also a derivation of budgeting. The detailed costs of a budget will make a business understand that its pricing strategy can cover all expenses with just enough profit. Such knowledge is important to keep a firm bottom line, which helps sustain the business in good conditions.

Overall, budgeting is essential for effective financial planning, risk management, and profitability. It provides a roadmap for spending, helping businesses maintain financial stability and adapt to changes in costs over time.

A budget is, therefore necessary to prepare in preparing cakes. In preparing these cakes, we need to first break down the cost that directly and indirectly becomes involved. The budget will help us find out how much we need for every aspect of cake production so that all the costs are covered.

- Direct Costs: These are costs that can be directly linked to the cake preparation, such as ingredients and labor.

Ingredients: Flour, sugar, eggs, butter, & other baking items.

Labor: The cost of employees or workers involved in the preparation process.

2. Indirect Costs: These are costs that are necessary for production but are not directly tied to the product. These include utilities like electricity, gas, & rent for the kitchen.

We will apply a 4% adjustment to account for potential increases in costs. This adjustment ensures we are prepared for any price hikes or unplanned expenses.

Now let’s calculate the estimated costs with the 4% adjustment.

Direct Costs for 100 Cakes (Before 4% Adjustment)

| Ingredient | Quantity | Unit Cost | Total Cost |

|---|---|---|---|

| Flour | 10 kg | $2.50 | $25.00 |

| Sugar | 5 kg | $3.00 | $15.00 |

| Eggs | 200 | $0.20 | $40.00 |

| Butter | 2 kg | $5.00 | $10.00 |

| Labor | 10 hours | $12.00 | $120.00 |

| Total Direct Cost | $210.00 |

Indirect Costs for 100 Cakes (Before 4% Adjustment)

| Cost Item | Quantity | Unit Cost | Total Cost |

|---|---|---|---|

| Electricity | 50 kWh | $0.10 | $5.00 |

| Gas | 10 m3 | $1.00 | $10.00 |

| Rent | 1 month | $200.00 | $200.00 |

| Miscellaneous | - | - | $15.00 |

| Total Indirect Cost | $230.00 |

Adjusted Direct and Indirect Costs (After 4% Increase)

| Cost Type | Original Cost | 4% Adjustment | Adjusted Cost |

|---|---|---|---|

| Direct Costs | $210.00 | $8.40 | $218.40 |

| Indirect Costs | $230.00 | $9.20 | $239.20 |

| Total Cost | $440.00 | $17.60 | $457.60 |

The adjusted total cost for preparing 100 cakes, after including the 4% adjustment, comes to $457.60.

Final Budget Overview

| Category | Before Adjustment | After 4% Adjustment |

|---|---|---|

| Direct Costs | $210.00 | $218.40 |

| Indirect Costs | $230.00 | $239.20 |

| Total Costs | $440.00 | $457.60 |

This budget allows us to plan and ensure that all necessary resources are accounted for while considering potential cost increases.

Preparing a budget for hairdressing service provision involves showing both direct and indirect costs, as when making a cake. First, we shall outline the major inputs involved in hairdressing service provision. Then we shall alter them by 3% to account for the possible fluctuations in costs.

Direct Costs:

Direct costs for hairdressing services include direct costs attributed to the service provided, including professional hair products, tools, and labor (hairdresser's salary). These costs can be traced to specific hairdressing services performed.

- Products: Products used in the hair coloring service include hair color, shampoos, conditioners, styling gels, among others. For example, if a salon utilizes 10 bottles of high-quality hair color at $15 per bottle, the total would be $150.

- Tools: These include things such as scissors, combs, brushes and hairdryers. These may require periodic replacement, which adds to the direct costs.

- Labor: These are the wages paid to the hairstylists. For instance, if a stylist is paid $20 an hour and works for 40 hours a week, then the labor cost for that week would be $800.

Below is the table showing the direct costs before the 3% adjustment:

| Product/Service | Quantity | Unit Cost | Total Cost |

|---|---|---|---|

| Hair Color Products | 10 bottles | $15.00 | $150.00 |

| Hair Tools | - | - | $100.00 |

| Labor | 40 hours | $20.00 | $800.00 |

| Total Direct Cost | $1,050.00 |

The total direct cost for hairdressing services before the 3% adjustment is $1,050.00.

Indirect Costs:

Indirect costs for a hairdressing service include the general operational costs that are necessary but not directly tied to each client, such as utilities, rent, and other overhead expenses.

- Utilities: Electricity for lighting and hairdryers, water for washing hair, and heating/cooling systems are crucial utilities.

- Rent: If the salon is in a rented space, the monthly rent is a fixed indirect cost.

- Miscellaneous Supplies: Includes items like cleaning products for the salon, towels, capes, and disposable gloves.

Below is the table showing the indirect costs before the 3% adjustment:

| Cost Item | Quantity | Unit Cost | Total Cost |

|---|---|---|---|

| Electricity/Water | Monthly | - | $150.00 |

| Rent | 1 month | $500.00 | $500.00 |

| Miscellaneous Supplies | - | - | $75.00 |

| Total Indirect Cost | $725.00 |

The total indirect costs for hairdressing services come to $725.00 before the 3% adjustment.

Applying the 3% Adjustment:

To prepare for unexpected cost increases, we apply a 3% increase to both direct and indirect costs. This provides a buffer for unforeseen changes in prices.

For direct costs:

- The total direct costs before adjustment were $1,050.00.

- The adjustment is 3% of $1,050.00, which is $31.50.

- The new direct costs after the adjustment are $1,081.50.

For indirect costs:

- The total indirect costs before adjustment were $725.00.

- The adjustment is 3% of $725.00, which is $21.75.

- The new indirect costs after the adjustment are $746.75.

Below is the table summarizing the adjusted costs:

| Cost Type | Original Cost | 3% Adjustment | Adjusted Cost |

|---|---|---|---|

| Direct Costs | $1,050.00 | $31.50 | $1,081.50 |

| Indirect Costs | $725.00 | $21.75 | $746.75 |

| Total Cost | $1,775.00 | $53.25 | $1,828.25 |

The final adjusted total for providing hairdressing services, after accounting for a 3% increase, is $1,828.25.

Final Budget Breakdown:

To give a clearer picture of the cost structure for the hairdressing service, here’s a detailed overview after the 3% adjustment:

| Category | Before Adjustment | After 3% Adjustment |

|---|---|---|

| Direct Costs | $1,050.00 | $1,081.50 |

| Indirect Costs | $725.00 | $746.75 |

| Total Costs | $1,775.00 | $1,828.25 |

This adjusted budget ensures that the business can manage fluctuations in prices of products, tools, and other related costs, providing a more accurate financial estimate for running the hairdressing service.

I am inviting my friends @suboohi, @saintkelvin, @dove11 to participate in this contest. Thank you for reading .

Best Regards,

artist1111

Comments