SEC S19-W3 || Mastering the P2P Market

46 comments

This is my homework post for Steemit Crypto Academy Season 19 Week 3, Mastering the P2P Market.

Note : I performed this task on Windows 10 PC, Google Chrome.

Task 1 - Explain how the P2P (Peer-to-Peer) market for USDT works on platforms like Binance and Huobi. What are the main characteristics that differentiate P2P transactions from traditional transactions on a centralized exchange platform?

How the P2P (Peer-to-Peer) Market for USDT Works On Binance and Huobi

Before we get into the topic, it would be good for us to observe the history and interesting facts behind peer-to-peer technology.

The model of technology resembling the peer-to-peer technology (which is the core technology in blockchain) that we recognize today was first introduced by Usenet, an online discussion and file-sharing forum, without involving a specific server to mediate the process. It works by allowing each participating computer to act as both server and client. Usenet was introduced in 1979. The most popular example of this peer-to-peer technology, which is easily found in telecommunications devices, is Bluetooth. However, the most significant contributions to the development of peer-to-peer technology have come from online file sharing. The most popular example might be BitTorrent.

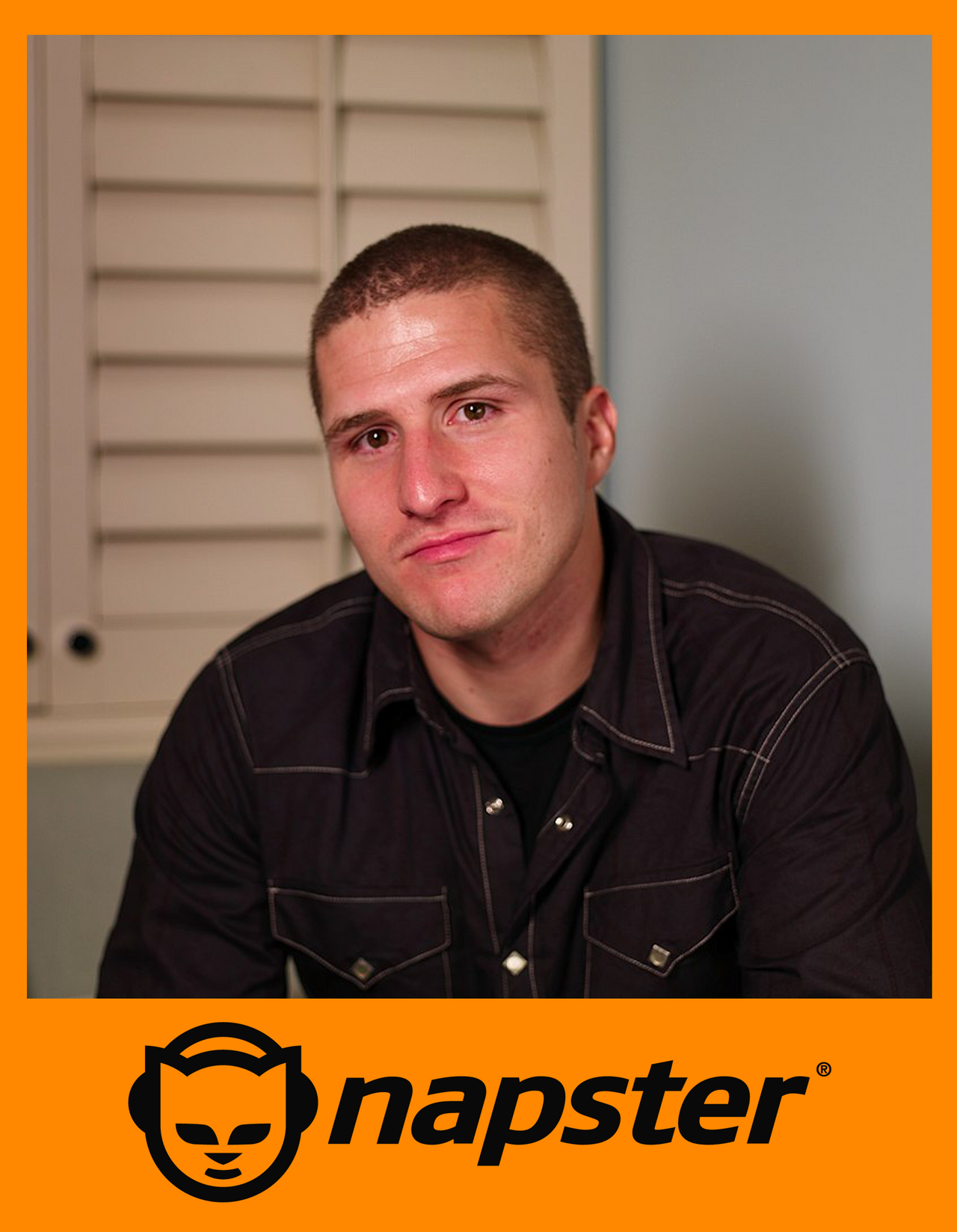

In 1999, amid the growing use of the internet, an American student named Shawn Fanning brought this peer-to-peer technology to form a Windows-based application offering online music sharing services called Napster. Napster became a major name during its brief history, before running into copyright issues and being shut down in 2001 following lawsuits from members of the American recording industry. However, it played a significant role on bringing to the internet the peer-to-peer file-sharing technology that eliminated the need for third-party involvement. This technology continued to evolve and find a broad array of applications, leading to Satoshi Nakamoto bringing it into the world of blockchain in 2009.

Peer-to-peer trading, as the name implies, is trading conducted directly from one peer to another, without the involvement of an intermediary. The freedom from third-party involvement is what differentiates this type of trading from traditional trading on centralized platforms. In the world of crypto, Binance and Huobi are amongst trading platforms that provide peer-to-peer transactions.

Therefore, peer-to-peer market is a place where trading (or transactions) happens where sellers and potential buyers can meet directly.

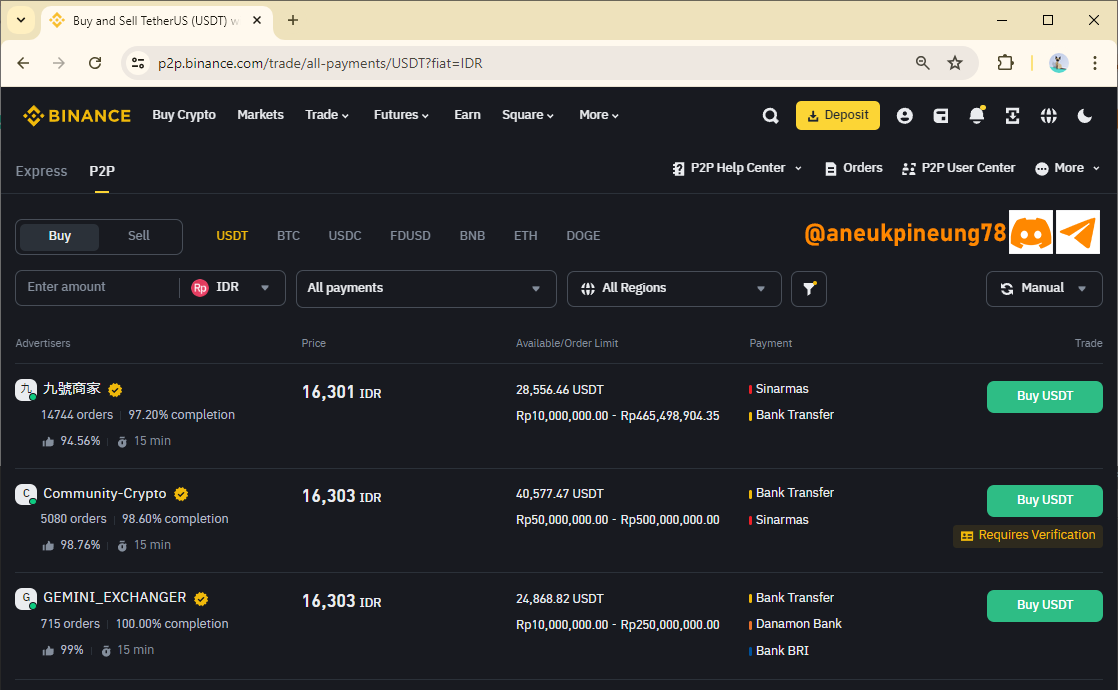

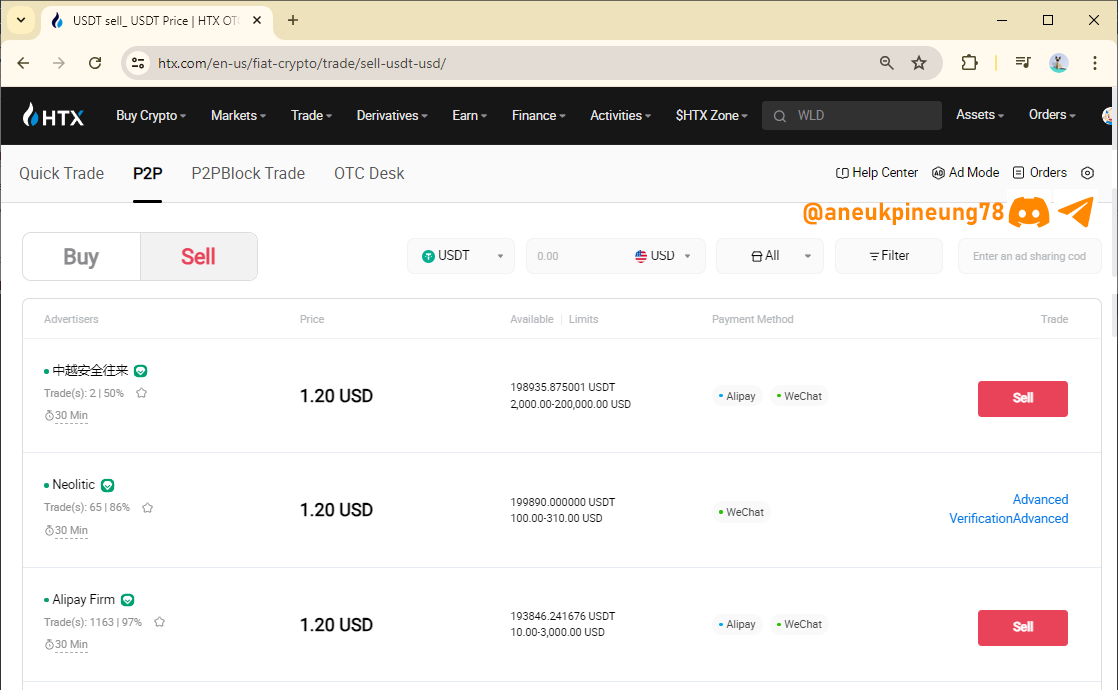

Both on Huobi and Binance, peer-to-peer trading is conducted in the similar way. Traders or sellers offer cryptocurrencies by displaying data such as: minimum and maximum purchase amount, payment timeframe before the order is considered canceled, accepted payment methods. The trading platforms also shows trust lever of the traders’ (traders’ feedback rating).

Potential buyers or sellers come and learn the displayed info of list of sellers or buyers of a particular cryptocurrency, decide which one of the traders or buyers in the list they would like to trade with. Not only the offered price will be a consideration for prospective buyers in deciding whom to trade with, but also factors such as feedback level, minimum and maximum purchase amounts, supported payment methods, and so on. Someone with limited funds will buy from a seller who offers a higher price but provides a lower minimum purchase amount. The same goes to potential sellers.

Below is the screenshot showing interface of Binance P2P Market on Seller page.

Let’s see the interface of Huobi P2P Market, but for Buyers page.

The Main Characteristics That Differentiate P2P Transactions from Traditional Transactions on A Centralized Exchange Platform

The primary characteristic that distinguishes peer-to-peer transactions from traditional transactions is the absence of intermediaries. This means that each party involved can send their funds directly from their wallet to the intended recipient without a third party taking a potentially unreasonable cut. It saves money and time. This is essentially the basic idea behind peer-to-peer trading.

In traditional transactions, parties need to involve a third party to manage the flow of their money. For example, if A wants to send a certain amount of money to B, A first needs to deposit the money in a bank. Meanwhile, B also needs to have an account at a certain bank to receive the funds from A. The intermediary (bank) will take a profit for their service.

The easiest and most relevant example to illustrate peer-to-peer transactions is a market (traditional markets or the more modern ones like malls), where sellers and buyers meet directly and exchange funds and commodities between them without intermediaries. So, in terms of peer-to-peer trading as offered by platforms like Huobi and Binance, these platforms can be likened to market organizers that "connect" traders and buyers. However, since traders and buyers do not physically meet in person, a system is needed to ensure the security of both parties, and that is where the function of escrow comes in.

But do peer-to-peer cryptocurrency trading systems like those we see on Binance or Huobi fully accommodate the idea of total peer-to-peer transactions? Of course not. Payments still involve transferring funds through banks. This is understandable because FIAT currencies operate within the traditional banking system. However, the key point is that traders and buyers meet and transact directly without intermediaries, regardless of the payment method that enables the transaction.

But couldn't the platform organizers also be considered third parties? They can be, but not in the same way as third parties in traditional transaction systems. They only provide a trading platform and security system (escrow) with low fees, but they do not manage the funds of the parties involved.

Task 2 - What is TRC-20 USDT and what are the main differences between TRC-20 USDT and other USDT token standards like ERC-20?

What Is TRC-20 USDT

TRC-20 USDT consists of two terms: TRC-20 and USDT. Here are the explanations for each term:

- TRC-20 is a token standard of TRON blockchain. It is created with TRON blockchain technology and run within the TRON blockchain. An interesting fact about the TRON blockchain, which has a native currency named TRON (symbolized as TRX), is that TRON initially started as a token generated through the Ethereum blockchain, then separated and formed its own blockchain. Now, the TRON blockchain is among the popular blockchains, and TRX is a highly sought-after cryptocurrency.

- USDT (USD Tether, often simply called Tether) is a token whose value is pegged to the value of the US Dollar. Therefore, it is classified as a stablecoin. Stablecoins are digital currencies whose value is pegged to the value of FIAT currencies or commodities (such as oil, gold, silver, and so on). Another example of a stablecoin is BUSD (a stablecoin issued by Binance and pegged to the value of the US Dollar). The Indonesian currency, Rupiah (IDR), has also been used as a value peg for several stablecoins, including Rupiah Token (IDRT) and StraitsX Rupiah (XIDR).

So, TRC-20 USDT is stablecoin Tether that is created with TRON blockchain token standardization and runs on TRON blockchain network.

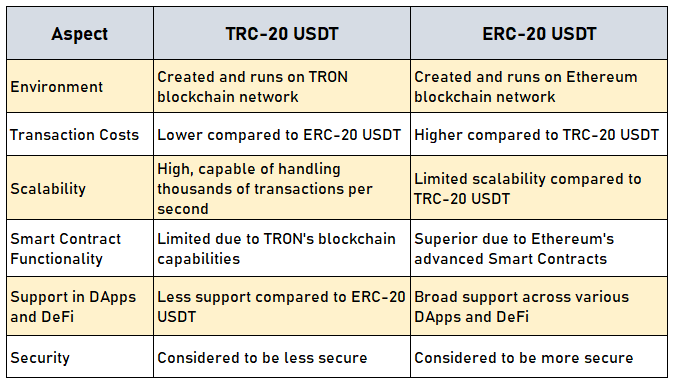

The Main Differences Between TRC-20 USDT And ERC-20 USDT

Made with Adobe Photoshop 2021.

USDT has become one of the popular stablecoins due to its ability to adapt to various blockchains, including TRON and Ethereum. The most fundamental difference between the two types of USDT is that TRC-20 USDT operates on the TRON blockchain, whereas ERC-20 USDT operates on the Ethereum blockchain. The difference in the adapted blockchain creates different effects on aspects such as transaction fees, where TRC-20 USDT has lower transaction fees compared to ERC-20 USDT. These fee differences can be quite significant.

Additionally, their scalability differs as well. TRON's more advanced technology allows for high scalability, capable of handling thousands of transactions per second.

Although TRC-20 USDT "wins" in terms of transaction costs and scalability, in terms of Smart Contract functionality, ERC-20 is far superior. This results in ERC-20 USDT receiving much broader support from various DApps (Decentralized Applications) and DeFi (Decentralized Finance). Ethereum's technology is also considered to provide greater security benefits to ERC-20 USDT compared to what TRON can offer to TRC-20 USDT.

I'll organize those facts into a table for easier observation:

Image is clickable and might show larger resolution.

Task 3 - What is the role of Escrow protection in P2P transactions and how does it help secure transactions for buyers and sellers?

The Role of Escrow Protection in P2P Transactions

In peer-to-peer (P2P) transactions where the parties do not meet physically, the risk of fraud and misconduct, which could cause losses to one party, is very high. To prevent losses and ensure fair transactions where all parties fulfill their obligations to receive their rights, the escrow service emerged. The role of escrow can be illustrated as that of a witness who temporary hold the traded assets and will act regarding to the situation development.

How Escrow Protection Helps Secure Transactions for Buyers and Sellers

After a prospective buyer places an order, the digital asset being traded will be held by the platform organizer (put in escrow). The buyer is obligated to make the payment within the time frame specified by the seller. Once the buyer has made the payment and informed the seller that the payment has been made, and the seller verifies that the payment has been received, the escrow will release the traded asset to buyer.

That’s if everything goes smoothly. What if one party fails to fulfill their obligations?

If the buyer does not make the payment within the specified time, the transaction is automatically considered canceled, and the escrow will return the asset to the seller. If the buyer makes the payment but does not receive the asset, the buyer can file a dispute by providing as much evidence as possible, including proff of payment and proof of communication with the seller. Therefore, during the transaction (after placing the order), it is highly recommended to engage in conversations and take screenshots as a precaution. If all valid evidence is provided by the buyer, the market will verify this information and release the asset in escrow to the buyer or release back their funds.

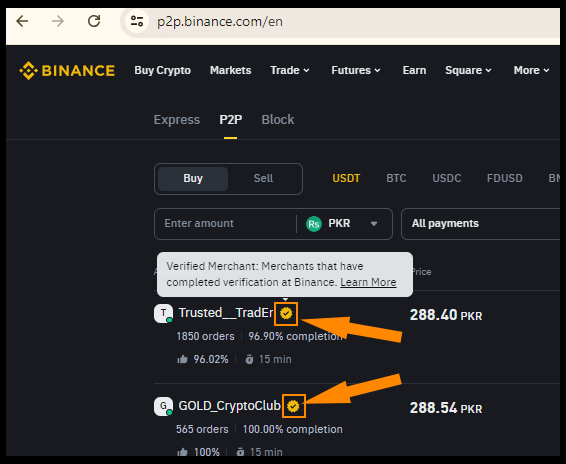

However, even though escrow protection can be utilized, for the convenience of prospective buyers, it is advised not to make transactions carelessly and to only transact with verified and well-known sellers, using the safest payment methods. Binance marks verified sellers with a checkmark inside a yellow circle. The following image shows two verified sellers on Binance P2P Market.

Task 4 - What are the different payment methods available on P2P exchange platforms for USDT transactions? Compare at least three payment methods in terms of speed, security and fees.

The Different Payment Methods Available on P2P Exchange Platforms for USDT transactions and Comparison of 3 Payment Methods in Terms of Speed, Security and Fees

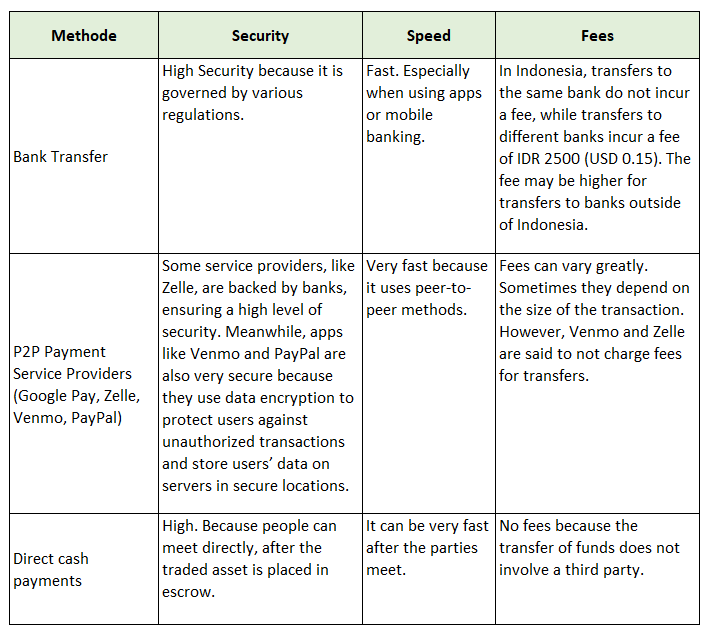

Basically, the payment methods in peer-to-peer trading are not different from those in traditional trading. The trader specifies the payment methods they accept. The most popular method might be instant bank transfers. The comparison of three payment methods that can be used in peer-to-peer trading of USDT is shown in the table below:

Task 5 - Complete a P2P transaction to purchase USDT using a payment method of your choice on a P2P exchange. Document each step of the process with screenshots or detailed descriptions, and share your observations about the benefits and challenges encountered.

How I Purchase USDT on Huobi Peer-To-Peer Market

I chose Huobi to complete this task.

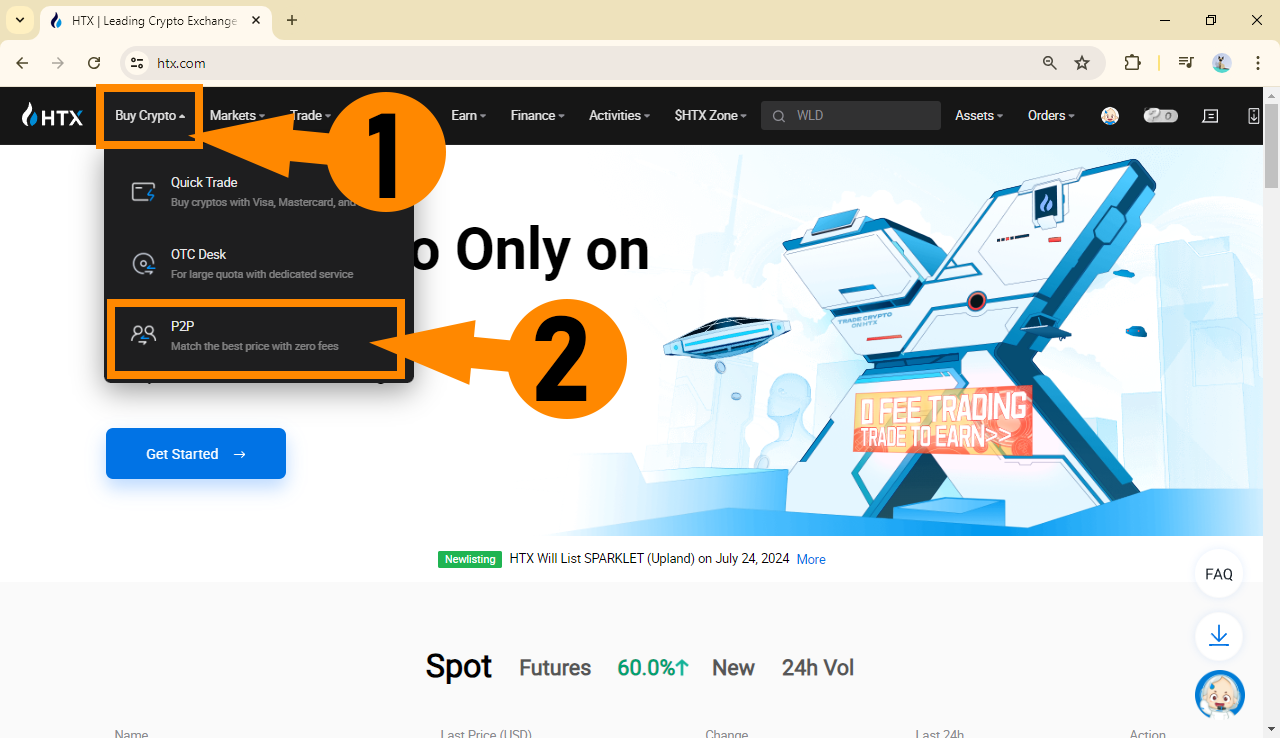

After logging in to Huobi, click [Buy Crypto] (1), then select P2P from the dropdown menu (2).

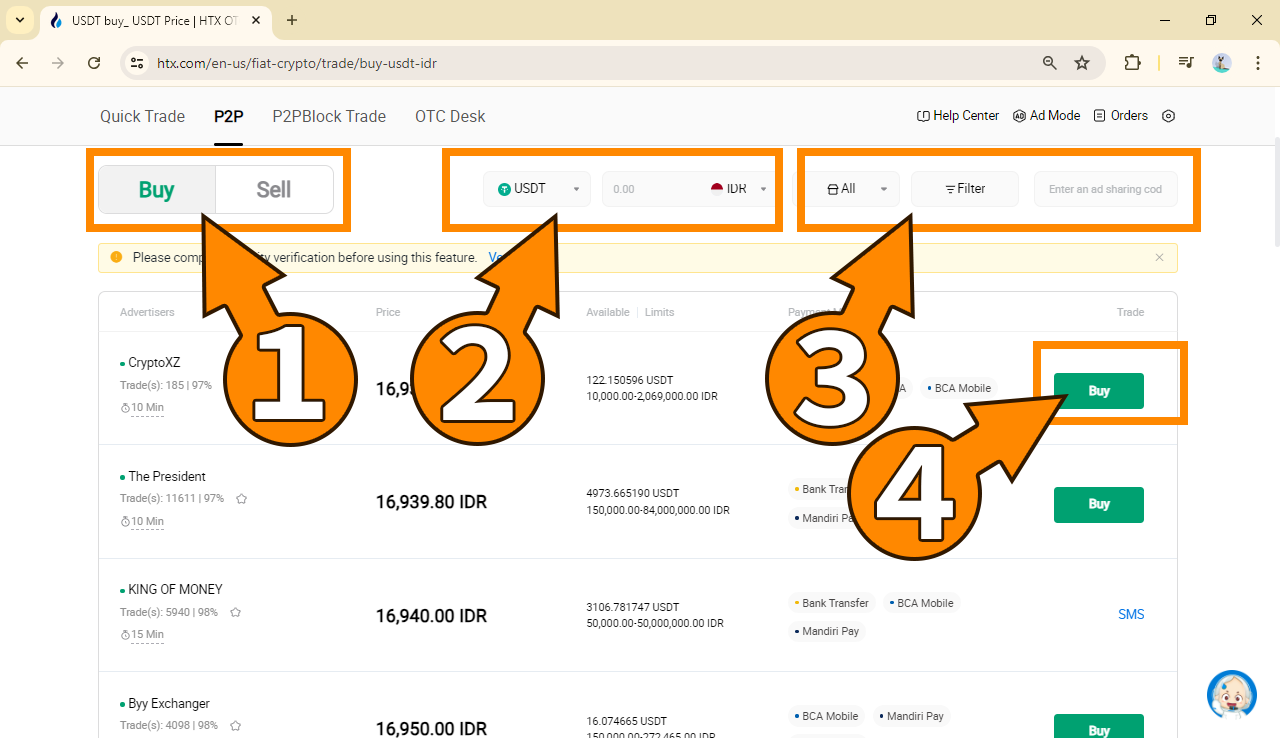

I made sure that I was on the Buy page (1). I input information of what to buy and with what I would pay (2). If needed, users can also do some additional adjustment which I did not need to (3). When I found a seller that suits my need, I clicked [Buy] (4).

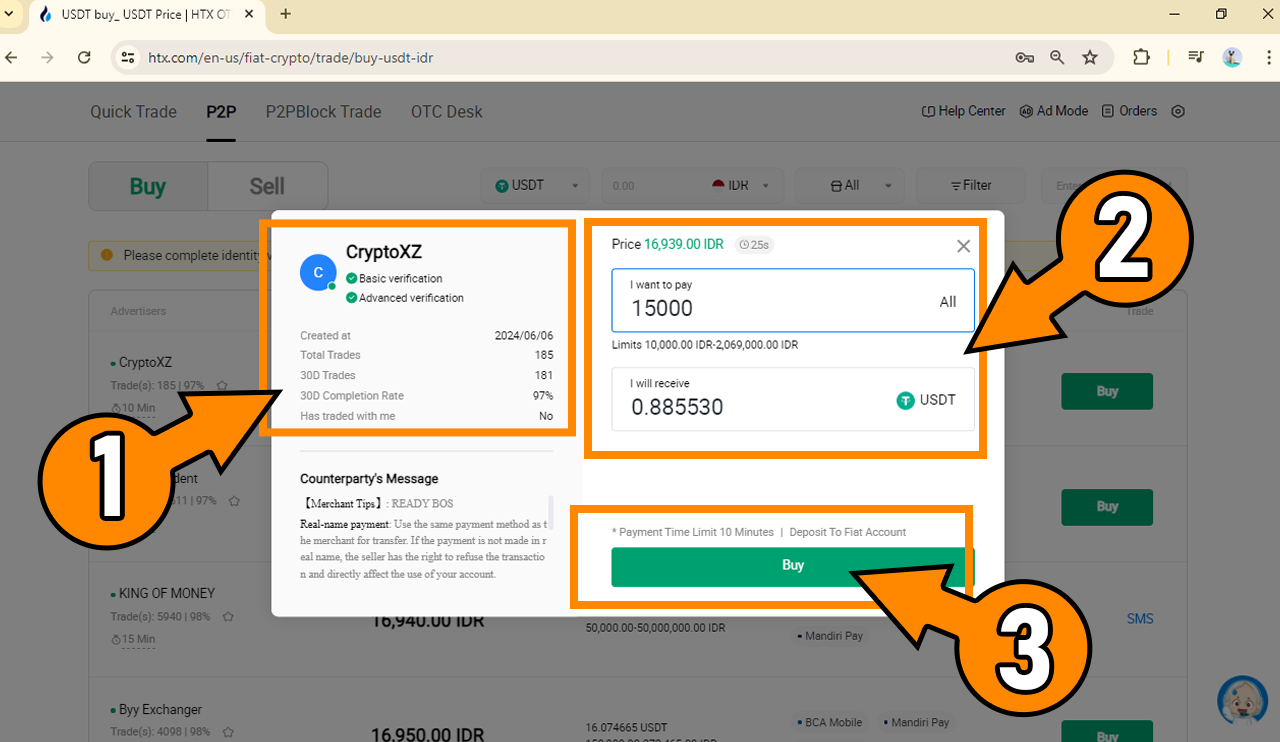

A brief summary of the trader’s reputation was shown (1). I entered the purchase amount in IDR and the page automatically calculated the amount of USDT I will get (2). To proceed I clicked [Buy] (3). There’s a small countdown timer runs beside the price which will update price every time it hits zero before potential buyer hit the [Buy] button on (2).

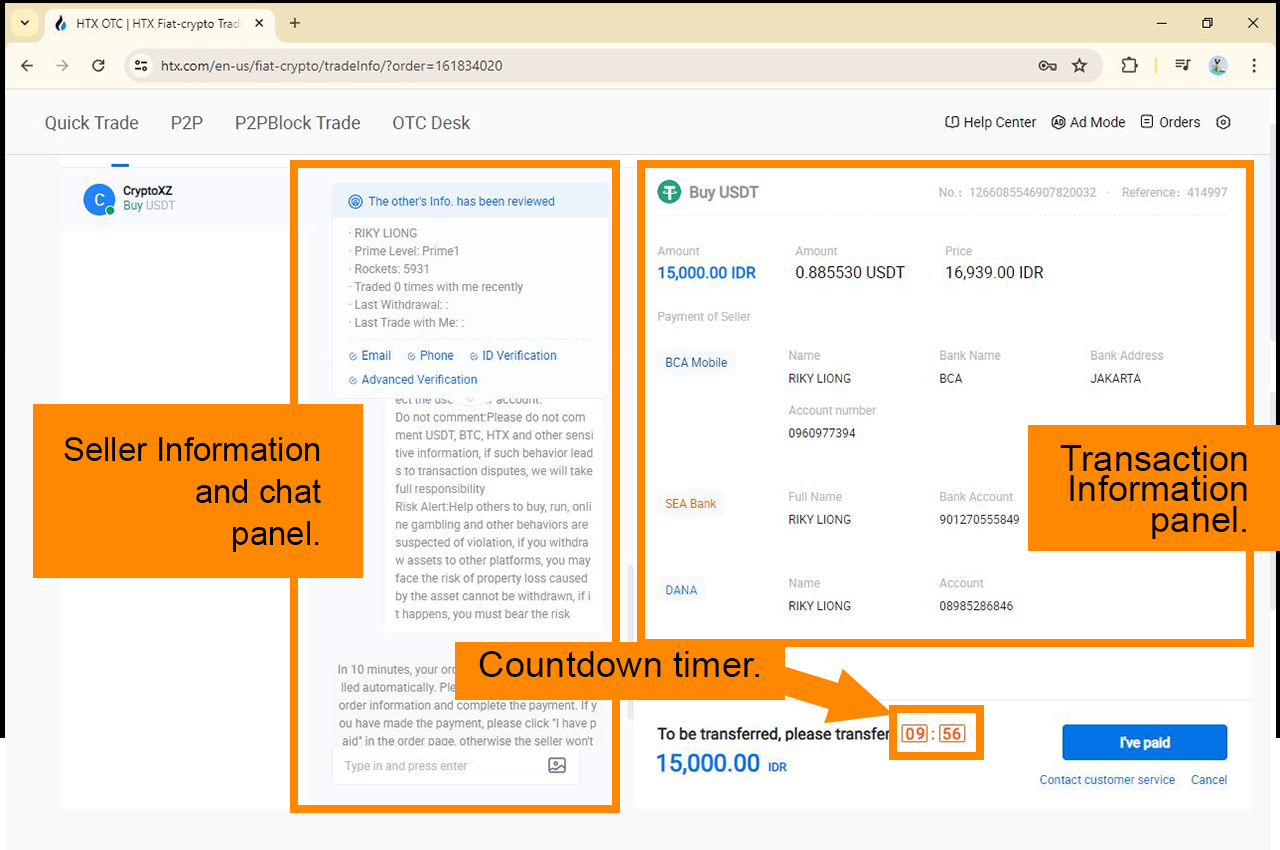

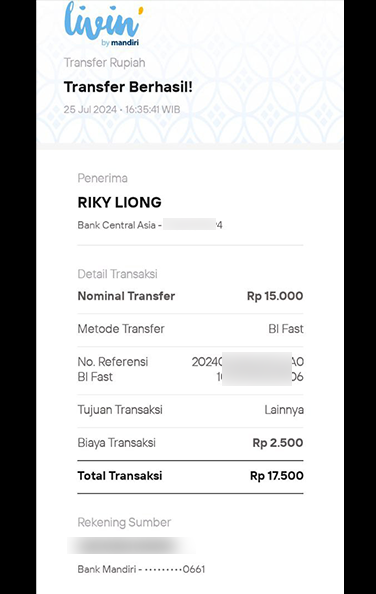

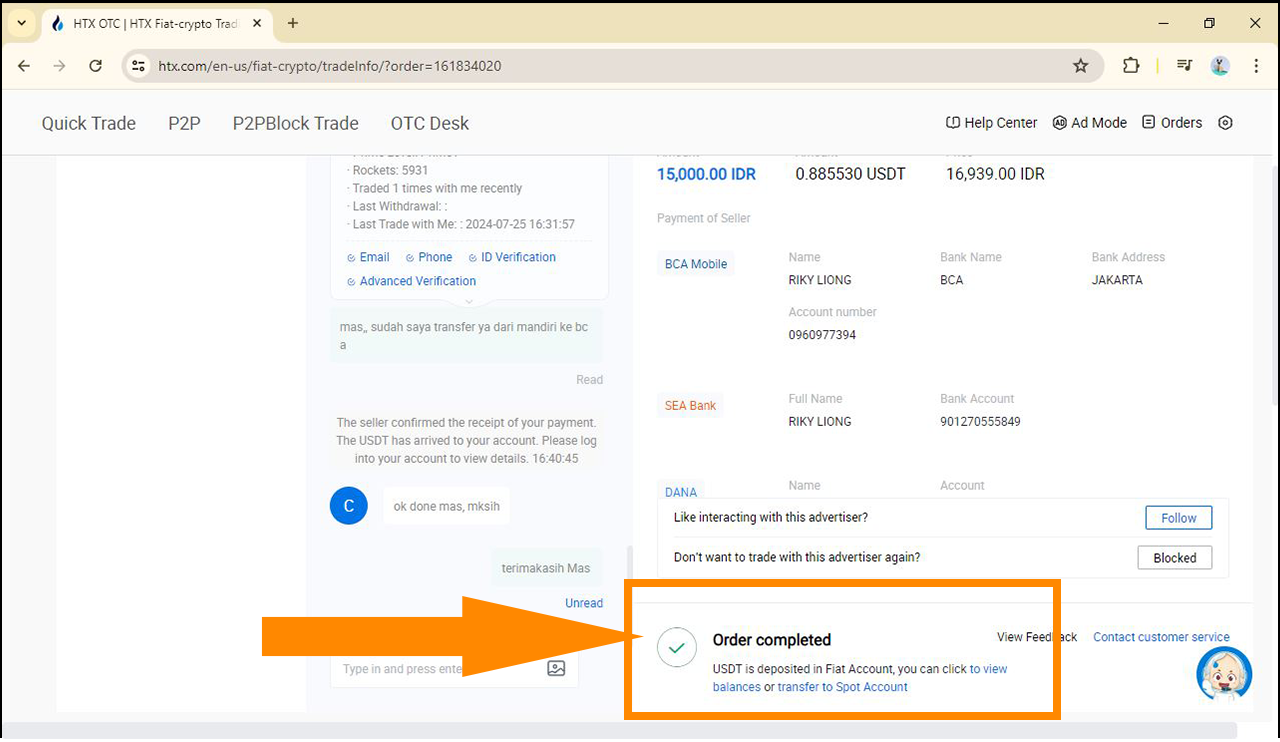

The page then displayed the information that tells me that the purchase order has been placed. I now needed to complete payment before the timer runs out or the transaction will be terminated.

I opened my mobile banking application and sent the payment to the seller's bank. Because we had different bank, I had to pay fees as much as IDR2500.- (equals to USD0.15).

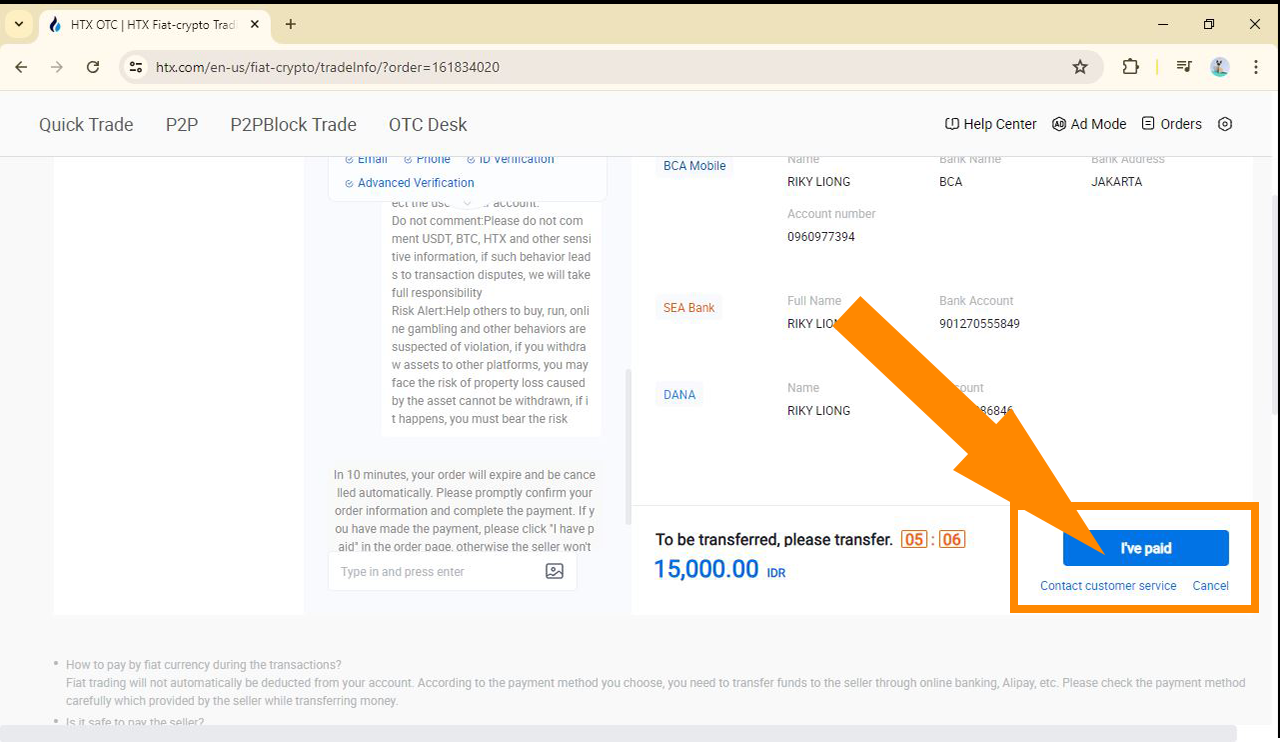

Once I completed the transfer, I hit the [I've paid] button. It's needed to be done to alert the seller.

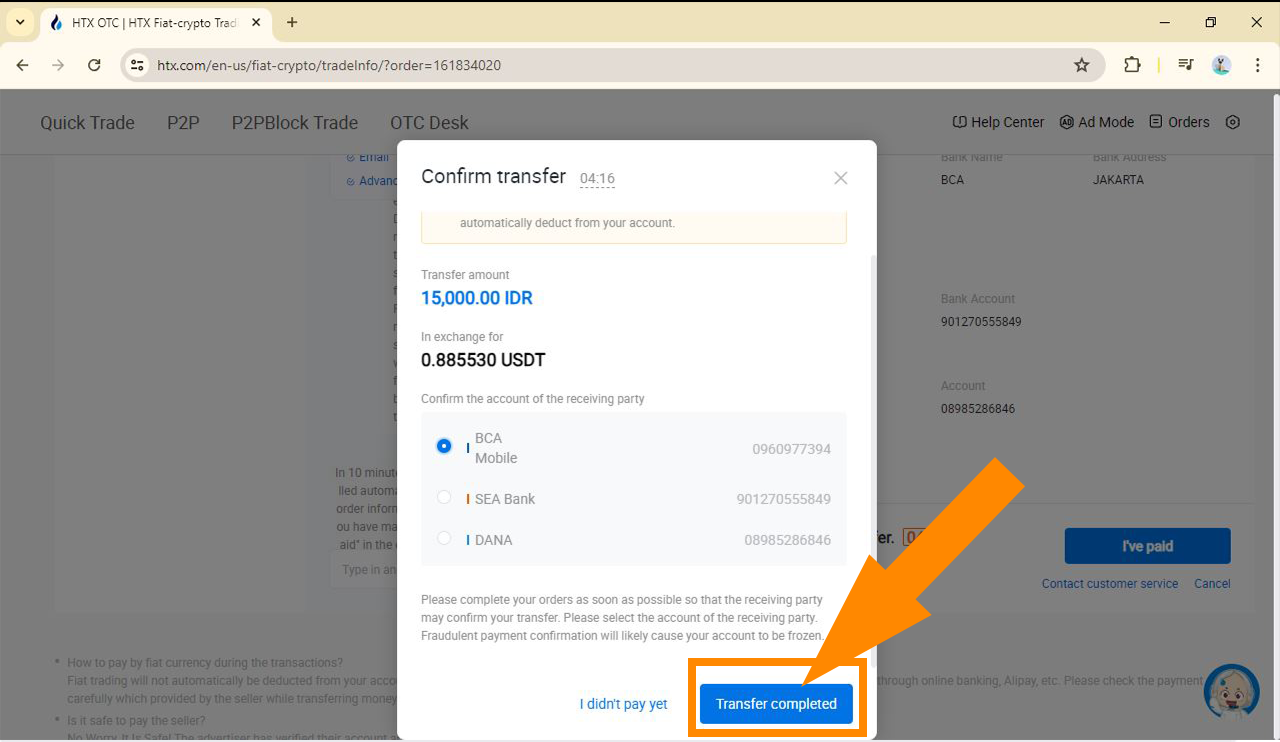

Then I had to confirm the statement by clicking [Transfer completed].

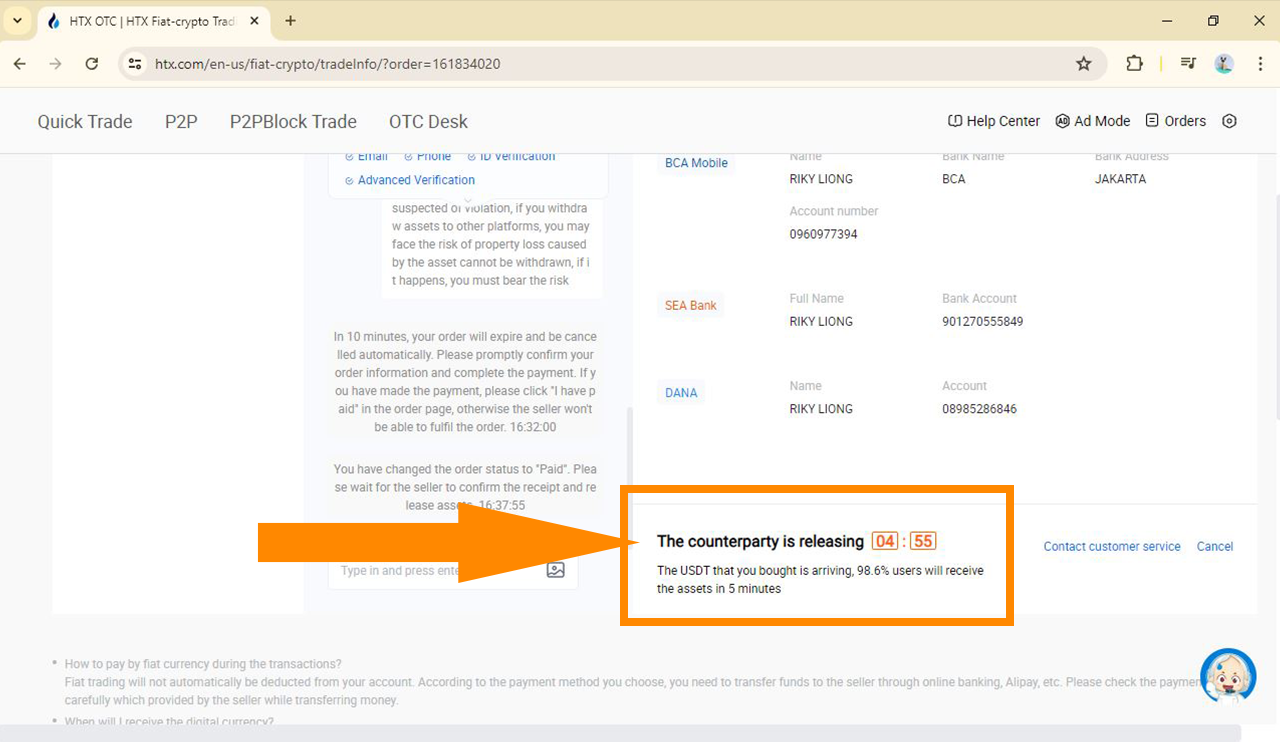

Then I waited for the seller to release the asset.

A few minutes later I was informed that the order has been completed.

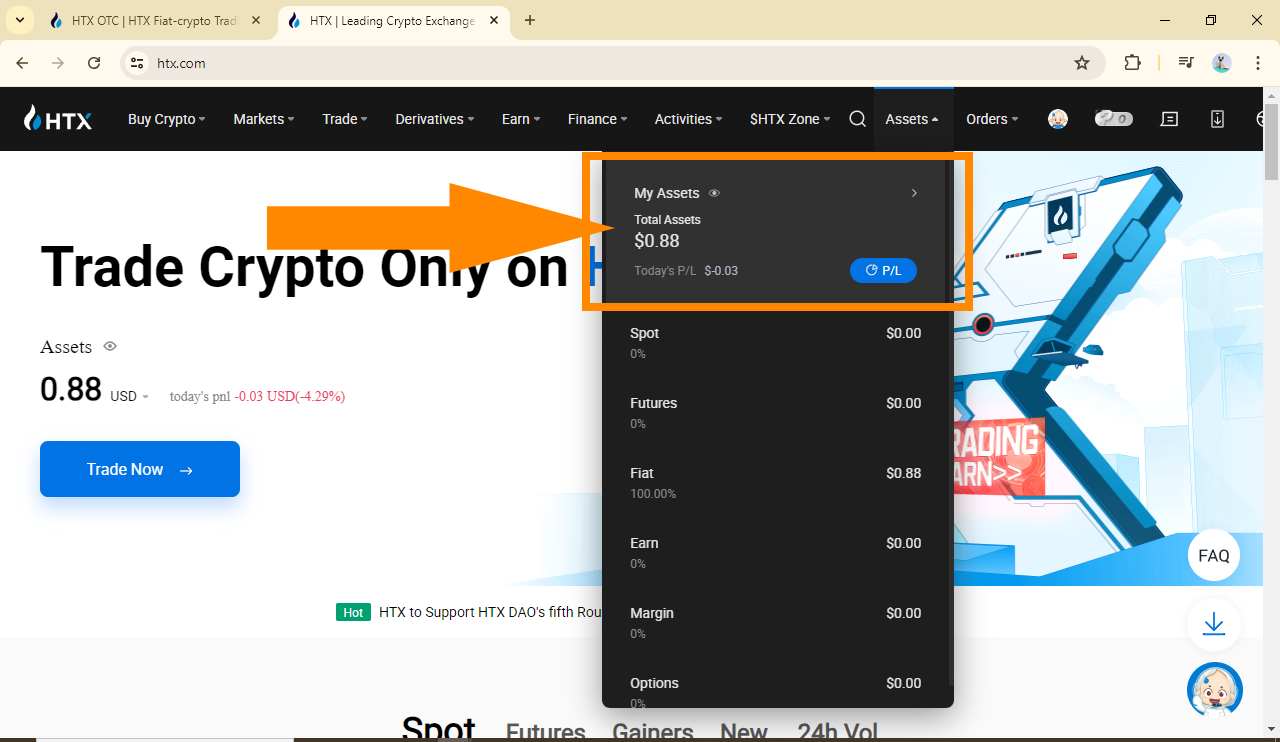

Now I have the 0.88 USDT in my wallet on Huobi. The very first crypto I ever bought via Huobi. I have done some P2P trades on Binance before, and my conclusion is that they both operate in similar way.

The Benefit and Challenges

In my experience, the benefits of peer-to-peer trading are:

- that buyers can directly purchase assets from individuals who possess the assets they desire, without having to pay intermediary fees which can sometimes be quite substantial.

- buyers and sellers have the opportunity to review and evaluate many offers and choose the one that fits their needs and budget.

- transactions can be completed in a short time.

- the trading system is relatively secure because it involves the market acting as "witnesses" through implementation of escrow, who mediate in case of any negligence that could potentially cause losses to either party.

Personally, I haven't faced any challenges while engaging in peer-to-peer crypto trading. I've conducted such transactions several times before on Binance. Internet connection could sometimes be the problem, but that's unrelated to the trading system itself. But in my opinion, some things must be taken in to consideration in doing peer-to-peer trading:

- The traders’ reputation. We need to ensure that this entity is well-trusted on the platform, Binance makes it clears every time we open the buy page on peer-to-peer market. We can check for a certain seller whether they are verified already or not. And we can also observe their ratings, usually is available beside their names, the number above 97% I think tells us that we can proceed with confident.

- Time given to complete payment. One minor inconvenience could be the sometimes short time provided for making and complete payments. However, with a good internet connection, I find that 10 minutes is usually more than enough. Through mobile banking, money transfers can be completed in about two minutes. Then it takes a few minutes to notify the seller and a few more minutes for the seller to confirm and release the crypto asset. In performing this task, it took me about 7 minutes from the time I placed the order until I received the asset in my wallet on Huobi. I never conducted business on peer-to-peer market with the seller who gives time under 10 minutes, and as I can remember, I never met one like that.

- Finding an offer within budget used to be a challenge for me. However, nowadays, it's not uncommon to find very low offers from sellers; someone can even buy crypto for as low as IDR 10,000 (USD 0.62).

But since this type of trading is like a shop, a shopkeeper must be present if they don't want to miss a transaction opportunity. This differs from more traditional crypto transactions, where sellers or buyers can place their offers at their preferred prices and leave it to the market mechanism. In certain cases, this can be very time-consuming.

Conclusion

- USDT (USD Tether, or simply Tether) is a stablecoin whose value is based on the value of the US Dollar;

- Stablecoins are crypto tokens whose value is pegged to fiat currencies or commodities like gold or silver, Tether Gold is one of them;

- USDT has become a popular stablecoin because of its flexibility to operate on multiple blockchain networks, such as TRON and Ethereum;

- Some types of stablecoins pegged to fiat values include BUSD (Binance USD), IDRT (Indonesian Rupiah Token), PYUSD (PayPal USD), and EURt (Tether EURt).

- SBD is a stablecoin from the Steem blockchain, intended to be equivalent in value to USD, but it has long had a higher value.

- Peer-to-peer data exchange firstly introduced in 1979 by Usenet, a discussion forum and file exchange that did not use separate servers to connect computers, each computer acts as both a server and a client at the same time;

- The P2P Market has provided an alternative trading system that helps traders and buyers save time and cut costs.

- The escrow feature in peer-to-peer trading is a solution to alleviate concerns and bring peace of mind to the involved parties. By following all the secure steps in executing transactions, no party will be harmed.

Thanks

Thanks @crypto-academy for the lesson.

Pictures Sources

- The editorial picture was created by me.

- Unless otherwise stated, all another pictures were screenshoots and were edited with Adobe Photoshop 2021.

Sources and Reading Suggestion

- What is P2P Crypto Exchange and How Does Peer-to-Peer Work?;

- What is P2P Crypto Trading? A Guide to Direct Digital Asset Transactions;

- A Complete Guide to P2P Trading;

- Peer-to-peer file sharing;

- P2P;

- What is Usenet: Setup Guide & Best Service Providers (2024);

- The History of P2P Networks- and Why They Remain So Important Now;

- What is P2P Trading: A Simple Guide for Crypto Traders and Users;

- Shawn Fanning;

- BINANCEReview;

- Peer-to-Peer (Virtual Currency): Definition and How It Works;

- How Does P2P Work?;

- What is peer-to-peer transfer? What are the pros and cons?;

- Advantages and Risks of P2P Payments;

- Understand Peer-to-Peer Foreign Currency Exchange;

- What Are Peer-to-Peer Payments?;

- How to Create a USDT TRC20 Wallet: Step-by-step Guide;

- Tether token;

- Tether (USDT): Meaning and Uses for Tethering Crypto;

- The Most Adopted Indonesian Rupiah Stablecoin;

- IDRT vs XIDR: Mana Stablecoin Rupiah Terbaik di 2024?;

- 9 Best Tether (USDT) Wallets in 2024;

- TRC-20 vs. ERC-20: Differences Between Tether (USDT) Networks;

- What Are Token Standards? An Overview;

- Why TRC20 Is The Most Popular USDT Network;

- Bagaimana Cara Kerja Layanan Escrow Binance P2P?;

- Mengamankan Transaksi Kripto Anda di Nigeria: Lindung Nilai Layanan Escrow P2P;

- CARA UMUM UNTUK TETAP AMAN DI BINANCE P2P;

- What Are P2P Payments and How Can You Use Them in Your Business;

- What Is A P2P Payment System & How Does It Work?;

- How to Add a Payment Method for P2P Trading on Bybit;

- Binance P2P: How to Buy Bitcoin with Your Bank Account;

- How to Buy Bitcoin (BTC) with SEPA (EU) Bank Transfer;

- SEPA (Single Euro Payment Area);

- PayPal vs Venmo vs Zelle: Who’s the best?;

- PayPal Instant Transfer: tips to get the most from it;

- Top Stablecoin Tokens by Market Capitalization;

- DAI: A Systematically Sustainable Stablecoin;

Comments